Fortescue’s green hydrogen pullback creates plenty of opportunities

Fortescue's hydrogen retreat presents opportunities for smaller, nimbler players. Pic: Getty Images

- Fortescue’s decision to abandon its goal of producing 15Mt of green hydrogen by 2030 is seen as a setback for the sector

- However, it has paved the way for companies such as PH2 to build up hydrogen demand by starting small

- Meanwhile, Hazer’s technology is promising to produce hydrogen just as cleanly and far cheaper than green hydrogen

Fortescue’s (ASX:FMG) recent decision in mid-July to pull back on its goal of producing 15Mt of green hydrogen by 2030 is generally seen as a setback for the broader sector.

With the company pointing the finger towards the high cost of electricity, its move has led to questions about the broader green hydrogen sector, which is reliant on renewable electricity to power electrolysers that split water molecules into hydrogen and oxygen.

However, while the company’s plans have been put on hold, its founder Andrew Forrest remains confident that green hydrogen still has the power to decarbonise hard-to-abate industries.

This includes the use of green hydrogen to produce green iron, a key plank of Fortescue’s plan to eliminate about 90% of its CO2 equivalent emissions associated with its Australian iron operations and hit net zero Scope 3 emissions by 2040, those which include those generated by its steelmaking customers.

FMG also recently introduced a prototype hydrogen haul truck “Europa” for testing at its operations.

Government support strong but lacking on the small end

While Fortescue’s step back is indeed a blow for perceptions of green hydrogen, it doesn’t mean the sector is all doom and gloom.

Speaking to Stockhead, Pure Hydrogen Corporation (ASX:PH2) sales manager Clint Butler said that in recent times there has been increased engagement from governments at the federal and state levels to support the growth of Australia’s hydrogen industry.

“In the 2024 budget, the Federal government announced it will establish a temporary Hydrogen Production Tax Incentive to incentivise renewable hydrogen production for eligible Australian-resident corporations, with a time-limited and uncapped refundable tax offset,” he pointed out.

“This will provide a $2 incentive per kilogram of renewable hydrogen produced for up to 10 years, between 1 July 2027 and 30 June 2040 for projects that reach final investment decisions by 2030.

“At the state level, we have noted ongoing efforts by Queensland policymakers to support the growth of hydrogen, which the government promoted in a recent advertising campaign featuring Pure Hydrogen’s Taurus truck.”

However, Butler criticised the lack of targeted support in the short term for smaller hydrogen production strategies.

This includes the company’s planned domestic Hydrogen Highway, which would help the heavy vehicle industry wean itself away from dirty imported diesel.

He added that while producing green hydrogen should be the end goal, there were several factors that needed to be considered before it could reach the point of being produced and sold at a competitive rate.

“When making hydrogen using renewable energy (solar/wind), the cost of electricity is still a big factor that will need to be generated at a very low price point to reduce the end price of green hydrogen producer,” Butler noted.

“There is no point producing hydrogen in the middle of nowhere away from population centres and away from where it will be used as the transport cost, which then exacerbates the end cost of hydrogen,” he added.

Building hydrogen demand from ground up

PH2 itself believes hydrogen demand needs to be built from the ground up.

The starting point is constructing hydrogen micro-hubs capable of producing up to 400kg/day – that’s enough to fuel 20 trucks or buses a day close to or at where the customer has its base.

It also plans to build its previously mentioned Hydrogen Highway along the way, which will feature micro-hubs along the route that can be scaled up as demand grows.

“Such a strategy requires smaller Capex and it can be flexibly scale up based on demand,” Butler said.

“There’s no point building the hydrogen “Taj Mahal” if there is not enough demand to support it – which at this point in time there isn’t.

“Strategically, PH2 is concentrating building out demand via our zero-emission vehicle business HDrive International, and scaling up production in a targeted way to meet demand.

“In that context, our demonstration plant at Archerfield Airport in Queensland is a great example that our hydrogen micro-hub strategy will work. We are focused on getting that right because it will be our showcase to other locations across Australia and into the international markets.

“There has already been interest from Vietnam, USA, South America and the Middle East to adopt the same micro-hub model that PH2 has introduced.”

He added that over the next 6-12 months, the company’s focus was on marketing sales of its zero-emission vehicles as well as developing the Archerfield micro-hub.

Clean hydrogen’s chance to muscle in

While green hydrogen has been in the limelight, there are alternatives – colloquially known as clean hydrogen – seeking to produce emissions-free hydrogen using fossil fuel feedstock.

Leading this charge is Hazer Group (ASX:HZR), which has made great strides towards commercialising its self-named process.

Managing director Glenn Corrie told Stockhead that while Hazer was caught up in the down draft from the Fortescue decision, it believed that the pullback was inevitable due to the high cost of producing green hydrogen. This has created an opportunity for the company.

He pointed out that splitting a water molecule into hydrogen and oxygen using renewable electricity is an energy-intensive process due to the strong molecular bond of water.

“To put that into numbers, it currently requires about 55Kwh to produce 1kg of hydrogen. That’s a lot of energy,” Corrie noted.

“By contrast, what we do is we effectively remove carbon from natural gas (methane) to produce hydrogen and graphite and that requires just 8KWh to achieve.

“When you translate that into costs, you can see immediately that green hydrogen is going to be seven times the cost of what we do.”

Given the big disparity in costs, Corrie believes there is an opportunity for an advanced manufacturing process like Hazer to capture a large share of the market.

“The way I see it, it is an opportunity for Hazer because we can provide clean hydrogen today for a fifth to a seventh of the cost and accelerate the pathway to hydrogen much faster and more affordably than what green hydrogen can do,” he added.

Working on commercial scale

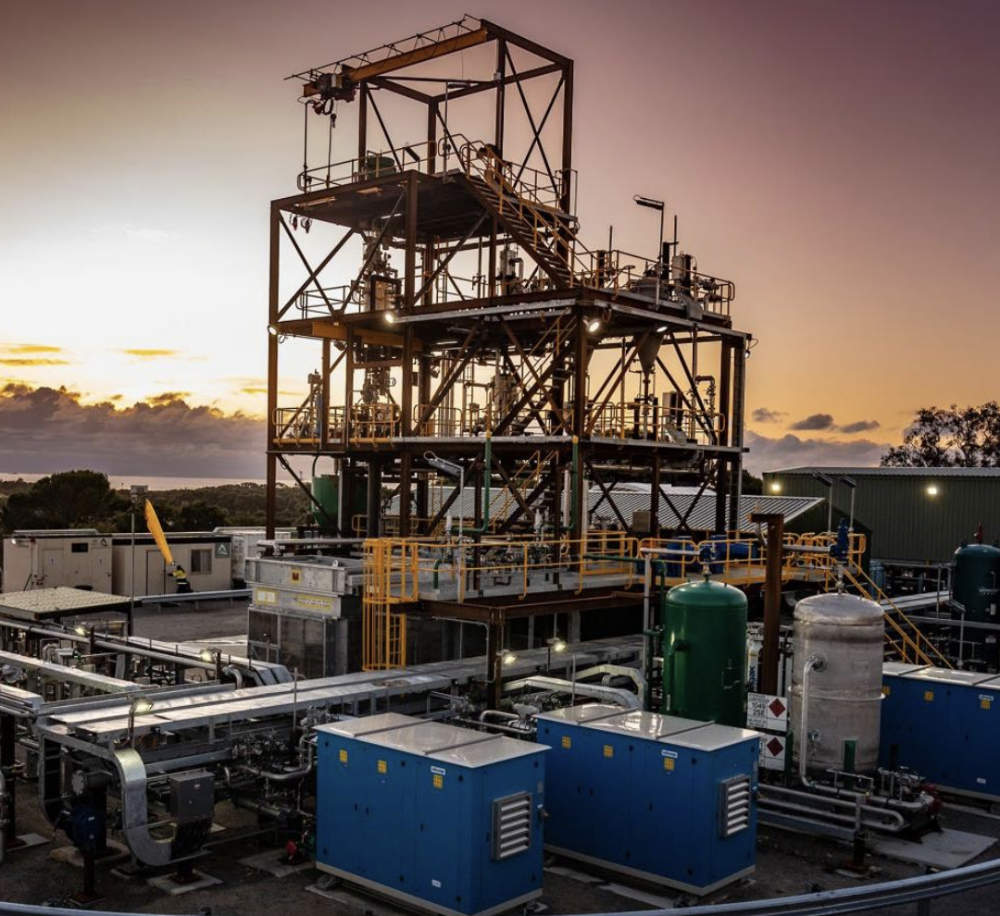

Corrie also pointed out that the company’s commercial demonstration plant, which represents the fifth successful scale-up of its technology, had passed through 240 hours of continuous operation.

This is an achievement that proves, de-risks and demonstrates that HZR technology works continuously on a commercial scale.

“It kicks off a number of really important critical success factors for our technology, so we are really excited about it,” Corrie said, adding that it is also the final stage before Hazer moves towards overall commercialisation.

“It is 15 years of development, $100m of capital deployed to develop the technology to where it is today and to prove it and de-risk it at this level is transformational for our company.”

Proving just how mature the technology is, HZR has already secured four commercial customers that will license the technology, with South Korean steel maker Posco being a notable example.

“We have had so much demand for the tech and with the CDP and demonstration plant going to plan, the interest in the technology has accelerated,” Corrie added.

“What a lot of people don’t appreciate is that all of the hydrogen produced today in the world is derived from natural gas. Our process uses the same feedstock but instead of producing carbon dioxide, we produce graphite instead, so we have a built in carbon capture and storage technology.

“We have some more milestones coming out of the demonstration plant, which again shows the progress of our technology and preparing it for commercial readiness by the end of this year.

“Concurrently, we have four commercial projects that are under early-stage licence arrangements.”

Corrie said all four are being progressed.

“The first cab off the rank is our project in Canada, which we’ll be taking to FID next year,” Corrie said.

“There are a lot of milestones between now and then in terms of the final licence terms this year, and early revenue from our engineering services agreement coming in just around the corner.

“Corporately, we are in a pretty strong position. We are well funded today, we have a R&D rebate, further ARENA grant funding on the way and other applications for grant funding, so there’s more non-dilutive funding coming through at that level as well.”

At Stockhead, we tell it like it is. While Pure Hydrogen and Hazer Group are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.