Finder Energy makes big splash with 34 million barrels of net discovered oil in Timor-Leste

With the acquisition of PSC 19-11, Finder Energy has been transformed into a balanced developer and explorer. Pic: Getty Images

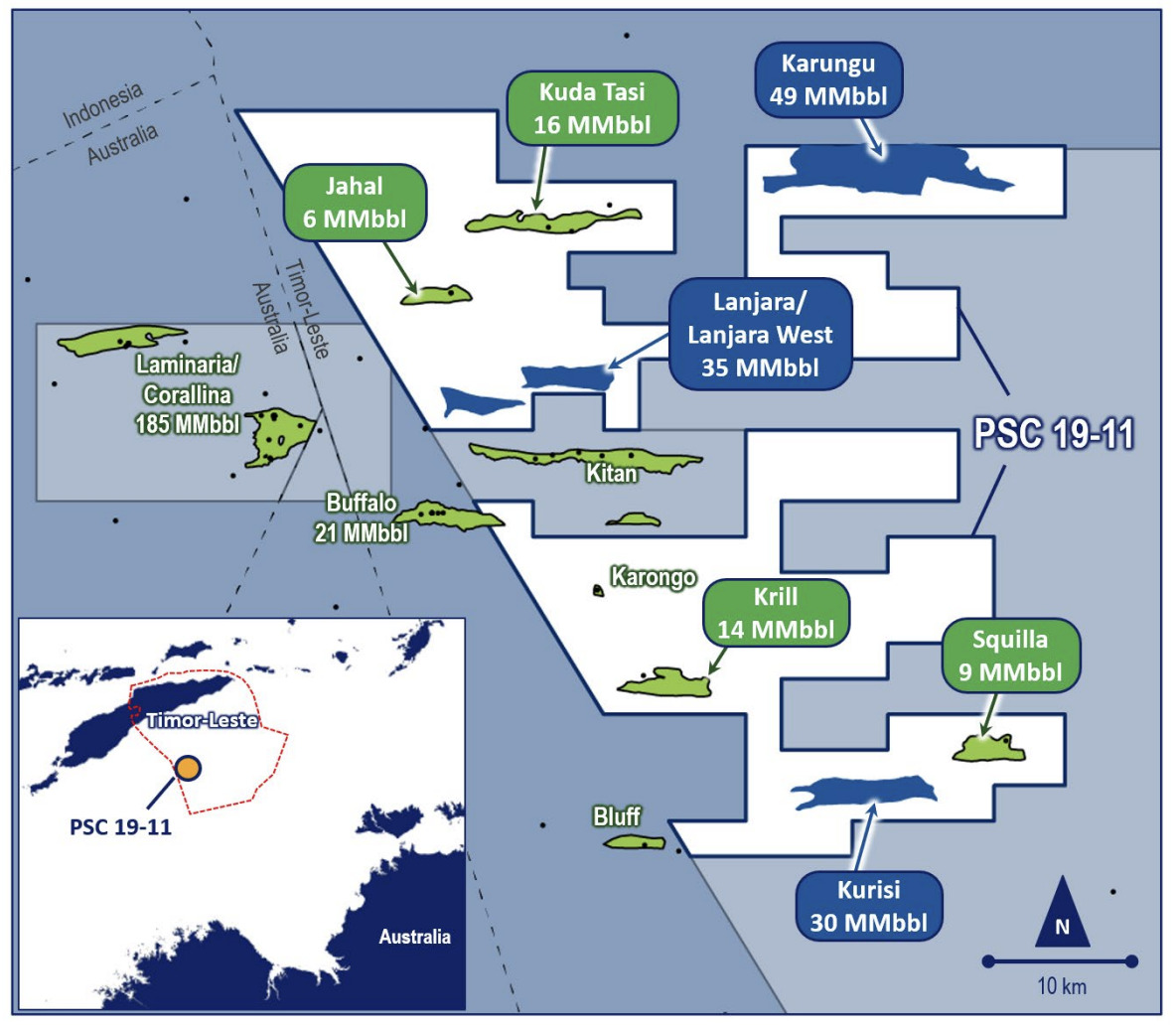

- Finder Energy completes acquisition of 76% stake in PSC 19-11, giving it 34MMbbl of net discovered oil

- Company will now fast track development of the Kuda Tasi and Jahal fields that host gross 2C contingent resource of 22MMbbl oil

- Significant potential also exists to add more barrels, including the Krill and Squilla discovered Oil Fields and up to 116MMbbl of prospective resources in low-risk, near-field exploration potential

Special Report: Finder Energy is now the proud owner of 34 million net barrels of discovered oil offshore of Timor-Leste after completing the acquisition of a 76% stake in PSC 19-11.

The company acquired the stake, which turns it into a balanced explorer and developer, from Eni International and Inpex Offshore Timor-Leste for an upfront acquisition cost of US$2m along with an additional consideration of up to US$6.5m on reaching a final investment decision as well as 5% royalty on production.

PSC 19-11 contains four discovered but undeveloped oil fields – the Kuda Tasi and Jahal fields that have also been appraised and flow tested and host a combined gross best estimate (2C) contingent resource of 22 million barrel of oil – as well as the Krill and Jahal fields with combined 2C contingent resources of 23MMbbl oil.

While these resources are certainly attractive, there is also significant potential for Finder Energy (ASX:FDR) to add more barrels with the project area hosting low-risk, near-field exploration potential for up to 116MMbbl of mean prospective resources.

Contingent resources are already proven to host hydrocarbons though still at a stage where economic viability is unknown, while prospective resources require drilling to prove up the presence of oil (or gas).

Read here to learn more.

“This acquisition transforms Finder into a developer with 34 million barrels (net) of discovered oil and an exciting period of rapid development activity and value catalysts ahead of us,” FDR managing director Damon Neaves said.

“Our highest priority will be to fast-track the development of the Kuda Tasi and Jahal oil fields and we have laid out a clear path to FID and first oil. We have mobilised resources on those objectives so that we hit the ground running.

“The Government of Timor-Leste and the regulator, ANP, together with our joint venture partner, TIMOR GAP, have demonstrated strong support for Finder and our development strategy.”

Development strategy

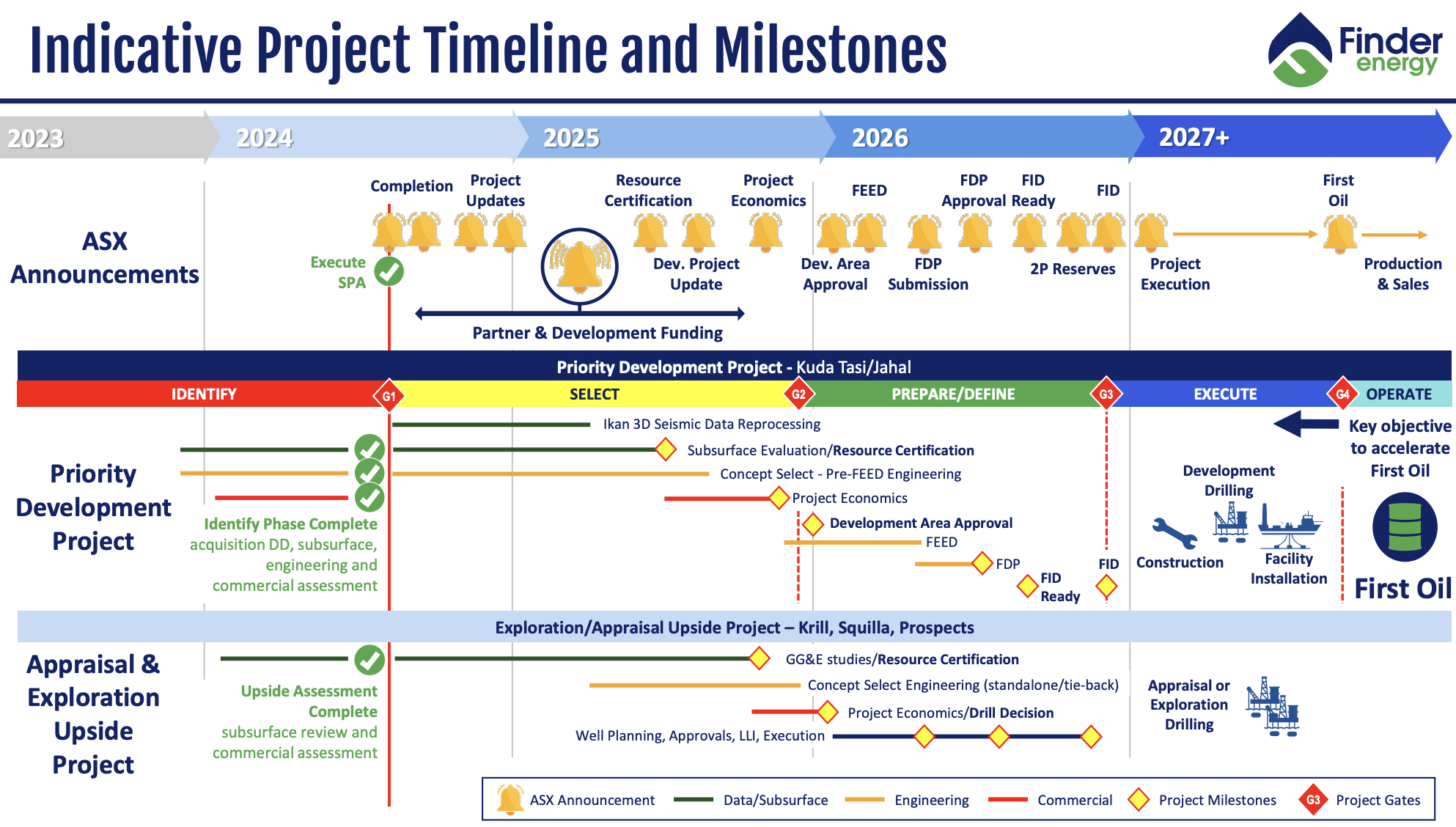

FDR has already crossed the first of four decision gates in its quality assurance system.

It has completed subsurface geological and geophysical evaluation and resource estimation, reservoir engineering evaluation including production profile modelling of Kuda Tasi and Jahal development scenarios, along with preliminary development concept studies and costings by Petrofac and project economic modelling.

Over the remainder of 2024 and in 2025, the company will carry out work to progress the Kuda Tasi and Jahal oil fields through to completion of the “select” phase.

Work to be carried out during this phase includes key project milestones such as approval of the development concept (pre-FEED engineering) and associated project economics with FDR budgeting $3m to complete it.

Once this phase is completed, the company will then decide on whether to proceed through the second decision gate and unlock further upside through appraisal and/or exploration drilling.

Entitlement offer

The company is also currently in the process of raising up to $6m through a pro-rata non-renounceable entitlement offer.

Existing shareholders have the opportunity to subscribe for one new share priced at 4.8c each for every 1.26 shares held. This represents a 15.67% discount to the 15-day volume weighted average price prior to August 6, 2024.

Shareholders who take up their entitlement in full may elect to apply for additional shares up to a maximum of 100% of their entitlement under a top-up facility.

Major shareholder Longreach Investment Capital has already committed to take up its full $3.2m entitlement while directors and key management personnel have also confirmed their intentions to take up their full entitlements.

Proceeds will be used to support completion costs associated with the acquisition of PSC 19-11 and progress the forward work program.

This article was developed in collaboration with Finder Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.