Invictus’ Zimbabwe gas project heads into the limelight

Pic: Getty

Special Report: Could Invictus Energy unlock the next major oil and gas province in Africa?

One of Africa’s largest seismically defined yet undrilled onshore structures with the potential for gas and oil resources that are normally found in offshore fields, a well credentialled management team and strong support from the government.

The project which lay dormant for nearly 25 years since the previous exploration campaign could be on the cusp of unlocking the next major oil and gas province in Africa.

This is due to a combination of changes in technology, the in country investment environment and market dynamics.

These factors have enabled the company to progress the project rapidly and identify one of the largest conventional exploration targets globally.

Taken together, these points would normally draw considerable attention on the market.

Yet, Invictus Energy (ASX:IVZ) has largely flown under the radar for most investors, a fact that managing director Scott Macmillan attributes largely to the company’s singular but highly prospective project being located in Zimbabwe.

While 40 years of rule by former President Robert Mugabe have certainly done no favours in relation to ongoing perceptions of the country, current President Emmerson Mnangagwa has made some major changes aimed at wooing investors into Zimbabwe to bolster its economy.

This included the appointment of former resources industry executive Winston Chitando as the country’s Mines Minister, the amendment of the Indigenisation and Empowerment Act to allow 100 per cent foreign ownership while guaranteeing investor rights and passing Special Economic Zones legislation that offers attractive fiscal and non fiscal benefits.

“Zimbabwe has changed quite dramatically since the Mugabe era, they have implemented a lot of reform, most notably the removal of the Indigenisation law, which mandated a 51 per cent government/local participation,” Macmillan told Stockhead.

“There are many other reforms beside that, and the President has appointed key people to some of the crucial ministries.

The resources industry has the potential to make a significant contribution to the economy of Zimbabwe and the President appointed Minister Chitando to lead the recovery of the sector.

The Minister was appointed directly from the resources industry and was tasked with putting in place the policy settings required to promote and protect investment into the country and we have seen a lot of progress on this front.

“The government recognises that the resources industry and mining has the potential to turn around the economy very quickly.”

Cabora Bassa project

With the questions about Zimbabwe’s suitability as an investment decision answered, the picture surrounding Invictus’ Cabora Bassa project in northern Zimbabwe becomes a lot clearer.

The project was first defined by Mobil during the 1990s with the supermajor spending $30m acquiring 2D seismic, gravity and aeromagnetic data.

Mobil chose to relinquish the project after its assessment indicated that the key Mzarabani anticline feature would more likely be a gas discovery than an oil discovery and there was no gas market in the region at the time.

Several onshore gas fields discovered decades earlier in neighbouring Mozambique had still not been developed at the time and so Mobil saw little point in trying to discover more gas and relinquished the project.

Fast forward to 2018 when the project was acquired by Invictus and the wealth of data that Mobil acquired was made available to the company, which reprocessed the information and applied its updated understanding of other successful rift basin plays in Africa to Carbora Bassa.

“Ordinarily, if you are going into a frontier area, you have to acquire big data sets to explore a large area as Mobil did. And there is no guarantee even after spending $20m to $25m that you can identify anything that is worth drilling,” Macmillan said.

“We short-cut that whole process with the Mobil data, they did a very thorough job in their exploration program and we were able to pick up where they left off and advance the project quickly.

“All the data was in good condition, which meant you could reprocess it using modern technology and get a huge uplift in data quality.”

And the results have been spectacular. Not only has the Mzarabani primary target increased since the first independent estimate, but other high potential horizons above and below the Alternations Member have been identified and quantified as well.

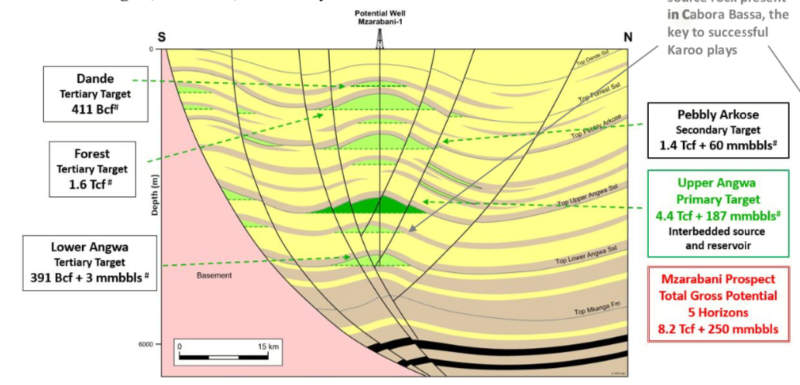

The Mzarabani anticline feature is a massive stacked prospect that could hold 8 trillion cubic feet of gas and 250 million barrels of condensate in a single target.

The prospect has 5 stacked objectives that can be tested by a single well.

The multiple objectives increases the chance of success dramatically compared to targeting a single objective.

Work completed by Invictus in the time since acquiring the project has also confirmed the presence of potential hydrocarbon indicators from the reprocessed seismic data that de-risks the project in terms of the source rock presence and their ability to generate hydrocarbons and fill a structure.

This includes new source rock data sample from outcrop earlier in the year has confirmed the potential for substantial liquids and gas generation.

The source rock, reservoir and seal present at surface can be tracked on the seismic lines into the subsurface and the prospects which has only been made possible due to the reprocessed seismic data which enables better visualisation of the subsurface.

Most companies in the region have traditionally chased the Permian plays with mixed success.

The technical work completed by Invictus has identified the presence of Triassic age source rock as the key differentiator of the successful discoveries in Karoo basins.

Triassic age source rock is present in only a handful of basins on the continent, of which the Cabora Bassa Basin is one.

Should exploration of Mzarabani prove the presence of oil or gas, , there is plenty of mapped potential that offers substantial upside.

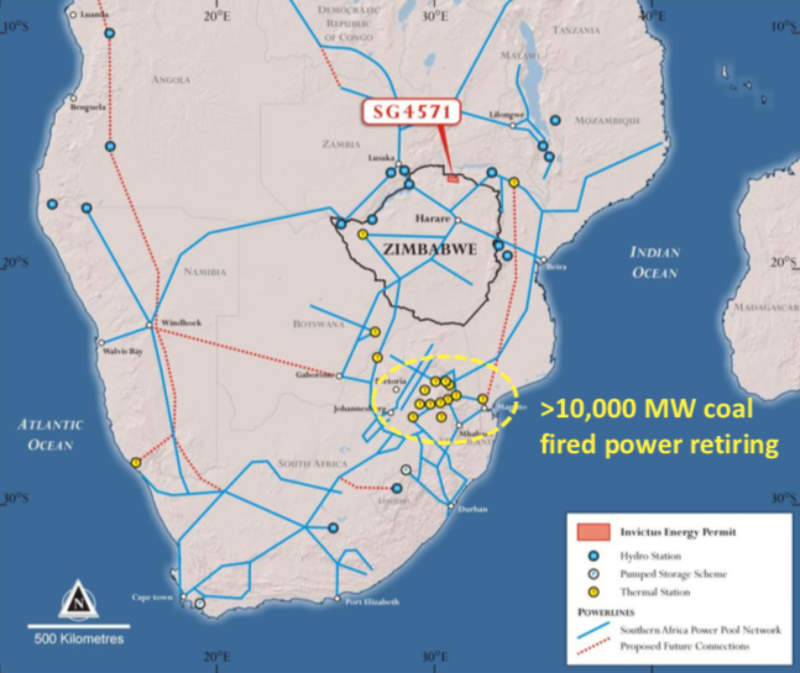

To top it off, southern Africa now has a substantial demand for gas that has a ready market to monetise any production from the project rapidly.

Indeed, South Africa is projected to have a supply deficit of up to 2 billion cubic feet of gas per day by 2020, which compares to the Australian East Coast shortfall of about 100 million cubic feet per day.

The power crisis being experienced in Southern Africa can be addressed through gas to power which can be exported through the Southern Africa Power Pool.

The SAPP enables the trading of electricity through the grid that connects South Africa through to the DRC.

The spine of the SAPP runs through Zimbabwe which makes it ideally placed to serve the wider region and monetise gas through the electricity grid and provide energy to the region.

Invictus has already signed a memorandum of understanding to supply Sable Chemical Industries with 70 million cubic feet of gas per day for a 20-year period to replace imported ammonia for the production of fertiliser.

In the event of an oil discovery, Zimbabwe has a domestic consumption of 36,000 barrels per day and can serve the domestic and regional markets

Some idea of how valuable Carbora Bassa could prove to be comes from French supermajor Total’s Brulpadda gas-condensate off the coast of South Africa, which had pre-drill resource estimates of between 500 million and 1 billion barrels of oil equivalent (boe).

This compares favourably to the primary Upper Angwa target at Mzarabani, which has pre-drill estimated resources of about 965 million boe.

While the total cost of exploring Brulpadda is currently about $350m, with $200m from the original exploration well that was abandoned in 2014 because of rough sea conditions and Total’s $150m side track, the discovery could pump up to $100 billion into the South African economy.

An onshore prospect with a simple well that can be drilled for $10 million to test a similar size target is compelling proposition.

Not only would it be cheaper to drill, but also quicker to develop and get to market.

Leadership strength

Invictus’ other standout feature is the quality of its board and management.

The company recently appointed former AGM Petroleum CEO Dr Stuart Lake as its non-executive chairman, bringing a wealth of petroleum industry experience into the company.

Dr Lake has over 34 years of experience operating assets in 20 countries worldwide including over 10 African countries.

Prior to serving with AGM, he was the CEO of African Petroleum Corporation, where he successfully concluded a number of farmouts and commercial deals in the company’s African portfolio in a challenging market.

Between 2009 and 2013, Dr Lake was the vice president of exploration for Hess Corporation and led successful exploration campaigns including the seven consecutive deep-water discoveries in Ghana and 30 onshore discoveries in Russia.

“Dr Stuart Lake is a world-class oil finder with a very prolific track record, 272 discoveries from 300 wells, which is virtually unheard of in the industry because he is very detailed oriented,” Macmillan added.

“He is not going to join a small junior company from Australia without seeing the potential. It is a real endorsement of the project to have him come aboard.”

Macmillan himself is a native of Zimbabwe and has worked for Woodside Petroleum (ASX:WPL) and AWE, where he was responsible for the Waitsia gas field development in Western Australia’s Perth Basin.

The now prolific Kingia play in the Perth Basin was also overlooked until recently when the Waitsia discovery has unlocked further large gas discoveries in the basin by the likes of Strike and Beach Energy.

Farm-out plans

With a potentially monstrous hydrocarbon resource in play and strong leadership in place, Invictus is now on the hunt for a farm-out partner to participate in a high impact basin opening exploration well.

Macmillan believes that the company has hit the exploration market at the right time where players are reloading their portfolios and looking for game changing projects.

“Ordinarily when you want to get into new acreage you would have to go through a long competitive bid round, spend several years and tens of millions acquiring data in the hope of turning up a decent prospect,” he told Stockhead.

“This prospect comes ready made to market and IVZ has 80 per cent equity which means there is enough equity to get a major or independent interested due to the huge size of the prize and running room.

“We are following in similar footsteps to Hardman, Heritage and Energy Africa in Uganda and Africa Oil in Kenya, all of which were juniors that moved into those basins after they had been explored by majors over many years and written off and overlooked.

“They applied new understandings of other successful interior rift basins and gave new life to old datasets acquired by the majors previously in these basins.”

With a market cap that is just above the $10m mark, Invictus is well leveraged to the news flow to come and will be one of the most anticipated drills on the continent.

This story was developed in collaboration with Invictus Energy, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.