HyTerra in pole position as natural hydrogen emerges in 2023

HyTerra is looking to soar on natural hydrogen in 2023. Pic: via Getty Images

As the fuel of the future, hydrogen promises to replace fossil fuels in both industrial applications and in areas other clean solutions – such as batteries – might not be suitable.

This is particularly true for heavy industries such as manufacturing, transport, heating, and energy storage where the use of hydrogen will radically reduce or even eliminate emissions.

Where the use of hydrogen runs into problems is the source of fuel. The production of which needs to hit 614 million tonnes by 2050 according to the International Renewable Energy Agency.

Currently, most hydrogen used globally is produced by using high temperature steam and a catalyst to break apart methane molecules (natural gas) into hydrogen, carbon monoxide and carbon dioxide.

This requires significant energy and a big carbon footprint, which defeats the whole point of using hydrogen to decarbonise industries.

Natural hydrogen vs manufactured hydrogen

ASX-listed HyTerra believes that the issues faced by what it calls “manufactured hydrogen” – – can be addressed through the production of “natural hydrogen”.

Manufactured Hydrogen is either Blue Hydrogen, which combines methane reforming with carbon capture and storage (CCS) to significantly reduce its carbon footprint or Green Hydrogen, which uses electrolysis powered by renewable energy to split water molecules into hydrogen and oxygen without any emissions. Blue Hydrogen remains controversial due to concerns about the viability of CCS while Green Hydrogen currently suffers from high cost of production as well as low efficiency.

HyTerra is the first ASX company focussed on natural hydrogen, or hydrogen that was naturally formed through geochemical reactions within the earth and trapped in reservoirs akin to those that host oil and gas.

While pure hydrogen is relatively rare in the Earth’s atmosphere due to its reactivity with oxygen (to form water), it is known to be produced when water reacts with certain rocks, deep in the subsurface.

Under suitable conditions, natural hydrogen could also be renewable and continuously generated over very short geological timeframes.

That exploration can be carried out using techniques already used by the oil and gas (and mining) sectors, including the use of conventional drilling rigs to drill exploration wells, means that costs can be kept fairly low.

Speaking to Stockhead, HyTerra (ASX:HYT) chief operating officer Luke Velterop highlighted the discovery of natural hydrogen in Mali as an example of this potential for a rapidly recharging resource.

“It was accidentally discovered while drilling a water bore in 1987 and a new operator went back in 2011 and successfully tested the discovery that flowed natural hydrogen at very high concentrations of about 98%,” he explained.

This hydrogen was used to generate carbon-free electricity for the local village with Velterop noting that a number of appraisal wells have been drilled since then to understand the commercial potential of that resource.

What is especially interesting is that the discovery well produced without decline for up 5 years before it was shut in.

“This suggests natural hydrogen could be a renewable resource and continuously recharging, which is not something that we typically see in the production of natural gas, which declines over time,” he added.

USA calling

While the potential for a continuously renewing resource is undoubtedly at the back of HyTerra’s mind, the company is clear that this is not the reason why it picked up its Project Geneva in Nebraska, US (though it will be good to have).

“First of all, you’ve got a very supportive regulatory system in the US so the path to acquiring leases, drilling wells and developing a resource is much more accelerated than in Australia,” Velterop explained.

“It’s not to say that there aren’t environmental boxes which need to be ticked, but there’s not as much red tape as there is in Australia, for instance.

“And there’s also a huge archive of exploration data that can be used to understand where natural hydrogen has been encountered, and the types of geological systems responsible for its production.

“Additionally, because it’s built off a huge oil and gas industry, you’ve got low cost operations there.

“In Australia it’s expensive to mobilise a rig to your location and drill a well because it is not a very competitive market, whereas in the US you have ~ 600 drilling rigs, 10s of thousands of service providers; the more diluted the market is, the lower the cost of developing these projects.

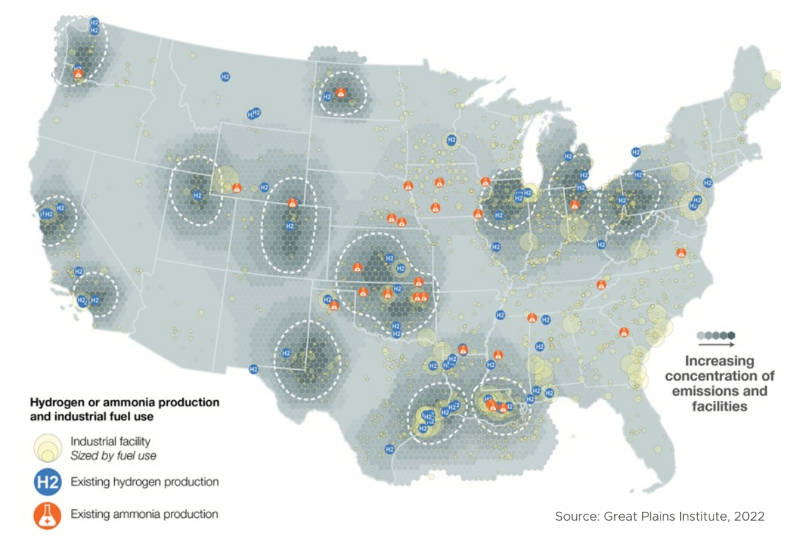

“You also have markets, big populations and industrial applications, and markets are really the whole point in developing a resource.”

He adds that the US Inflation Reduction Act provides further impetus by providing a $3 per kg tax credits for hydrogen.

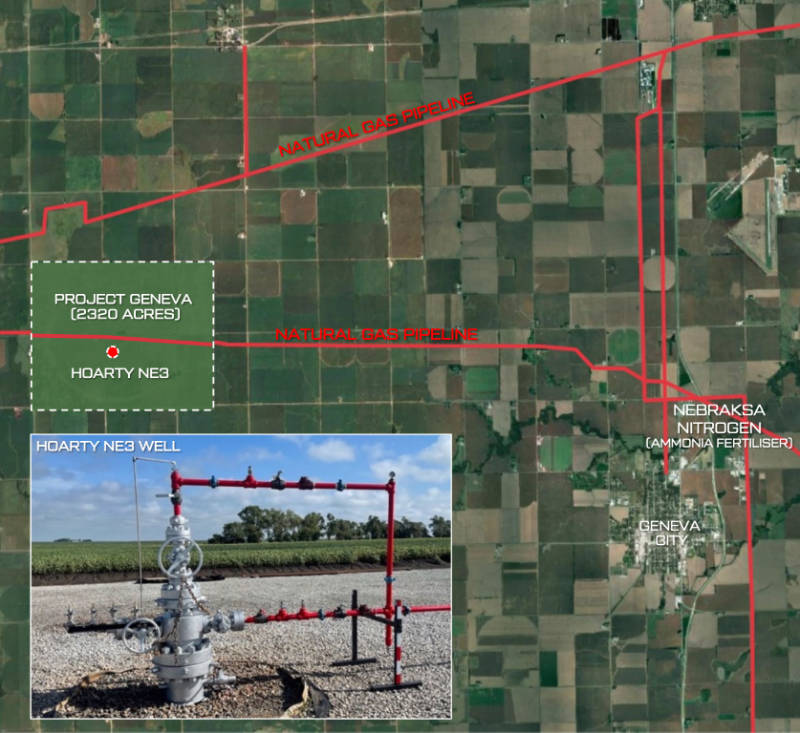

HyTerra has a 10% interest in Project Geneva with the right to earn up to 51% under its Joint Development Agreement with Natural Hydrogen Energy.

The project area is favourably located near infrastructure and market opportunities in Geneva, Nebraska.

It includes the world’s first wildcat exploration well to specifically target natural hydrogen.

Natural hydrogen well

The Hoarty NE3 well targeted Precambrian basement rocks predicted to contain hydrogen enriched gases and has been drilled, completed and swab tested.

Manual sampling of gas from the drilling mud has already yielded elevated hydrogen concentrations.

Additionally, gas evacuated while swabbing burned with a clear flame in direct sunlight, which is interpreted to verify that hydrogen gas was predominant in the gas stream.

HyTerra and Natural Hydrogen Energy are preparing to commence an extended well test on the Hoarty NE3 this quarter.

This will involve dewatering the well with a pump to reduce hydrostatic pressure on prospective zones, which is expected to allow hydrogen enriched gases in these zones to flow freely.

Well and flow data will be recorded over a period of about three months to understand the hydrogen production potential of the well by measuring parameters that include gas composition, pressure and flow rate.

This data will also be used to establish a resource estimate.

Looking further afield

HyTerra is currently focused on the advantages of operating in the US to develop what’s essentially a new industry analogous with the development of the US shale gas industry, which is a good example of an of IP that was developed in the location where it could be done cheaply and then took off globally.

However, Velterop did not rule out looking at other areas once the company matured its IP.

In Australia and Europe companies exploring for oil and gas are branching out and looking at natural hydrogen and in South Australia companies such as Gold Hydrogen and H2EX have snapped up acreage.

Velterop took the emergence of competitors – Gold Hydrogen is poised to join HyTerra on the ASX this week – as a positive, saying that “if you’ve got competitors, you’re on to something”.

This article was developed in collaboration with HyTerra, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.