Frontier Energy’s Waroona procurement process surprises with potential to lower capex

Most long lead items for Frontier Energy’s Waroona renewable energy project look to be cheaper than expected. Pic: Getty Images

- Frontier Energy to finalise equipment selection and contracts for Waroona long-lead items this quarter

- All long lead items are either in line with or, in most cases, lower than estimated in its DFS

- WA peak energy prices have hit a record high of $172/MWh

Special Report: Development of Frontier Energy’s Waroona renewable energy project in WA is proceeding apace with final equipment selection and contract negotiations for long lead items expected to be completed this quarter.

The Waroona project comprises a 120MWdc (megawatts of direct current) solar facility with an integrated four-hour 80MW battery – the latter expected to be invaluable due to increased volatility in WA electricity prices.

Frontier Energy (ASX:FHE) has already delivered a definitive feasibility study outlining attractive economics for the $304m project.

These include EBITDA of $68m over the first five years of operation and post-tax IRR of 21.6% using an average energy price of $143/MWh4 (peak periods) and $80MWh4 (solar price) over the life of operations.

This is in line with 2023’s actual prices on WA’s Wholesale Energy Market (WEM).

Energy prices reaching record highs

However, the company’s estimates could turn out to be hugely conservative.

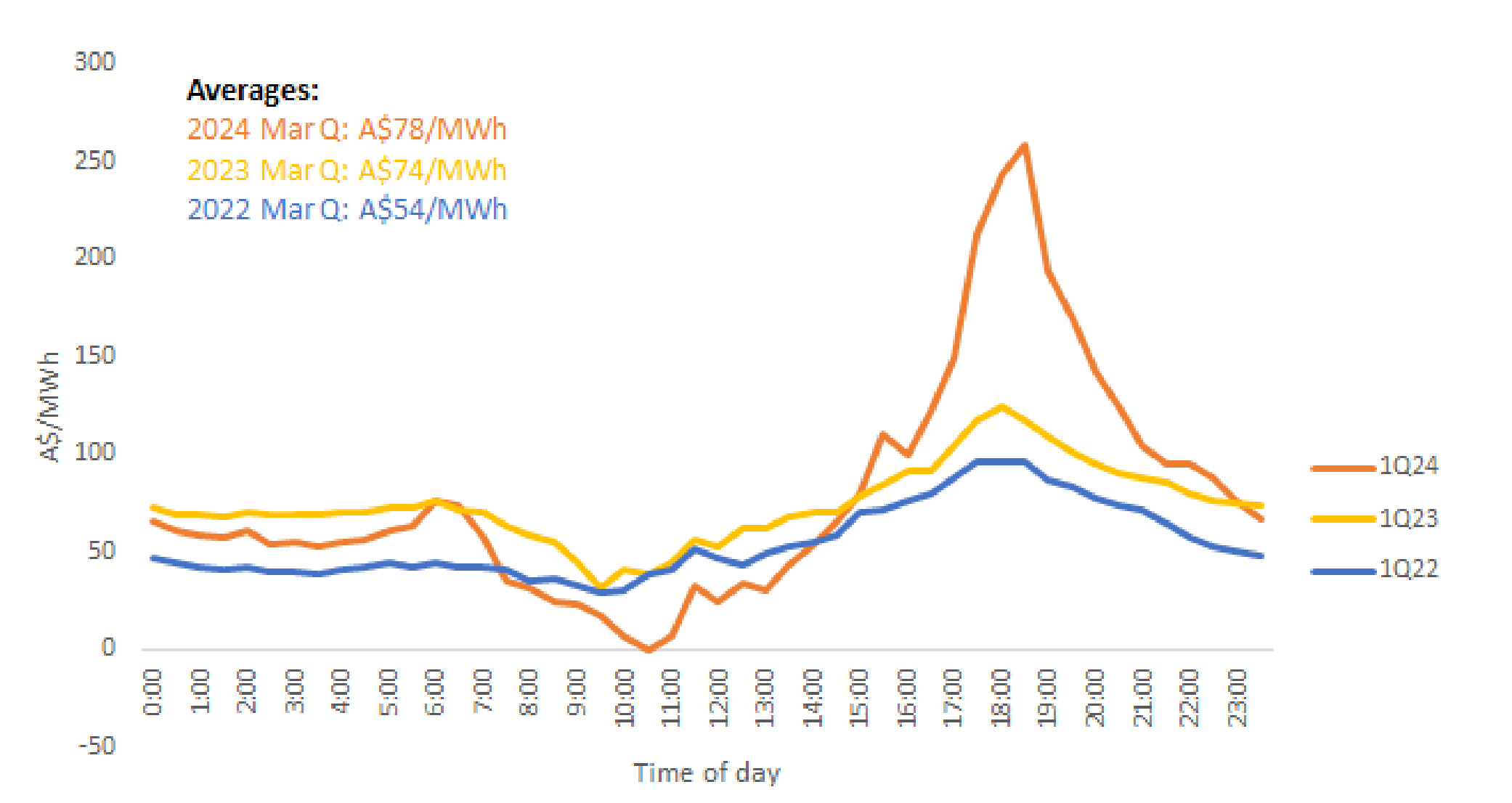

Frontier’s move to secure batteries, photovoltaic panels and inverters comes amidst a significant increase in peak energy prices (4pm-9pm) during the March quarter.

WA’s peak demand reached a new record of 4.23GW in February 2024, and exceeded the record peak six times during the March quarter, sending peak prices up 65% to $172/MWh compared to the previous year.

This proves the wisdom of the company’s decision to include a battery that can store solar energy generated during low price periods in the morning through to midday and dispatching this energy during the afternoon/evening peak.

Wholesale prices also averaged $78.5/MWh during the March quarter, up 6% on the previous corresponding quarter.

Potential to LOWER CAPEX

Procurement of the long-lead items also looks positive with capital cost estimates either in line with, or lower than, estimates in its DFS despite only including tier-1 global suppliers in the process, which could lower capital costs.

Additionally, no delay in the delivery of key long lead items has been identified through the process.

FHE has also received expressions of interest from a number of highly regarded EPC contractors and will shortlist the preferred parties in the coming weeks.

“A key risk for any project is an escalation in capital costs through the procurement process. It’s pleasing that cost estimates for all major long lead items have either been in line with expectations or, in most cases, actually fallen,” FHE chief executive officer Adam Kiley said.

“Only tier-1 suppliers have been invited to tender. Good quality equipment supplied by reputable suppliers helps us ensure the facility will start-up and operate as expected and importantly will be reliable.

“In addition, the company is also quickly progressing our funding strategy, as both the debt financing and the potential strategic divestment process is well advanced. The company will provide a more detailed update regarding both processes in the coming weeks.”

Kiley recently joined host Peter Strachan on Stockhead’s Rock Yarns podcast to dish it all on the plans for Waroona. Click here to tune in.

This article was developed in collaboration with Frontier Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.