Explainer: Why is fuel so expensive and are soaring global oil prices to blame?

Pic: Matthias Kulka / The Image Bank via Getty Images

The national average price for unleaded fuel – just the plain old 95 not the fancy 98 – was a whopping $2.22 last week, with diesel sitting at $2.21.

And it’s not all down to the Russia/Ukraine war which pushed oil prices beyond the US$100/b mark this month.

Australian Competition and Consumer Commission (ACCC) chair Rod Sims says the world was already experiencing high crude oil prices late last year due to the continuing actions of the OPEC and Russia cartel, and the enduring Northern Hemisphere energy crisis.

“The shocking events in Ukraine have forced crude oil prices even higher, as Russia is a major supplier of oil,” he said.

“Retail petrol prices in Australia are largely determined by international refined petrol prices and the Australian/US dollar exchange rate. As refined petrol is made from crude oil, movements in the global crude oil price drive the international price of refined petrol.

“Crude oil prices have been climbing sharply since late-2020 and prices at the bowser here have followed.”

But fuel prices in Australia are also subject to competition in different areas and the whimsical pricing decisions of wholesalers and retailers across the country.

International benchmark prices

The ACCC says that the largest component of the price you pay for fuel is generally represented by the international benchmark price, which for Australia comprises of:

- Regular Unleaded Petrol – Singapore Mogas 95 Unleaded;

- Diesel – Singapore Gasoil 10 parts per million sulphur; and

- LPG – Saudi Contract prices for butane and propane.

You might be looking at the oil prices each day and think phew, fuel will come down in price tomorrow.

But it doesn’t quite work that way, or that quickly.

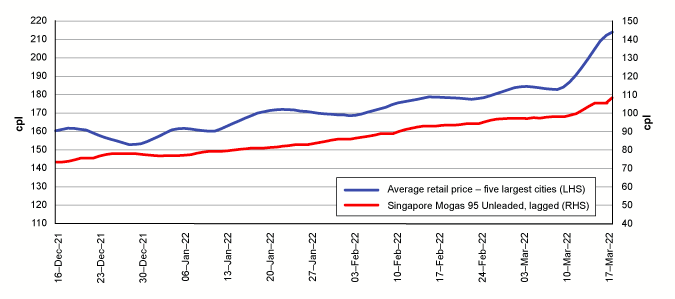

Changes in international prices can take around two weeks to work their way through the supply chain in cities and even longer in regional areas.

This is because our retail prices are 7-day rolling averages and while international prices are also 7-day rolling average Singapore Mogas 95 Unleaded prices, Australian Government regulations require wholesale suppliers to publish Terminal Gate Price (TGP) prices daily, which lag one or two weeks behind a price change in Singapore. So they actually lag by about 10 days.

What role does Singapore play in our pricing?

MOPS95 is our key pricing benchmark, and is the price of unleaded fuel in Singapore and that’s determined by crude oil prices for the Asia-Pacific only, and the fact that Singapore is our refining and distribution centre so helps set the refiner margin (the price difference between crude and the end product).

It’s also subject to prices in different regions which can be volatile due to the weather, civil unrest, industrial action etc.

And it’s worth bearing in mind that if Australia’s petrol prices were below Singapore’s prices, our suppliers would have no commercial incentive to import because sales would be at a loss – and Australian refiners would have an incentive to export.

Our dollar value is hitched to the USD

International benchmark prices for petrol, diesel and LPG are in US dollars so our Aussie dollar compared to that can impact the price of fuel domestically.

And if you see our price looking strong against the USD, don’t get too excited.

The ACCC flagged that we shouldn’t expect fuel prices to fall every time the Australian dollar is higher than the US dollar.

“This can only happen if the benchmark price remains the same or falls and other local factors don’t push prices up,” they said.

Wholesalers and retailers add their margins

Don’t forget that capitalism comes into play in Australia too.

The companies selling fuel have to make a profit and recoup the costs of wharfage, freight, insurance, transport, storage, salaries and whatnot.

And the margin on top of retail fuel prices is ultimately determined by the level of competition in the marketplace.

You might think they jack up the prices leading into long weekends and public holidays but, apparently, we all just go on long trips and fill up more often, so we notice the price more.

Petrol price cycles for the big smoke/s

We also have petrol price cycles which are deliberate pricing policies of retailers and are not directly related to changes in wholesale costs.

Basically, the retail price goes sharply increases, goes down and the increases again in a never-ending cycle that’s no fun for the consumer if you missed the dip.

“The duration of petrol price cycles in Sydney, Melbourne, Brisbane and Adelaide varies from cycle to cycle, and has increased in recent years,” the ACCC says.

“In 2019, price cycle durations in these capital cities ranged from a low of 13 days to a high of 38 days.

“In 2020, price cycle durations in these capital cities ranged from a low of 11 days to a high of 56 days.

“In Perth, the price cycle has consistently remained around seven days.”

So if you’re looking to fill up soon, check out the ACCC’s price cycle for each capital city here for the best time to buy fuel in your city.

Or you could grab an app.

Top free apps in Australia – Higher oil prices are influencing app downloads. #petrol pic.twitter.com/zsCRTMvzqL

— Brenden Wood (@BrendenWood) March 24, 2022

Don’t forget about taxes

All retail fuel prices in Australia include GST at the rate of 10 per cent plus there’s the excise rates which was re-introduced by the Government in 2015.

That’s where the price you pay for unleaded petrol (regular or fancy premium) and diesel includes the Government’s fuel excise price which was 44.2 cents per litre, as at February 2022.

These excise rates are indexed twice a year in line with the consumer price index (CPI) – generally in February and August.

The fuel excise is spent on constructing and maintaining roads infrastructure, and the Australian Automobile Association says motorists will pay $49.3 billion in net fuel excise over the four years from 2020- 2024

Almost all of which will be re-invested into road infrastructure.

So basically, half of what you pay for a tank of petrol is taxes and half is the wholesale price, company costs and profit margins.

According to Treasurer Josh Frydenberg, the Morrison Government might be considering cutting the fuel excise in its federal budget – which is due for release on Tuesday.

But it remains to be seen if that would just be a temporary Band-Aid over the soaring cost of fuel and, you know, living.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.