Green Energy: WoodMac says China’s renewable boom poses major challenges for Western markets

Aerial photo of a solar photovoltaic plant. Pic:

China’s renewables manufacturing has kicked off the new year bigger than the last, and while Western markets are benefiting from trading with the world’s biggest energy consumer, energy research and consultancy firm Wood Mackenzie says balancing reliance on China’s technology providers with local interests is now a key political as well as environmental challenge.

China’s needs to meet increasing power demand coupled with ambition to reduce its dependence on coal and gas has given local manufacturers the incentive to grow big.

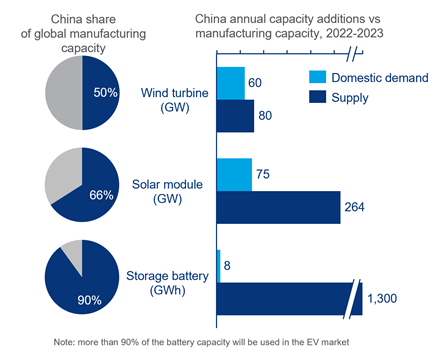

Currently, China is the world’s dominant supplier of solar modules accounting for nearly 70% of global manufacturing, the research firm said.

Although Chinese manufacturers have not quite made such significant inroads into overseas markets yet for wind turbines, they still account for 50% of global manufacturing.

The country also accounts for nearly 90% of global manufacturing capacity of lithium-ion batteries.

Wood Mackenzie research director Alex Whitworth said this production of “epic proportions” is enough to meet what China needs to accelerate decarbonisation, while supporting the ambitions of much of the rest of the world

“But this also creates a political headache for many countries that have announced more ambitious 2030 emissions targets on the promise of jobs and prosperity,” he said.

“Achieving this without greater dependence on China looks harder than ever as its manufacturers expand capacity and drive down costs.

“And with China’s power demand now cooling on the back of more manageable economic growth, local manufacturers are looking to further extend global reach.”

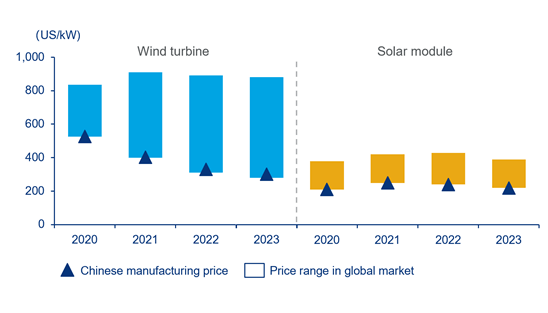

The sheer scale of China’s manufacturing capacity places it with a major competitive advantage, principal analyst Xiaoyang Li said.

“Despite increases in raw material prices since 2020, China’s massive expansion in clean energy manufacturing and ability to scale up output has seen its manufacturing costs decrease relative to its global competitors,” he said.

“Chinese wind turbine prices fell by 24% on the year in 2021 and will drop by a further 20% in 2022.”

Wood Mackenzie expects equipment costs to retreat in 2023 as commodity prices recede, logistical bottlenecks ease and supply-chain investments are made.

But it’s not all sunshine and roses

However, the massive deployment of clean energy means an increase in raw materials such as aluminium, copper, nickel, lithium, cobalt, rare earths, graphite and silicon, and China could face supply disruption risks on the back of increasing anti-China sentiment in Western markets.

The country will have to rebuild its brand as a responsible superpower, WoodMackenzie says. To counter this, Chinese clean energy manufacturers are actively investing overseas to avoid both anti-China sentiment and the barriers to market entry that increasingly come with the ‘Made in China’ label.

“China is also greening its massive Belt and Road Initiative, ending coal-fired plant investment overseas and channelling more capital into renewables made by Chinese companies,” the report highlighted.

“The rising cost of financing coal plants, carbon price risks and the growing competitiveness of solar and wind may be the economic drivers, but ditching coal could bring PR success.”

Response by Western markets

In response to China’s dominant position, Western markets have introduced policy and taxonomy initiatives designed to put the spotlight on the sustainability and supply chain of clean energy investments and to offer greater support for local manufacturers.

In the US, the current administration has recently extended the Trump-era solar tariffs that have effectively limited Chinese-made solar modules accessing the US market.

President Biden’s climate agenda includes extending solar investment tax credits for another 10 years and allowing the technology to take advantage of the federal production tax credit and direct payment.

The same bill also includes a solar manufacturing tax credit that helps lower the cost to produce solar modules in the US and boost domestic supply’s competitiveness.

The EU taxonomy is similarly aimed at helping the bloc scale up sustainable investment and implement the European Green Deal.

But competing with China will require more than tax breaks and stricter market-entry regulations.

“For Western markets, there is a rising call for collaboration between governments, miners and energy producers to access raw materials in an equitable and sustainable manner,” Li said.

“And for manufacturers, it is the push for greater technical innovation, efficiencies and reliability.”

Clean energy manufacturers outside of China are also responding, producing larger and more efficient battery units with lower lifetime costs and less outages to compete against their Chinese rivals.

With governments increasingly tying clean energy agendas to investment at home, local supply chains are featuring in tenders for renewables, bringing advantages for manufacturers and project developers supporting domestic employment.

Principal analyst Shirley Zhang said while China’s dominance in renewables is clear, its long-term energy transition strategy is arguably flawed by its over-dependence on wind and solar.

“China is far from a global leader in several of the sectors that will be equally critical to reducing emissions, including carbon capture, low-carbon hydrogen, and even further ahead, emerging technologies such as next-generation green fuels,” Zhang said.

“This presents opportunities for those more advanced in these areas to gain competitive advantage and work with China.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.