Good news for oil juniors as prices hit three-year highs

Pic: Thana Prasongsin / Moment via Getty Images

Oil prices rose to fresh multi-year highs on Wednesday morning after OPEC said it cut supply more than expected and markets poised for sanctions on Iran.

That’s good news for ASX-listed oil juniors — many of which have enjoyed recent share price gains.

>> Head here for a list of ASX oil small caps

Brent, the international benchmark, rose as much as 1 per cent to $US79.47 per barrel. The US benchmark West Texas Intermediate was up about 0.9 per cent to $US71.89 a barrel.

Both haven’t hit those levels in more than three years.

OPEC on Monday reported it’s cutting production by more than is required.

The cartel also said its output rose slightly last month, mainly via Saudi Arabia, but raised its demand forecast for next year by 25,000 barrels per day to average 98.85 million barrels per day.

Elsewhere, supply concerns have been mounting over the last week after President Donald Trump the US pulled out of the Iran nuclear deal – a move that reimposes sanctions on Iranian barrels.

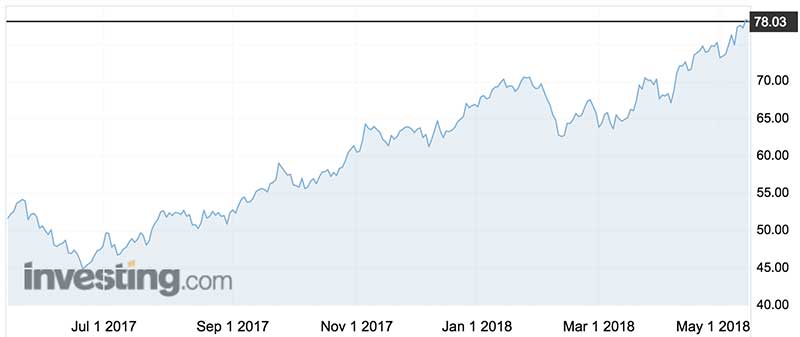

Brent is up 51 per cent over the year.

This graph shows the price of global oil benchmark Brent crude over the past year:

Here’s the one-year price graph for the US oil price benchmark, West Texas Intermediate:

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.