Finder Energy races at speed towards Timor-Leste oil fields development

Finder Energy is rapidly progressing development of its Kuda Tasi and Jahal oil fields offshore Timor-Leste. Pic: Getty Images

- Finder Energy evaluating alternative development scenarios for its Kuda Tasi and Jahal oil fields

- Company currently evaluating suitability of available FPSO vessels

- Reprocessing of existing 3D seismic underway to optimise placement of development wells

Special Report: To speed through early project milestones, Finder Energy is leveraging the enormous amount of work sunk into its Kuda Tasi and Jahal oil fields offshore Timor-Leste by previous operators.

It acquired the 76% stake in PSC 19-11, which hosts the two fields that have combined best estimate (2C) contingent resources of 22 million barrels of oil equivalent (MMboe), in August 2024 for the low upfront consideration of US$2m from major oil and gas companies Eni International and Inpex Offshore Timor-Leste.

The acquisition includes an additional consideration of up to US$6.5m and a 5% royalty on reaching a final investment decision.

Contingent resources are already proven to host hydrocarbons though a decision on the economic viability of development has not been made.

While the fields were discovered when oil prices were low and are not quite of the scale required to warrant development by larger companies, they represent a significant and potentially economic asset for smaller companies like Finder Energy (ASX:FDR), particularly at current oil price levels.

Adding fuel to this endeavour is the potential for a development at the two fields to serve as a hub for exploring and developing other prospects in PSC 19-11. This includes the discovered Krill and Squilla fields that still require more work to mature.

Given the capital already invested into the fields, the company has been able to quickly tick off the boxes for the exploration and appraisal phases, allowing it to move into development.

Engineering progress

FDR is currently evaluating alternative development scenarios with key considerations being reduced capex, accelerated first oil, reduced opex and risk, and sources of funding.

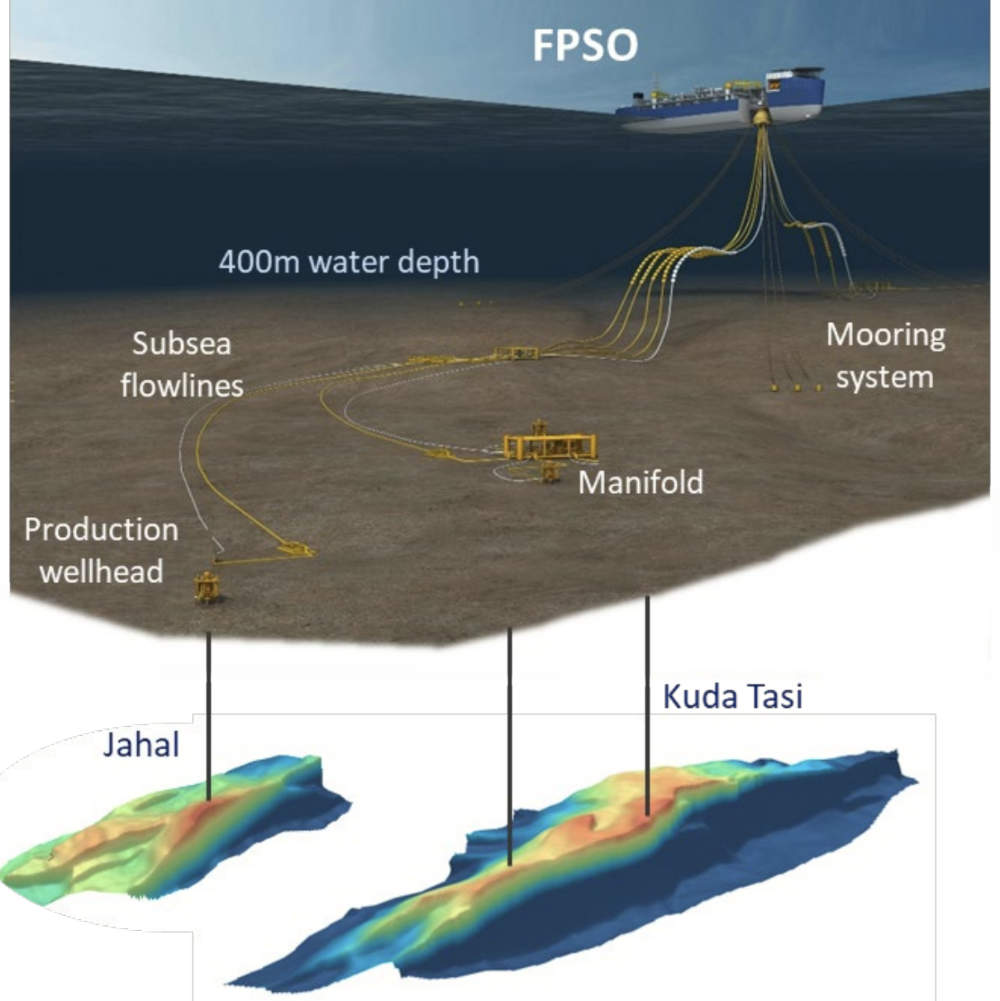

The main scenario for developing Kuda Tasi and Jahal centres around the use of a floating, production, storage and offloading vessel, which is essentially an oil tanker with topsides connected via subsea flexible flowlines and umbilicals to a number of wells on the sea floor.

FPSOs are readily purchased – increasing Capex and reducing Opex – or leased, which reduces Opex and increases Opex.

The company has undertaken a market survey to identify available FPSOs and is evaluating their suitability and – where applicable – the costs of any modification and Class Society certification.

Preliminary feasibility discussions are underway that include the consideration of deploying a potential early production system – a rapid, low capex development that uses a single well, or phased series of wells, to accelerate cash flow.

Dynamic modelling simulations are also being carried out across a number of scenarios to take into account production topside requirements and FPSO capacities.

High-flow tests on the Kuda Tasi-2 well have demonstrated superior reservoir performance due to excellent Laminaria Formation reservoir parameters such as porosity and permeability.

The regionally connected aquifer also provides high pressure support that is expected to lead to high recovery factors.

FDR expects initial production rates to be in the range of 25,000-40,000 barrels of oil per day depending on the number of wells, reservoir performance and FPSO facility constraints.

Excellent production rates have been proven at the nearby Laminaria/Corallina, Kitan and Buffalo oil fields that produce from the same reservoir formation.

Seismic reprocessing

The company is taking full advantage of its in-house experience in reprocessing seismic data to do so with the Ikan 3D seismic survey that was carried out in 2005 over the entirety of PSC 19-11.

This work, which was 20% complete by the end of October, uses high-end PSDM reprocessing technology to enhance subsurface imaging.

Reprocessing is aimed at improving the mapping of the Kuda Tasi and Jahal reservoirs and faulting to optimise placement of development wells to maximise production and recovery.

It will also evaluate the updip appraisal potential of the Krill and Squilla discoveries and derisk exploration prospects, including tie-back opportunities around Kuda Tasi and Jahal.

The project is expected to be completed by April 2025, with interpretation and updated dynamic modelling to follow.

Next steps

FDR is currently in the Concept Select phase, which is critical to refining the development concepts, costs and economics leading into front-end engineering and design (FEED) studies, and ultimately the project field development plan and final investment decision.

This will also feed into the process of securing a development partner with the company noting that is already seeing early interest in the form of capital, FPSO vessels or other development solutions that could greatly benefit the project.

This article was developed in collaboration with Finder Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.