Green Energy: New investment in renewable energy hits $174 billion… ‘nothing to write home about’

Pic: Thana Prasongsin / Moment via Getty Images

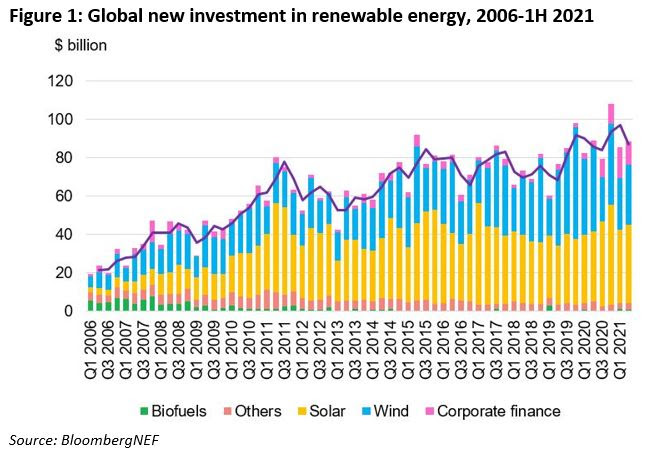

BloombergNEF says that new investment in renewable energy projects and companies totalled $174 billion in the first half of 2021 due to record public market financing and record levels of venture capital and private equity commitments.

It’s the highest total ever recorded in the first half of any year, and 1.8% more than during the same time a year prior (but 7% down from the second half of 2020) according to the latest Renewable Energy Investment Tracker.

While there was a decline in investment in new renewables projects – down 12% from H1 2020 at $145.8 billion – this was offset but a jump in equity offerings of renewable energy companies.

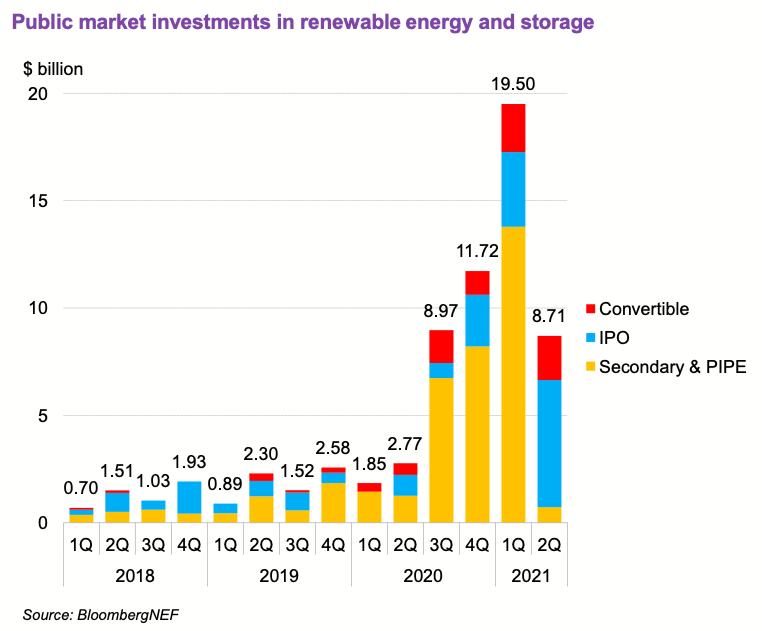

New equity raised on public markets hit a record high at $28.2 billion in 1H 2021, as did venture capital and private equity commitments to renewable energy companies at $5.7 billion.

But BNEF head of analysis Albert Cheung said it’s nothing to write home about if we want to reach global net zero.

“Renewable energy investment has withstood the effects of the global pandemic, in contrast to other sectors of the energy economy where we have seen unprecedented volatility,’ he said.

“However, a 1.8% year-on-year increase is nothing to write home about. An immediate acceleration in funding is needed if we are to get on track for global net zero.”

Investors want exposure to renewables

The first half of the year saw the highest ever total for equity raised on public markets by clean energy companies – $28.2 billion – up 509% from last year.

And the bull run for clean energy shares enabled many companies to issue new shares to finance growth.

Among the largest share offerings was Chinese renewable energy generator China Three Gorges Renewables which raised $3.5 billion, PV manufacturer Longi Green Energy Technology ($2.4 billion), and US fuel cell company Plug Power ($2 billion).

“As the energy transition accelerates, investors are increasingly looking for ways to increase their portfolio exposure to renewable energy and related areas, such as energy storage and hydrogen,” BNEF head of clean power Logan Goldie-Scot said.

“This record first half for clean energy fundraising underlines the strength of appetite for sustainable investment opportunities aligned to a net zero future.”

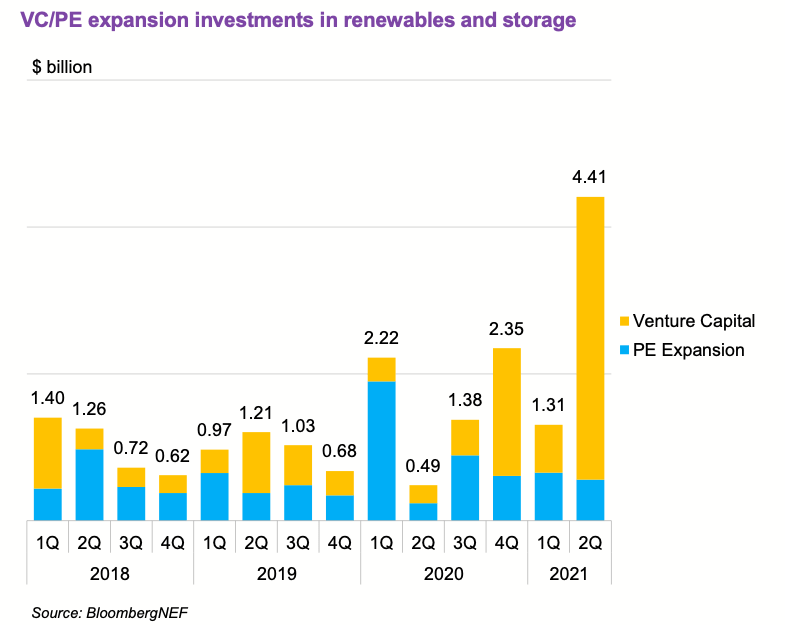

Record venture capital and private equity investment

Public investments weren’t the only thing breaking records.

BNEF said that venture capital and private equity expansion capital have been key elements in the growth of renewable energy and storage, with young companies tapping specialist early-stage funds for capital, well ahead of seeking public market flotations or trade sales.

In 1H 2021, VC/PE expansion investment in renewable energy and storage companies totalled $5.7 billion – up 111% on the previous year and an all-time record in this space.

The largest deals included $2.7 billion for NorthVolt AB, a Sweden-based battery manufacturer, and $374 million for Amp Solar Group Inc., a Canada-based renewable energy generator.

Solar investment up 9% but wind cooled

Interestingly, investment in large and small-scale solar projects rose to a record-breaking $78.9 billion, up 9.5% from 1H 2020.

And it was China that led the pack, nabbing a tidy $4.9 billion for solar projects in 2Q 2021, up from $2.8 billion in the first quarter.

This increase was largely driven by major financings of gigawatt-scale ‘subsidy-free’ projects developed by state-owned enterprises like China Energy Investment Corp and Huanghe Hydropower, which must be commissioned this year.

The US followed, with large-scale solar project investment rising to $6.4 billion in 2Q 2021, from $5.3 billion in the first quarter, driven by a number of large projects closing.

While solar soared, wind financing was actually down 30.5% from 1H 2020 at $58 billion.

BNEF said that last year, the world invested more than $500 billion in the energy transition – it remains to be seen if we can top that figure in 2021.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.