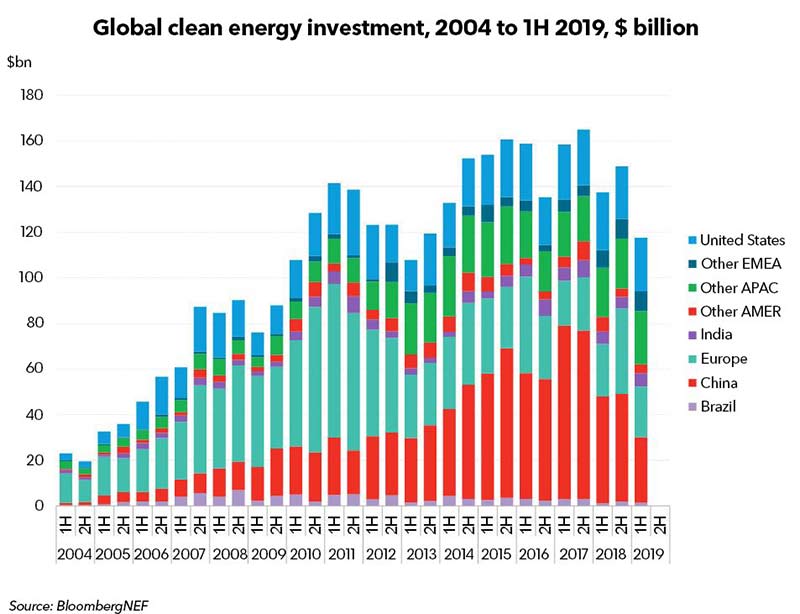

Global clean energy investment plummets to 2013 levels

Pic: Getty

Global clean energy investment tumbled in the first half of 2019, driven by a 39 per cent drop in the world’s largest market, China.

US and Europe also fell by a relatively modest 6 per cent and 4 per cent, respectively.

Compared to the same period last year, overall global investment was down 14 per cent to $US117.6 billion ($168.5 billion) — the lowest figure for any half-year period since 2013, says Bloomberg New Energy Finance (BNEF).

Justin Wu, head of Asia-Pacific for BNEF, says while the slowdown in China is real, the figures probably overstate its severity.

“We expect a nationwide solar auction happening now to lead to a rush of new PV [photovoltaic] project financings [in China],” Wu says.

“We could also see several big deals in offshore wind in the second half.”

This pullback was tempered by a couple of massive deals, including a world-record $US4.2 billion 950MW solar thermal and photovoltaic complex in Dubai, as well as two offshore wind arrays (640MW and 900MW) in the sea off Taiwan worth a combined $US5.7 billion.

Money also continues to flow into electric vehicles, BNEF says.

Investment in publicly listed specialist clean energy companies jumped 37 per cent to $US5.6 billion for the half, boosted by two big equity raisings for EV makers Tesla ($US863m) and China-based NIO ($US650m).

Venture capital and private equity funding was down 2 per cent to $US4.7 billion, with three exceptionally large deals — a collective $US2.7 billion for EV-facing companies Northvolt, Lucid Motors, and Rivian — taking the lion’s share.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.