Has OPEC become temporarily irrelevant, or is it dead?

After two and a half years of oil prices gradually rising, they fell sharply in the final quarter of last year.

Some short-term bumps have occurred, such as last night when investors realised storm season was beginning in the Gulf of Mexico and the odd tweet or leak by the Trump administration stating a trade deal with China was close.

But oil prices remain low by the standards of 2016-18. Furthermore, the US has taken the mantle as the world’s largest oil producer as infighting occurs among OPEC members.

America is producing 11 million barrels of crude oil. Not only is that figure a record for the US, but according to BP the annual increase is a record for any country in any year.

We’re not family…

Saudi Arabia left the last OPEC meeting a fortnight ago with a private production deal negotiated with Russia. Russia are not a formal member, they’re just an ‘observer’ but the fact that Saudi Arabia seem a world apart from its own fellow members caused Iran to panic.

Iran’s oil minister, Bijan Zanganeh, said at the latest meeting OPEC was on the verge of death.

Additionally the kingdom has taken steps to attract foreign investment and wanted to list its state-owned company Aramco.

In the past OPEC production cuts were a significant influencer on oil prices. President Donald Trump has long been a critic of OPEC well before he reached the White House.

Crude is about to pass $90/barrel. The OPEC monopoly must be broken. They are robbing our country blind.

— Donald J. Trump (@realDonaldTrump) November 29, 2012

How times have changed, because now OPEC has far less power on oil prices. Even if Saudi Arabia ‘went at it alone’.

Stockhead spoke with National Australia Bank (ASX:NAB) chief economist Alan Oster. He attributed Iranian comments to geopolitical tensions between Iran and Saudi Arabia.

“Saudi Arabians are the biggest producer and they have the largest numbers, they can do it at $US15 per barrel,” he said. “They [Iran] want to keep all their mates onboard because they could lose their monopoly.”

Clearly OPEC has lost its power but is not (yet) dead.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Oil prices: Medium term gain

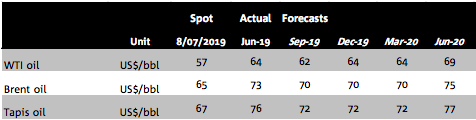

NAB released its commodity forecasts earlier this week and the banks sees a slight recovery over the next year.

“That’s fundamentally what you get through trade wars. So its short-term political risk and [the market reaching] equilibrium,” Oster told Stockhead.

He believes OPEC will continue with production cuts and implicitly they will be significant enough to have the influence OPEC cuts used to have on the global market.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.