Green Energy: Renewable energy accounted for 7pc of Australia’s energy consumption in 2021

Renewable electricity energy generation increased by 15pc to contribute to 23pc of Australia’s total. Pic: Getty

Does renewable energy reduce or increase the cost of electricity?

A new report by Savvy has delved into Australian energy prices and the ways in which we use renewables.

Since 2020, COVID-19 has forced many of us to spend more time at home, meaning our energy consumption has switched from commercial, which dropped 3.1%, to residential usage, which grew 2.7%.

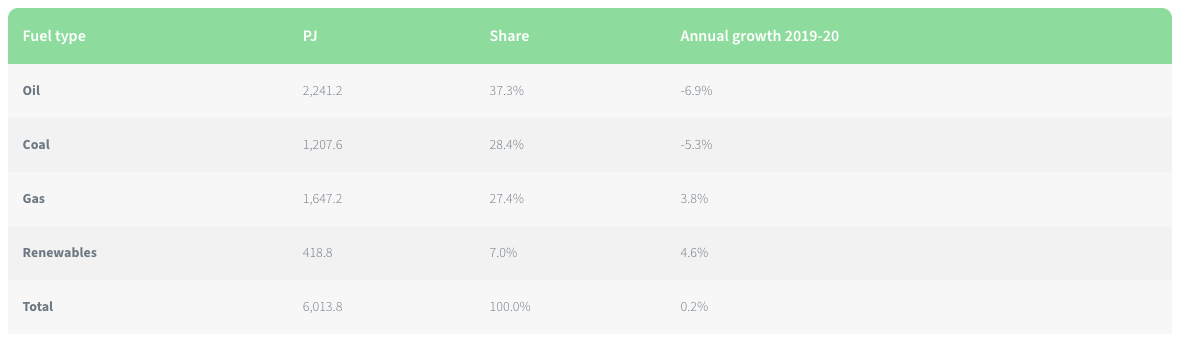

In 2019-20 Australia’s total energy consumption fell -2.9% overall, mainly due to the repercussions of COVID-19, with total energy consumption being 6,013.8 petajoules (PJ) – where one petajoule equals the electricity usage of 19,000 homes per year.

Of this figure, renewable energy represented 7% of all consumption.

However, of all the petajoule energy consumption in Australia, residential usage only represents 7.9% of this, positioned fifth after transport (26.5%), electricity supply (25.5%), manufacturing (17.1%) and mining (14.2%).

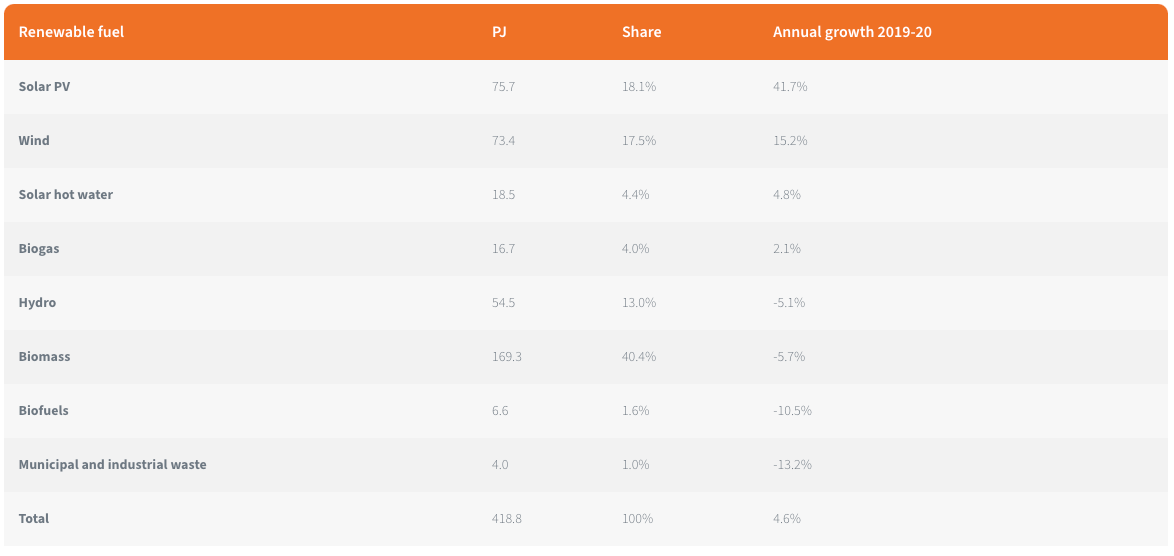

The 7% of Australia’s total renewable energy consumption is made up of many sources including hydropower, wind and solar, but also biomass, biogas and biofuel.

These are fuels derived from plants, including the breakdown of organic matter (such as animal and food waste).

Consumption from renewable sources saw a large increase of 4.7% growth in 2019-20 on the previous year, driven mainly by solar photovoltaic (PV), which increased by 41.7%, and wind by 15.2%.

Renewable energy generation

Generation by renewables increased by 15% in 2019-20 on the previous year, representing 23% of all energy generated in Australia. This figure increased further in 2020 to 24%.

Solar production experienced a massive increase of 42% and wind increased by 15%. Overall, of the 23% of renewable energy produced, solar and wind contributed 8% each to total generation.

Solar PV is the darling of Australians, the report highlighted, as it was the fastest-growing source of renewable energy over both periods.

The study found that there is ‘broad’ support for ‘de-carbonisation policies’ such as 82% of Australians believing that coal-fired power stations should be eliminated.

Overall, 63% prefer investment in renewables, with 79% citing that solar is their number one preferred energy source, followed by wind and hydro. Notably solar was the top choice across all ages, genders, states and political affiliations.

However, 23% of respondents cited that increasing electricity prices are due to the fact that renewable energy is expensive but is this really the case?

With pressure constantly on the household dollar, Australians could think that prices are increasing, however, it’s the opposite, authors of the report said.

The Australian Energy Market Commission (AEMC) Residential Electricity Price Trends report for 2021 found that prices will decrease on average by 6% into 2024 due to cheaper wholesale electricity and stronger implementation of renewables (solar, wind, gas and batteries).

The Australian Competition and Consumer Commission’s (ACCC) inquiry into the National Electricity Market for 2021 reinforces the above by stating that the average residential bill in 2020–21 was $1434, having decreased by $128 or 8% from the two previous financial years.

Savvy managing director Bill Tsouvalas said these statistics show Australians are scared of what the consequences of climate change will be.

“Australians are demanding greener choices now to fuel their basic everyday living requirements – electricity and thankfully change is happening in both the commercial and residential sectors and will only continue to increase, radically.”

To ASX news

FMG recognised as ‘global leader’ in sustainability

Fortescue Metals Group (ASX:FMG) has been recognised globally for its corporate responsibility performance with the company’s inclusion in the 2022 S&P Global Sustainability Yearbook with a gold class award.

More than 2,100 companies, representing more than 45 per cent of global market capitalisation, participated in the corporate sustainability assessment – the gold class award being awarded to those with an assessment score within one per cent of the top score in their industry.

In a market announcement this morning the company said it has also been listed on the Australian, Asia Pacific and World Dow Jones Sustainability Indices for the third year, recognising the company’s continued commitment to sustainability.

But earlier this month the iron ore miner got slapped with an ESG score of 66 out of 100 by S&P Global Ratings, reflecting a score one below the 67-point average of more than 100 entities rated across 22 sectors globally.

FMG’s subpar result demonstrates that even though it has “robust ESG management practices and a credible ambition to address its high environmental and social exposure” according to S&P, its efforts toward downstream decarbonisation still remain “fairly nascent”.

By region, S&P said the highest average score is 72 for companies headquartered in Europe, the Middle East, and Africa – which mean those companies are “less prone to experience material ESG-related events and are better positioned to capitalise on ESG-related growth opportunities.”

Cimic’s UGL awarded $185m utilities contract with Snowy Hydro

Cimic Groups’ (ASX:CIM) UGL has been named the principal contractor by Snowy Hydro Ltd for the construction of a 660MW power generation plant at the Hunter Power Project in Kurri Kurri, New South Wales.

It is expected the contract will generate $185m in revenue to UGL for a period of two years.

The plant will consist of two heavy-duty F-class gas turbine generators and the related auxillaries which operate using dual fuel sources, including provision to operate on a hydrogen fuel mix.

Cimic group chief executive officer Juan Santamaria said hydrogen-ready gas turbines have been “an important role” in reducing carbon emission from traditional power generation.

The contract will begin this month.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.