Emission Control: The inconvenient truth about coal, big hydrogen moves, and NEM power prices set to fall

Pic: Matthias Kulka / The Image Bank via Getty Images

Coal has been high on the decarbonisation agenda, but Wood Mackenzie metals and mining vice chair Julian Kettle says the inconvenient truth is that we still need coal-fired power to ensure an orderly transition to a low carbon world.

While the COP26 statement is clear – “to accelerate the phase out of coal” Kettle emphasises that it falls short on the detail.

“What’s more, this commitment could be considered something of a pyrrhic victory against coal, primarily because none of the countries with the top three largest coal-fired power fleets – China, India and the US – are signatories to the agreement,” he said.

“China, which possesses the largest coal-fired power plant capacity, has committed to peak carbon emissions, yet has made no firm commitment to reduce reliance on coal.

“And India was late to the decarbonisation pledge party but has committed to net neutrality by 2070.

“More urgently, it has pledged to reduce its projected carbon emissions by a billion tonnes by 2030 and has committed to 50% renewables share of power generation and to reducing the carbon intensity of its economy by 45% by the same date.

“That’s a tough ask for an economy projected to grow by 6-7% a year over the next decade,” he said.

Meanwhile, in the US, President Joe Biden’s plan for a zero-carbon grid by 2035 arguably embraces the spirit of the COP26 text.

But again, Kettle says there is the possibility of a significant reversal in policy should the next presidential election be won by the Republicans.

And regardless of these targets, under Woodmac’s base case, thermal coal demand (where it is burnt to produce electricity) will continue to rise until the mid-2020s.

How will COP26 commitments impact coal demand?

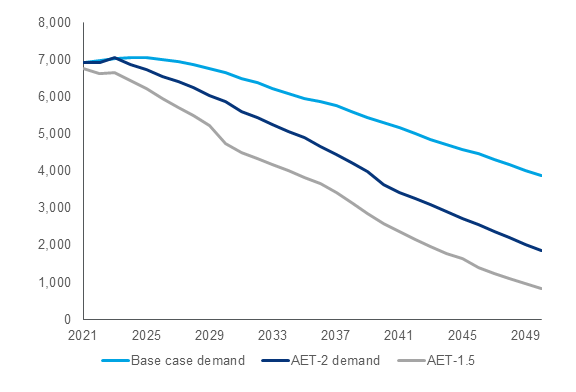

Under Wood Mackenzie’s base case Energy Transition Outlook (ETO), which is aligned to a 2.7C warming scenario, demand for thermal coal will peak in 2025 at just over 7 billion tonnes, falling by just 5% to 6.7 billion tonnes in 2030.

“That is hardly a transformation,” Kettle said.

And to achieve Wood Mackenzie’s accelerated energy transition (AET) of -2C pathway, demand for thermal coal will need to fall by a billion tonnes by 2030 while an AET-1.5 pathway removes a further 1.9b tonnes of demand.

“This is a dramatic 2.4b tonne reduction compared with the current base case peak in 2025,” he said.

The key question Kettle says, is will the yet-to-be-enacted policies based on watered down commitments made at COP26 be enough to deliver an AET-2 or AET-1.5 decarbonisation pathway?

“If the non-delivery against commitments made at COP Paris in 2015 are anything to go by, success by 2030 looks to be a long shot and is by no means guaranteed,” he said.

WA Government invests $117.5m in two hydrogen hubs

The McGowan Government has announced its plans to invest up to $117.5m for renewable hydrogen hubs in the Pilbara and Mid-West putting WA at the forefront of the new industry.

This week the State lodged applications through the Commonwealth Government’s Clean Hydrogen Industrial Hubs program for matching Commonwealth funding to develop hubs in the Pilbara and Mid-West.

The Pilbara Hydrogen Hub involves development of a hydrogen or ammonia pipeline connecting the Maitland and Burrup strategic industrial areas, the creation of a Clean Energy Training and Research Institute based out of both Karratha and Port Hedland, and port upgrades to facilitate export opportunities.

For the Mid West, the proposal includes construction of renewable energy and road infrastructure at the Oakajee Strategic Industrial Area, as well as connecting the area to power and water, and developing hydrogen refuelling infrastructure.

Combined, the hubs would create around 2,000 jobs across the State.

Hydrogen Industry Minister Alannah MacTiernan said both the Pilbara and Mid-West are attracting global attention for their renewable hydrogen potential.

“Energy companies from across the world are setting their sights here,” she said.

“We want to partner with the Federal Government to embrace this job-creating opportunity for Western Australia, which will make a significant contribution to global efforts towards net zero emissions.

“We urge the Commonwealth to recognise the huge national benefit from locating two hubs in WA.”

Edify Energy signs MOU to accelerate hydrogen export in Townsville

Queensland’s city of Townsville is one step closer to becoming a renewable hydrogen powerhouse after the signing of another memorandum of understanding (MOU) – this time with Australian solar and battery storage developer Edify Energy.

The Port of Townsville and Edify Energy will join forces to investigate the feasibility of exporting hydrogen through the city’s port and work to advance Edify’s renewable hydrogen project.

This move follows Edify’s recent development approval to build and operate a renewable hydrogen production plant with up to a 1GW electrolyser for 5,000-150,000 H2 tonnes per year of renewable hydrogen at the Lansdown Eco-Industrial Precinct, 46km south of Townsville.

Port of Townsville CEO Ranee Crosby said North Queensland is “uniquely positioned to play a leading role in the world’s growing demand for hydrogen.”

“Hydrogen made with renewable energy is completely carbon free and is a flexible energy carrier that can power almost anything that requires energy,” said Ms Crosby.

“This versatility represents boundless opportunities to align the North’s economic prosperity with global ambitions to transition to a clean energy future.”

Edify Energy joins a growing list of proponents seeking to export renewable hydrogen through the Port of Townsville, including Origin Energy and Ark Energy Corporation.

A QLD hydrogen fuel cell facility gets the green light

In another exciting move for Queensland, Australian energy technology company LAVO Hydrogen Technology has been given the green light to establish a $15 million hydrogen fuel cell manufacturing facility in Greater Springfield.

Backed by the Palaszczuk Government’s Invested in Queensland program, and part of the $3.34 billion Queensland Jobs Fund, construction of the facility will take place in early 2022 ahead of expected delivery by the end of the year.

Set to be Australia’s “first hydrogen fuel cell manufacturing facility”, Treasurer and Minister for Trade and Investment Cameron Dick said the fuel cells will be used in hydrogen energy storage systems for homes and businesses, developed by LAVO and the University of New South Wales.

The LAVO HESS (Hydrogen Energy Storage System) is an integrated hybrid hydrogen battery that can be combined with rooftop solar to store 40kWh of electricity – enough energy to power a typical household for two days.

Lavo CEO and executive director said the company is excited to be manufacturing the fuel cells here in Australia under a joint venture agreement with Netherlands-based Nedstack, developer of the fuel cells.

“Through our research and development, we are taking existing fuel cell technology and introducing integrated solutions to make hydrogen possible for everyday use and for a much wider audience,” Yu said.

Fossil fuels and nuclear nab a win in Biden’s clean hydrogen strategy

During the week President Biden unveiled a $1 trillion infrastructure package focusing on the build out of a ‘clean hydrogen’ industry in the US, with a dedicated $8 billion to fund four regional production hubs.

It represents the country’s first national hydrogen roadmap and strategy and will ultimately create tens of thousands of jobs. “It’s a big deal,” Biden said.

According to Argus Media, the Democratic-controlled US Congress is considering giving additional support for clean hydrogen as part of a separate $1.85 trillion budget bill that is still being negotiated.

“The bill would provide $3.5 billion in grants to support domestic manufacturing of electric and hydrogen vehicles, along with $200 million to fund hydrogen fuelling equipment,” Argus said.

Congress also directed funding so that “at least one hub would use fossil fuels, one would use renewables and one would use nuclear.”

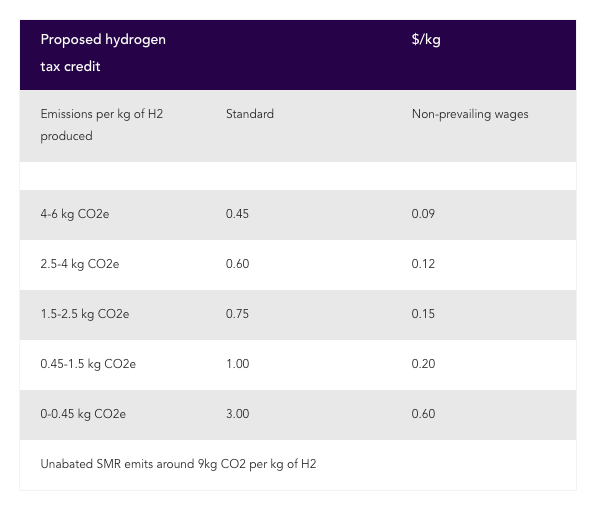

But the largest hydrogen section would create a tax credit for hydrogen production that is significantly cleaner than the conventional technique of steam methane reformation.

Director of energy finance studies at the Institute for Energy Economics & Financial Analysis Tim Buckley said this commitment is a major step forward on the global technology race to commercialise green hydrogen.

“Clearly fossil fuel advocates have gained a small win, getting a fossil fuel-based hub mandated as one of the four regional centres, and nuclear has wangled a massive new subsidy as well, but the proposed tax credits are aggressively defined as a very low level of CO2 emissions starting at <6kg CO2 per kg.

“This could be a new opportunity for CCS subsidies but given the very likely external verification of the whole supply chain, the key focus of the bill is to scale up deployments so as to make green hydrogen commercially viable.

“It is a major positive in the decarbonisation of the US economy,” he said.

“Electrify everything, rapidly decarbonise the electricity grid, drive building standards up, roll out EVs nationally and then use green hydrogen to help decarbonise the hard-to-abate heavy industry areas remaining.”

Aussie household electricity prices to fall across NEM

Yesterday the Australian Energy Market Commission (AEMC) announced household electricity prices are set to fall across the National Electricity Market (NEM) on the back of lower wholesale electricity costs and an increase in renewable generation.

The Residential Electricity Price Trends 2021 report from the AEMC said electricity costs to consumers are expected to decrease this financial year and fall further by 2023-24.

It found the average residential customer in the NEM will save $77 a year, or 6 per cent, on their electricity bill by 2024 compared with costs in 2020-21.

State by state electricity bill changes between 2020/21 and 2023/24 are:

- QLD decrease by 10 per cent (or $126);

- NSW decrease by 4 per cent (or $50);

- ACT increase by 4 per cent (or $77);

- VIC decrease by 8 per cent (or $99);

- SA decrease by 2 per cent (or $35); and

- TAS decrease by 6 per cent (or $125).

Who is winning from green energy this week?

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | SIX MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| PGY | Pilot Energy Ltd | 0.083 | 22.1% | 6.4% | 1.2% | 207.4% | 45,144,153 |

| FMG | Fortescue Metals Grp | 17.88 | 14.7% | 24.9% | -16.3% | -1.2% | 54,097,413,609 |

| DEL | Delorean Corporation | 0.22 | 12.8% | 12.8% | -8.3% | 0.0% | 39,397,222 |

| IRD | Iron Road Ltd | 0.21 | 10.5% | 7.7% | 6.3% | 44.8% | 158,918,059 |

| PRM | Prominence Energy | 0.011 | 10.0% | -31.3% | 0.0% | 83.3% | 12,406,306 |

| AVL | Aust Vanadium Ltd | 0.027 | 8.0% | 12.5% | 42.1% | 107.7% | 85,316,637 |

| BSX | Blackstone Ltd | 0.615 | 2.5% | -3.9% | 64.0% | 70.8% | 221,598,857 |

| VUL | Vulcan Energy | 10.62 | 1.9% | -20.7% | 58.7% | 346.2% | 1,276,734,860 |

| ECT | Env Clean Tech Ltd. | 0.056 | 1.8% | 250.0% | 273.3% | 460.0% | 74,707,532 |

| SKI | Spark Infrastructure | 2.88 | 1.8% | 1.1% | 33.3% | 36.5% | 5,036,718,784 |

| RNE | Renu Energy Ltd | 0.11 | 0.0% | 96.4% | 66.7% | 214.3% | 15,931,551 |

| AST | AusNet Services Ltd | 2.54 | -0.4% | 1.2% | 46.8% | 33.7% | 9,804,709,084 |

| IFT | Infratil Limited | 7.68 | -2.2% | -2.8% | 10.0% | 40.1% | 5,546,937,877 |

| MEZ | Meridian Energy | 4.37 | -2.2% | -9.9% | -8.4% | -23.3% | 5,725,355,201 |

| GNX | Genex Power Ltd | 0.19 | -2.6% | -13.6% | -15.6% | 20.2% | 208,630,509 |

| PRL | Province Resources | 0.16 | -3.0% | 3.2% | 3.2% | 1349.1% | 180,745,570 |

| NEW | NEW Energy Solar | 0.805 | -4.7% | -5.3% | -3.0% | -16.1% | 263,950,956 |

| KPO | Kalina Power Limited | 0.027 | -6.9% | -10.0% | -34.1% | -15.6% | 38,066,005 |

| RFX | Redflow Limited | 0.052 | -7.1% | -13.3% | -11.0% | 102.0% | 71,676,673 |

| HZR | Hazer Group Limited | 1.37 | -8.1% | 3.8% | 28.0% | 122.8% | 221,693,128 |

| QEM | QEM Limited | 0.2 | -9.1% | 11.1% | 11.1% | 110.5% | 23,251,783 |

| GEV | Global Ene Ven Ltd | 0.115 | -11.5% | 4.5% | 49.4% | 23.7% | 67,208,733 |

| CXL | Calix Limited | 7.03 | -12.0% | 32.6% | 172.5% | 572.7% | 1,172,314,001 |

| HXG | Hexagon Energy | 0.089 | -15.2% | 6.0% | -8.2% | 50.8% | 40,141,244 |

| PH2 | Pure Hydrogen Corp | 0.495 | -16.1% | 65.0% | 147.5% | 511.1% | 169,219,712 |

| LIO | Lion Energy Limited | 0.074 | -17.8% | 21.3% | 37.0% | 393.3% | 22,629,957 |

| MPR | Mpower Group Limited | 0.042 | -32.3% | -35.4% | -54.8% | -23.6% | 8,746,398 |

Pilot Energy (ASX:PGY) is the biggest winner this fortnight with shares up 22.1% on no news, followed by Fortescue Metal Group (ASX:FMG) gaining 14.7%, and Delorean (ASX:DEL) up 12.7%.

The biggest loser is MPower Group (ASX:MPR) with shares down 32.3%.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.