Energy: Leigh Creek has a gas reserve as big as the Cooper Basin; investors are impressed

Pic: Matthias Kulka / The Image Bank via Getty Images

Leigh Creek Energy (ASX:LCK) says it now has “one of Eastern Australia’s largest undeveloped and uncontracted gas reserves”.

The company told investors today that its Leigh Creek project in South Australia’s Telford Basin now hosts 1.1 trillion cubic feet of 2P gas reserves.

A 2P reserve means it’s proven and probable.

- Scroll down for the ASX’s other corporate movements today.

And there’s still more potential for additional reserve upgrades.

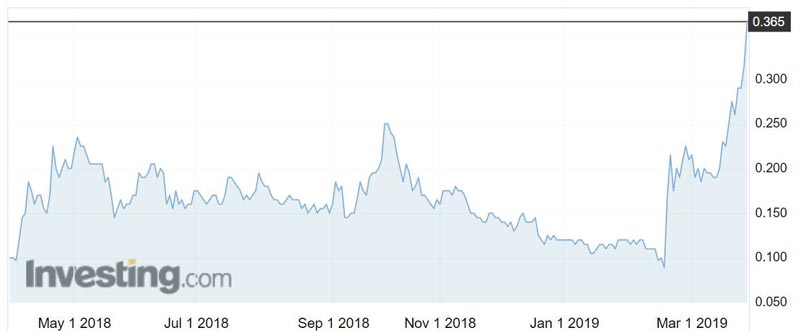

The news sent shares up over 33 per cent to an intra-day high of 42c just after market open on Wednesday.

Leigh Creek said that a comparison of its reserve to the Australian Competition and Consumer Commission analysis of Australian gas reserves and resources indicated that they were about the same size, on a 2P reserve basis, as the entire Cooper Basin.

The Cooper Basin, one of Australia’s largest and most important onshore oil and gas locations, contains about 150 gas fields and 90 oil fields currently on production.

These fields host roughly 700 producing gas wells and more than 360 producing oil wells.

Leigh Creek added that its namesake project hosts a larger 2P reserve than the Otway, Bass, Gunnedah, Clarence-Moreton, Sydney and Galilee Basins combined.

“This independent confirmation and certification of such a large 2P energy reserve means that LCK can further advance with its negotiations with potential joint-venture partners on investment structures and the full-funding solutions for a commercial facility at the Leigh Creek energy project,” chairman Justyn Peters said.

In late February, Leigh Creek revealed it could successfully produce commercial quantities of synthetic gas.

The company has been testing a pilot plant which converts underground coal into gas, which it plans to turn into products like fertiliser.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

In other energy news:

Deep Yellow (ASX:DYL) has upped its uranium resource for its Tumas 1,2 and 3 deposits by 51 per cent to 67.4 million pounds at 352 parts per million (ppm).

The company said resources within the Tumas paleochannel system now total 86.2 million pounds at 310 ppm, which is close to a three-fold increase since November 2016.

Strike Energy (ASX:STX) has had a bit of bad luck – it’s been denied a R&D refund. The oil and gas explorer had been hoping to change regulators’ minds about taking back the $6.3m R&D tax incentive Strike received in FY16.

Strike has until April 22 to appeal the decision and is currently discussing the potential tax implications with the Australian Tax Office.

MEC Resources (ASX:MMR) has lost its managing director and company secretary, Deborah Ambrosini.

Ms Ambrosini is leaving the energy investor to “pursue other opportunities”.

Uranium hunter Marenica Energy (ASX:MEY) has started a big 60-hole drilling effort at its Mile 72 project in Namibia.

The plan is to drill an 11km long by 2km wide target that hosts the same style of mineralisation as other Namibian calcrete deposits. Results are expected by the end of June.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.