Frontier locks in $215m financing from Cannon-Brookes backed Infradebt

Infradebt is set to provide debt financing of up to $215m for Stage One of Frontier Energy’s Waroona project. Pic: Getty Images

- Frontier Energy has entered into a debt financing agreement with Infradebt for up to $215m

- Infradebt is an Australian specialist infrastructure fund with investors including Mike Cannon-Brookes’ Grok Ventures

- The debt financing will fund the development of Stage One works at Waroona

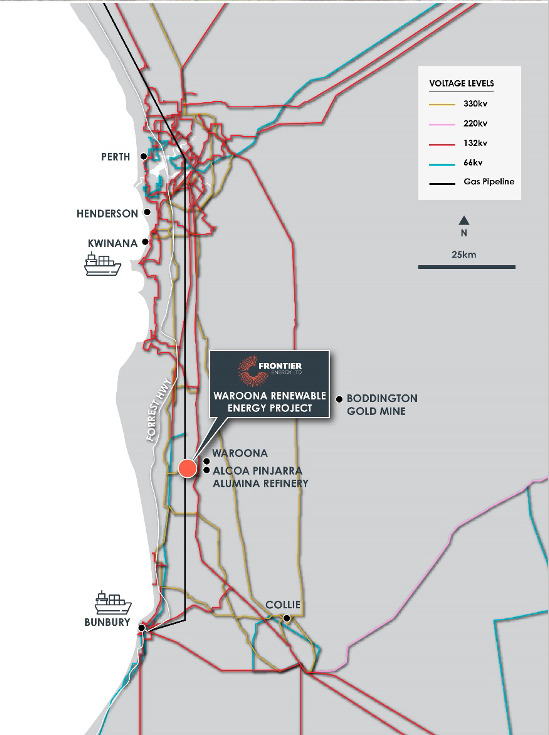

Special Report: The clear strengths of Frontier Energy’s Waroona renewable energy project in Western Australia have allowed it mandate Infradebt, which is backed by Australian billionaire Mike Cannon-Brookes, to secure $215m in debt financing.

Infradebt is an Australian specialist infrastructure fund which provides investors with fixed income products and a transparent investment approach.

Its products include the Infradebt Energy Transition Fund, which is dedicated to financing grid scale battery projects in Australia.

Initial investors in this fund include Cannon-Brookes’ Grok Ventures, which is itself focused on investing in companies and projects that seek to decarbonise the world, and the JANA Diversified Infrastructure Trust that seeks to fund sustainable investments.

Infradebt also works with the Clean Energy Finance Corporation to provide direct investment in mid-range utility-scale solar and wind projects with a generation capacity of up to 50MW. This includes a $150m commitment from the CEFC.

Under the agreement with Frontier Energy (ASX:FHE), Infradebt will provide debt financing of up to $215m for Stage One of the Waroona project with key terms including a 17-year debt tenor and an innovative repayment structure that allows the project to maximise exposure to its attractive economics.

It also includes a long-term partnership to finance further battery projects including the proposed Stage Two of the Waroona project.

The final debt quantum will be confirmed once the Reserve Capacity Price from the Australian Energy Market Operator is determined in late September 2024.

The benchmark Reserve Capacity Price of $230,000 for the 2026/27 capacity year has already been published.

“The company is delighted to mandate Infradebt, an Australian-based infrastructure specialist, to provide debt financing of up to $215m for the development of Stage One of our Waroona project,” chief executive officer Adam Kiley said.

“The company received multiple credit endorsed proposals as part of the debt financing process from several major financial institutions, however, the Infradebt offer was superior with a highly attractive tenor and interest rate, whilst also providing greater flexibility compared to alternatives.

“Infradebt’s proposal is also for 100% of the debt financing, meaning the company will only deal with a single party compared to a syndicate solution.”

Waroona Stage One

Stage One of FHE’s Waroona renewable energy project combines a 120MWdc (megawatts of direct current) solar facility with an integrated battery storage facility to supply clean electricity into the South West Interconnected System.

The 4.5 hour duration 80MW/360MWh lithium-ion phosphate (LFP) battery will allow the company to benefit from the high average energy price of $143MWh during peak periods by storing electricity generated by the solar panels during off-peak hours when the sun is shining.

This energy price is potentially conservative as peak prices for the first six months of 2024 averaged $164/MWh, ~14.7% higher than the assumed $143/MWh price used in the DFS.

Additionally, the final selection of LFP batteries also resulted in a 12% increase in battery capacity, and a ~5% reduction in cost compared to the definitive feasibility study estimate of $118.5m.

This, along with a reduction in the cost of solar panels, is likely to deliver significant improvements to the definitive feasibility study, which had indicated that Waroona will deliver annual EBITDA of $68m over the first five years of operation and a post-tax IRR of 21.6%.

Capex had been estimated at $304m in the DFS.

Waroona could also benefit from the Federal Government’s Capacity Investment Scheme in WA, which seeks to underwrite 1.1GW/4.4GWh of new, clean dispatchable energy in the state.

The final design of the scheme now allows co-located solar and battery projects rather than just battery-only projects to tender for the scheme, which will provide annual revenue underwriting of up to 90% based on the units of $ per MW of capacity credits, if the project falls below a revenue floor for up to 15 years after commissioning.

Should a project’s revenue exceed a ceiling rate, half of its revenue will need to be returned to the Government to cover the costs of the scheme, depending on the capacity credits generated and ceiling bid.

The CIS is expected to help underpin Stage Two of the Waroona project.

This article was developed in collaboration with Frontier Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.