GOT GAS: Deep Strike proves there’s more gas to flow from Perth Basin

Strike Energy's Erregulla Deep-1 well has found gas deeper than anywhere else in the Perth Basin. Pic: Getty Images

- Strike Energy’s intersection of deep gas proves the Perth Basin can still surprise

- Successful production test at Kiwi-1 will enable Bass Oil to push gas into the gas hungry east coast market

- Empire Energy to drill ambitious horizontal well in the Beetaloo Basin

Welcome to the revamped Got Gas, where Stockhead senior energy journalist Bevis Yeo gives you the lowdown on the news and insights you need to know in the ASX energy sector.

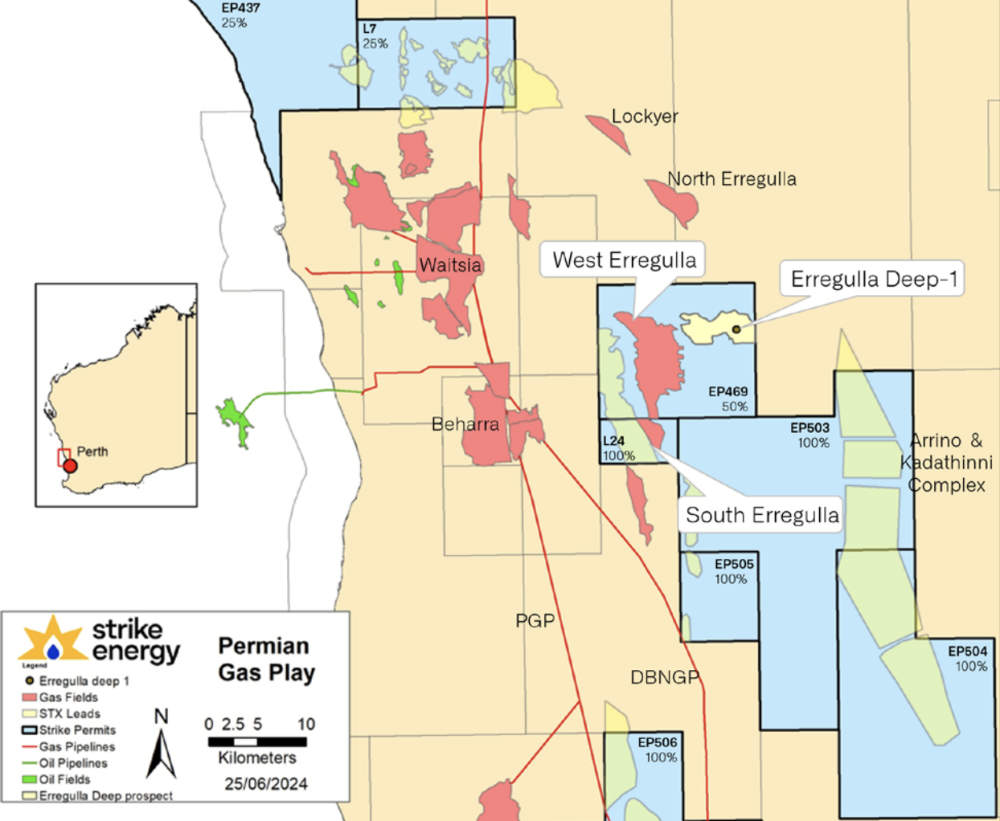

The Perth Basin has proven once again why it could be the next frontier to supply WA’s gas demand after Strike Energy (ASX:STX) made two high-quality gas discoveries at its Erregulla Deep-1 exploration well.

The deepest well ever drilled onshore Australia – at a measured depth of 5225m – intersected 28m of net gas pay at depths never encountered in the Perth Basin.

This includes 26m of net gas pay within the Kingia Sandstone with an average porosity of 13% and high reservoir pressures of ~7623 psia and 2m of net gas pay within the High Cliff Sandstone with an average porosity of 11% and reservoir pressures of ~7,807 psia.

Encouraging numbers. The porosities are well within the range for conventional gas reservoirs while the pressures are on the high end of the scale.

That the gas samples indicate even lower carbon dioxide content than observed at the company’s West Erregulla well is a welcome bonus indeed.

Unsurprisingly, the company plans to complete Erregulla Deep-1 as a future gas producer.

It also wouldn’t be surprising that this might light at least a small fire under the other Perth Basin operators.

Beach Energy (ASX:BPT) and its operating partner Mitsui E&P Australia are already well advanced with their plans to develop the Waitsia field, with first gas from the large Phase 2 development expected to flow in early 2025.

However, more gas is more gas and STX’s success could very well motivate the JV to look a little deeper with its future wells.

The same could hold true for diversified miner Mineral Resources (ASX:MIN), which is in the gas game with its Lockyer field, largely to lock in supplies for its mining operations.

A final investment decision for Lockyer, which also features the highest stabilised flow rate on record in the Perth Basin of 106 million standard cubic feet per day, is expected in Q4 2024, though this is subject to the WA State Government agreeing to a partial export exemption similar to that enjoyed by Waitsia.

East coast dispatches

STX is not the only player in the junior oil and gas sector which could fill supply shortages.

Bass Oil (ASX:BAS) could help address the gas supply shortfall on the east coast after successfully concluding the extended production test for its Kiwi-1 well in the Cooper Basin, South Australia.

It won’t ease all the projected supply woes, but Kiwi-1 looks set to be part of a combined solution where every little bit counts.

The well flowed gas at a maximum rate of 4.1 million cubic feet (MMcf) of gas and 988 barrels of condensate (light oil) per day.

What’s heartening for BAS is that this flow rate was constrained due to condensate storage limits. That means production could be a fair bit higher once a formal development is approved that actually has the required storage.

The other bonus is the condensate flows were over 10 times higher than pre-test expectations, meaning the company could be in for a real payday as this could actually mean the liquids flow has a higher value then the gas flow.

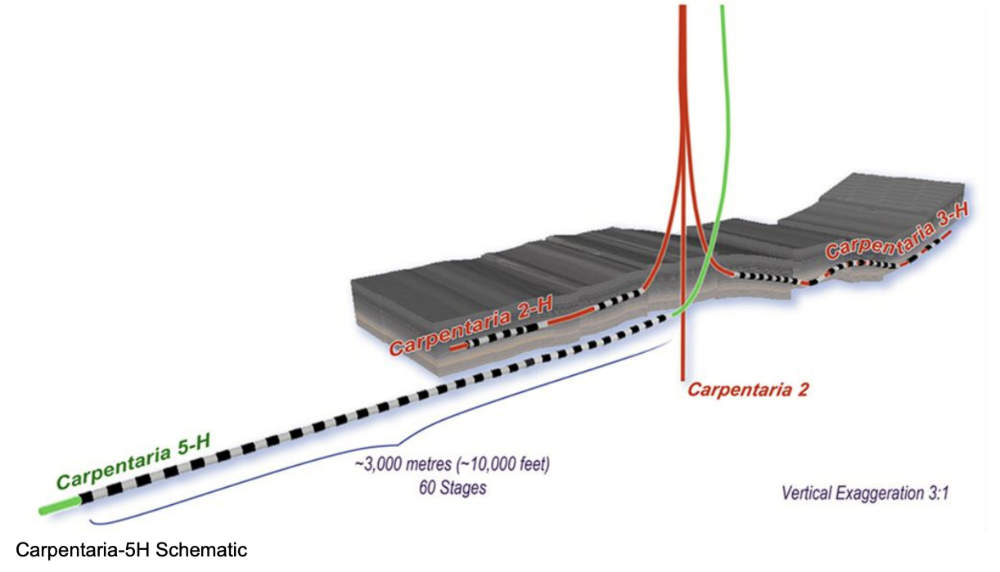

Meanwhile, Empire Energy (ASX:EEG) is preparing to drill its ambitious Carpentaria-5H well in the Beetaloo Sub-basin, the region in the Northern Territory that the gas sector likes to parade as the next big thing.

There is plenty of gas in the Beetaloo but proving up resources and getting the gas to market are major challenges.

EEG has some solutions here.

It is looking to do the first – at least for itself – with the work on Carpentaria-5H, and has the second all sewed up thanks to its acreage’s proximity to the McArthur River pipeline that provides access to the MRM power station and the McArthur River zinc-lead mine.

Nor is the company pulling its punches where Carpentaria-5H is involved.

Flush with funds from a capital raising that dropped a tidy $46.8m into its bank account in mid-April, EEG expects to spud the well in late October once the Ensign Rig 965 is released from its current contract with Omega Oil & Gas (ASX:OMA).

Carpentaria-5H will have an extensive horizontal section of ~3000m that will be the recipient of ~60 fracture stimulation stages.

Said fracture stimulation work will be carried out by international oil and gas services contractor Halliburton, which is bringing out the big guns with its 44,000 hydraulic horsepower (HHP) frac fleet – almost three times greater HHP than previous campaigns by EEG.

Further highlighting the company’s conviction, it will complete the well with 5 & ½ inch casing to allow fracture stimulation pump rates of over 100 barrels per minute.

This is double previous pump rates and may drive productivity gains.

All this work is expected to lead to initial flow testing in Q1 2025 that will let EEG know if all its efforts (and investment) were worth it.

If it does, pilot production sales could begin in mid-2025, which could be the catalyst EEG needs to really push development of its Carpentaria field and the associated infrastructure needed to fulfil the binding 10-year gas sales agreement it has reached with the NT Government.

Overseas dispatches

While many ASX juniors in South America are poking around for lithium, rare earths or copper, Condor Energy (ASX:CND) is betting that the waters off Peru could host oil and gas.

This is not an unfounded belief given its 4585km2 Tumbes Basin Technical Evaluation Agreement covers the existing Piedra Redonda gas field, which has a contingent resource of just over 400 billion cubic feet of gas and two high potential oil prospects.

The company has now started a review of these areas using recently reprocessed legacy 3D seismic that had vastly improved the data quality and is confident that this will lead to resource estimates.

It is also worth noting that the area has clearly piqued the interest of the big boys with French supermajor Total having recently snapped up all the acreage around CND’s projects right up to the Ecuador border.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.