Emission Control: Will nuclear energy have a place in Australia’s grid future?

Nuclear SMR technology is unlikely to be available in Australia for another two decades. Pic via Getty Images

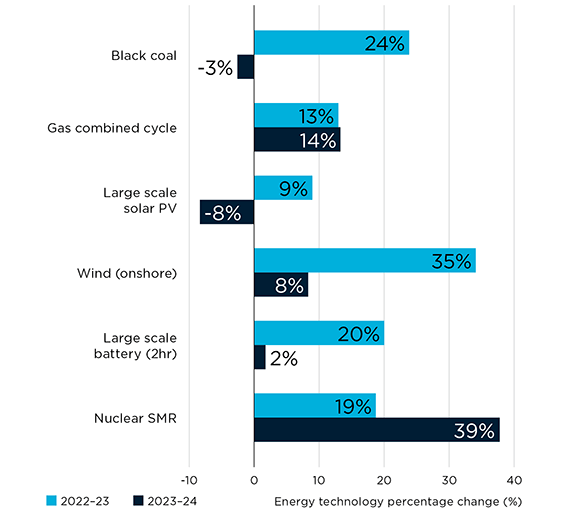

A new report by CSIRO and AEMO has found that new build costs for electric generation, energy storage and hydrogen production in Australia have stabilised since the 20pc increase reported last year but cost pressures remain on gas, onshore wind and nuclear small modular reactors (SMR).

In fact, while large scale photovoltaic (PV) costs fell by 8pc, variable renewables (wind and solar) were still found to have the lowest cost range of any new build technology and nuclear SMRs emerged as the highest cost technology explored in the report.

GenCost, an annual collaboration between CSIRO – Australia’s national science agency – and the Australian Energy Market Operator (AEMO), is an up-to-date economic report that provides cost estimates of building new electricity generation and storage projects up to the year 2050.

This includes cost estimates for coal, natural gas, solar photovoltaics, onshore and offshore wind, solar thermal, nuclear small modular reactors, bioenergy, pumped hydro, hydrogen electrolysers and batteries.

Drawing on the expertise of a large number of energy industry stakeholders, the report includes engagement and consultation with members of the energy community to review the work and provide pre-publication feedback to improve its quality.

Nuclear SMR cost blowout

The cost of onshore wind generation rose by 8pc, gas turbine technologies increased by 14pc and the cost of other technologies like onshore wind and pumped hydro also increased.

For estimating nuclear SMR current costs, GenCost requires first-of-a-kind cost estimates given the first commercial project is yet to be completed.

CSIRO has been monitoring the broader literature to try to firm up the current costs of nuclear SMR in the absence of its preferred data source and points to recent estimates from a leading SMR project in the US (the NucScale project in Utah) which was withdrawn due to soaring costs.

Costs were equivalent to $31,000/MW, much higher than the $19,000/MW estimated by the CSIRO in its previous report.

“The UAMPS (Utah utility) estimate implies nuclear SMR has been hit by a 70 per cent cost increase which is much larger than the average 20% observed in other technologies,” the CSIRO writes.

According to the report, the cost of battery storage remained steady and variable renewables (wind and solar) were still found to have the lowest cost range of any new build technology but nuclear SMRs emerged as the highest cost technology explored in the report.

“The cancellation of this project is significant because it was the only SMR project in the US that had received design certification from the Nuclear Regulatory Commission which is an essential step before construction can commence.”

The report, which represents the country’s most comprehensive electricity generation cost projections, comes as Australia attempts to meet ambitious emissions reduction targets during the transition to net zero.

While nuclear proponents suggest there’s potential for SMRs to be used for low-emissions electricity generation in Australia, the GenCost report makes it clear that nuclear isn’t an economically competitive solution for the country.

New information on deployment timing suggests that if a decision to pursue a nuclear SMR project in Australia were taken today, with political support for the required legislative changes, then the first full operation would be in 2038.

ASX green energy news this week

Final investment decision on AGL’s Liddell battery project

AGL Energy (ASX:AGL) is ready to begin construction in the new year on one of Australia’s biggest batteries after a final investment decision was made earlier this week.

With Fluence on board as the engineering, procurement, and construction (EPC) provider, construction will kick off at the 500MW, two-hour duration battery project in early 2024 with operations slated to come online in mid-2026.

Backed by a $35m Arena grant – as part of its Advancing Renewables Project – and Long-Term Energy Service Agreement (LTESA), AGL says the battery will be funded on its balance sheet, utilising operating cash flows and existing debt facilities.

“The final investment decision on the Liddell battery project marks another significant milestone in AGL’s decarbonisation pathway and the transition of its energy portfolio,” AGL managing director and CEO Damien Nicks says.

Once completed, the Liddell battery will add to AGL’s existing suite of grid scale battery assets and contracted capacity from third parties which includes the 250MW Torrens Island battery, where operations kicked off in August 2023, and the 50MW Broken Hill battery which will begin operations shortly.

Works to wrap up at the Kidston hydro project in ’24

Underground excavation works are continuing at Genex’s (ASX:GNX) 250Mw/2,000MWh Kidston pumped storage hydro project in Queensland with a target completion date set for Q1, 2024.

Kidston is the first pumped storage hydro project in Australia in >40 years and is part of the wider Kidston Clean Energy Hub which plans to integrate large-scale solar generation with pumped storage hydro to deliver renewable energy.

GNX believes construction is on track for energisation in the second half of 2024 following the successful excavation of the main access tunnel in November.

The excavation of the powerhouse cavern is now over 65% complete and is anticipated to be fully excavated in early Q1 CY2024 while the second intake shelf is over 50% complete and will be fully excavated in January ’24.

Nickel Industries introduces EVs to its mining fleet

Nickel Industries (ASX:NIC) says it is now trailing EVs in its own mining fleet as party of its strategy to achieve a 50% reduction in carbon intensity by 2035 and net zero emissions by 2050.

The trials are taking place at its Henjaya mine operations – a large tonnage, high grade nickel laterite deposit in close proximity to NIC’s projects within the Indonesia Morowali Industrial Park (IMIP).

Green hydrogen potential with Mitsubishi’s OZ arm

ReNu Energy’s (ASX:RNU) wholly owned subsidiary, Countrywide Hydrogen, is collaborating with DGA Energy Solutions Australia to conduct joint studies for Countrywide Hydrogen’s green hydrogen project opportunity at Portland in Victoria.

DGA is a wholly owned by Mitsubishi Corporation and is the Australian arm responsible for renewable energy and green hydrogen related business development.

The two parties plan to jointly conduct studies to determine the feasibility to deliver a Stage 1, 10MW green hydrogen production facility and refuelling station for domestic supply for road transport and mobility decarbonisation, as well as natural gas blending.

Stage 2 will be a larger scale project for hydrogen and/or ammonia exports to North Asia.

The companies plan to apply for funding jointly under the Portland Diversification Fund, a $7.5 million Victorian State Government program with the aim of facilitating diversification of the economic base of the Glenelg Shire by attracting new investment and supporting businesses.

Green energy stocks share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.