Here’s how Delorean Corporation aims to solve Australia’s food waste problem

Pic: Getty

Australia sends a vast amount of food waste to landfills each year. But this company plans to tap into organic food waste as a resource to produce a green fuel for energy.

Food that is disposed of and sent to landfill to decompose emits methane gas at a rate 25 times higher than carbon dioxide.

In Australia, around 7.6m tonnes of food, or about 312kg per person across the supply and consumption chain is wasted each year, accounting for around 3pc of the country’s annual greenhouse gas emissions.

But what if this wasted food could be diverted to green fuel to power our homes and businesses?

Delorean Corporation (ASX:DEL) is setting out to do just that.

The company collects food and organic waste from industrial and agricultural streams in local markets and processes it for energy production through a natural biological process called anaerobic digestion.

This process produces clean biogas to fuel conventional combined heat and power generators and can also be upgraded to mains-grade renewable natural gas for use in the existing gas network.

Vast scope for growth

While anaerobic digestion is globally established and led by Europe, DEL managing director Joe Oliver said it is underutilised in Australia and therefore provides vast scope for growth as well as the potential for Delorean to hold an early mover advantage.

It is one of only a small number of true green energy stocks on the ASX, and the only ASX-listed company leading with bioenergy and commercial production of mains-grade renewable natural gas in the form of biomethane.

Although bioenergy only makes up about 4pc of Australia’s energy mix compared to 7pc in some OECD countries, the Federal Government is developing a bioenergy strategy through the Australian Renewable Agency to help decarbonise the industrial and transport sectors.

Oliver said the company’s focus is to utilise its green bio-energy generation assets to build out a pipeline of projects nationally and ultimately supply that green energy in the form of electricity and gas into the grid. There is also scope for utilising the digestate by-product as biofertilizer, generating an additional revenue stream.

Five-time oversubscribed IPO

The company listed on the ASX back in April at 20 cents per share, in what ended up being a five-time oversubscribed placement to raise $14m through the issue of 70 million shares.

Investors flocked to the stock that day, with shares opening at 37c and more than doubling to a peak of 43c.

At the time of the IPO, DEL had been turning around a profit for five years based on third party revenues from its Engineering Division and Energy Retail Division, where it has become the fifth largest independent energy retailer in Western Australia.

Strong government support for green energy projects

The Australian Government’s recently released Bioenergy Roadmap Report is expected to deliver immediate commercial benefits and opportunities for Delorean, including the potential access to an initial $33mn of ARENA funding committed to the roadmap activities.

This roadmap sets out a public/private partnership framework underpinned by a series of targeted initiatives within the 2021 – 2030 horizon, most of which are directly relevant to the growth of Deloreans business.

For example, the modelling indicates that by 2030 around 33% of industrial, 23% of pipeline gas, and 8% of utility scale electricity generation could come from bioenergy infrastructure.

This means that Australia’s bioenergy sector could contribute to around $10 billion in extra GDP per annum.

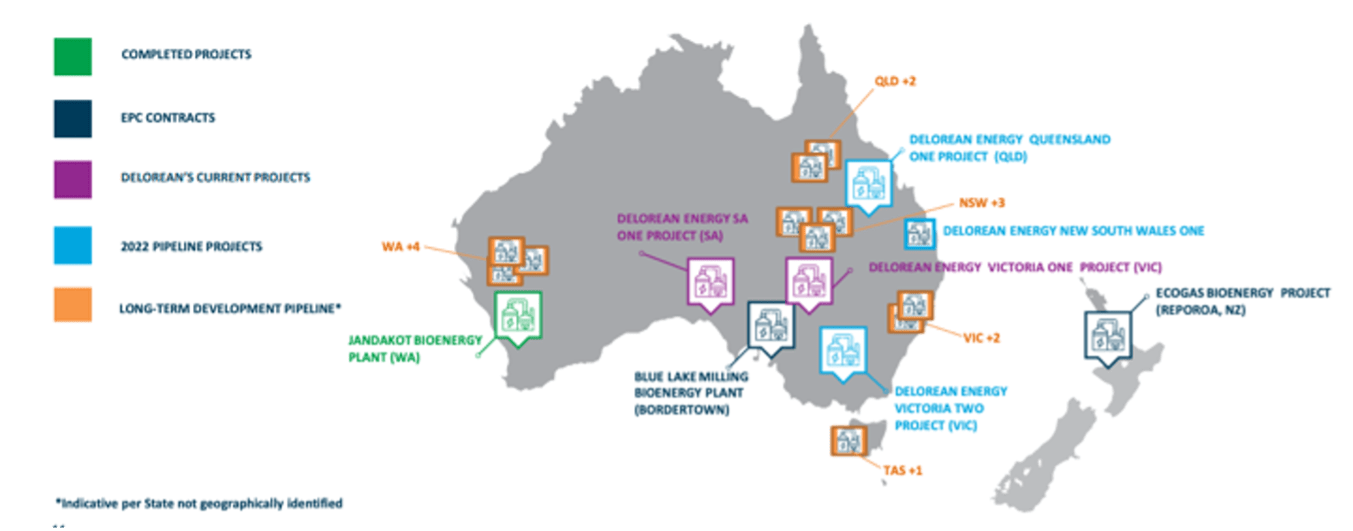

Project pipeline

Now, Delorean plans to own the anaerobic digestion facilities it develops, while also acting as a green energy retailer nationwide.

Its revenue model is based on a multiple of streams under two umbrellas – owned and operated bioenergy plants and third-party revenues (through EPC contracts and the sale of third-party energy).

These streams include waste disposal, which comprises gate fees for accepting organic waste, and energy generation – meaning the retail of Delorean generated energy in the form of electricity, gas, and heat.

Delorean’s initial success story is the Jandakot Bioenergy Plant in Western Australia.

The 2.4MW project was constructed, designed, and commissioned by the Company’s Engineering Division for Richgro and converts commercial and industrial organic waste stream to power generation.

Since its construction back in 2013, the Jandakot facility has diverted more than 100,000t of waste from landfill.

Wheels are in motion for two projects under construction/near completion – one in Bordertown, South Australia (The Blue Lake Milling Bioenergy Plant) and the other in Repora, New Zealand (Ecogas Bioenergy Project) while a further two shovel-ready projects in South Australia and Victoria are awaiting final investment decisions.

One of these projects includes the South Australia One Project (SA1) in Adelaide, acquired in May.

DEL and AGIG are looking to connect SA1, which it says will be Australia’s first waste to biomethane facility, into AGIG’s gas network.

The project will process commercial and industrial organic food and agricultural waste to deliver 150TJ per annum of biomethane into the gas distribution network in Adelaide under an offtake agreement with Origin Energy.

By blending and ultimately replacing natural gas with renewable gas such as biomethane and green hydrogen, AGIG will use its existing gas infrastructure to then supply a renewable gas blend to customers.

More recently, DEL entered into a collaboration agreement with Brickworks Building Products (ASX: BKW), which will see the two companies undertake a feasibility study to develop, build, and operate bioenergy facilities to convert organic waste to green gas and electricity.

The converted electricity will then be used in Brickworks Building Products beginning with its NSW brick manufacturing sites.

This article was developed in collaboration with Delorean Corporation, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.