Emission Control: Tesla executives say South Australia represents ‘the future’ of battery storage

Elon Musk in South Australia in 2017. Pic: Getty Images

Emission Control is Stockhead’s fortnightly take on all the big news surrounding developments in renewable energy.

South Australia’s Hornsdale Power Reserve, home to the world’s first big battery, was a game changer when it was built back in 2017.

Not only was it the world’s largest lithium-ion battery, but it was also the first of its kind to provide essential grid services with what are known as ‘advanced’ or ‘grid forming’ inverters – now referred to by Tesla as ‘virtual machine mode’.

Grid forming inverters stabilise the grid by providing inertia, which until Tesla, was usually provided by gas or coal fired generators.

Due to the rapid retirement of thermal power generation, inertia shortfalls or instability occurs especially in regions like South Australia where wind and solar penetration is the highest of any Australian state.

After successful trialling, Hornsdale Power Reserve can imitate the behaviour of fossil fuel based services and supply grid frequency deviations through a clean and regenerative substitute.

Speaking at Tesla’s Investor Day, executives Drew Baglino and Mike Snyder said South Australia represents “the future” by demonstrating how battery storage can replace fossil fuels “one plant at a time”.

The glue in the sustainable energy economy

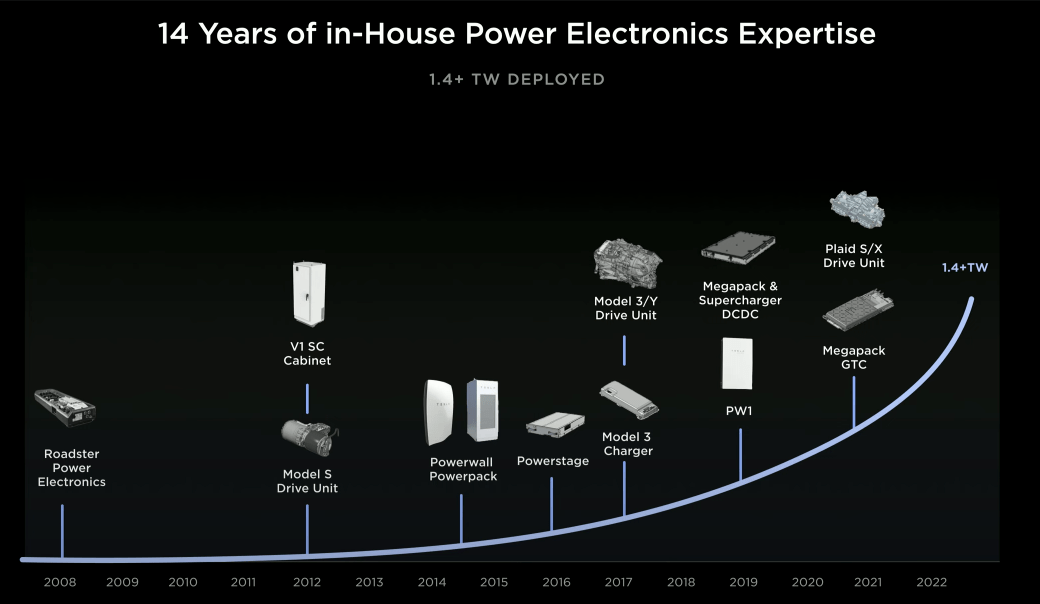

“It is hard to overstate how impactful these power electronics are, they are the glue in the sustainable energy economy between generation, storage and the end use,” Baglino said.

“These power devices are switching hundreds of thousands of times per second to efficiently react to whatever is needed either in the car or in the grid and because they are so software driven at their core, they can provide functionality that hasn’t been available to the grid in the past.

“It’s one of the reasons why renewables and storage together are such a great solution.”

On the topic of virtual machine mode, Tesla’s executives said the firmware software “keeps the ride smooth” and is the future of how batteries are going to add value.

“It’s going to be more about adding power stability as it is about energy,” they said.

“Tesla has deployed over 1.4 terawatts across energy storage and vehicles and we deliver more power electronics than the solar and wind industry combined on a per annum basis.

“This is an indication for where the future is headed.”

Hornsdale Power Reserve, also known as the Tesla Big battery, was brought about following a Twitter exchange between Musk and tech billionaire Mike Cannon Brookes, who challenged the CEO to end South Australia’s energy problems during a state-wide blackout.

In its first two years of operation, Hornsdale Power Reserve saved South Australian consumers over $150 million by returning the state’s energy system to its normal frequency and helping to keep the lights on.

Global hydrogen project pipeline nosedives

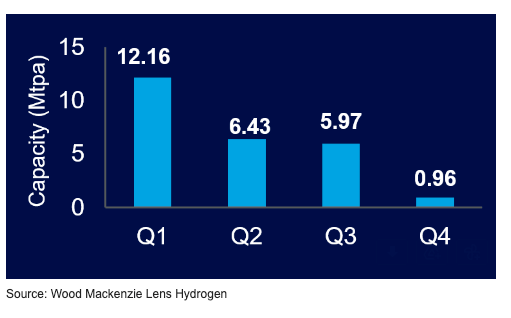

Despite a record 12Mt per annum of project capacity announcements in the first quarter of 2022, latest analysis from Wood Mackenzie says the global hydrogen pipeline slowed throughout the year with only 1Mtpa of new projects announced in Q4.

“2022 was marked by the energy crisis and a slew of policy announcements from the EU, US and UK supporting hydrogen production,” Flor Lucia De la Cruz, senior research analyst, Hydrogen and Emerging Technologies at Wood Mackenzie said.

“Announcements slowed through the year as developers shifted their focus to de-risking the existing project pipeline.”

The slow-down in project announcements was counterbalanced by record electrolyser manufacturing announcements where a record 45 gigawatt of renewable hydrogen electrolysers (GWe) was announced in Q4 2022.

This took the total announced nameplate electrolyser manufacturing capacity to 106GWe.

Original equipment manufacturers (OEMs) chased the 360GWe pipeline with a record 83GWe in manufacturing announcements through 2022, according to Wood Mackenzie findings.

With 45GWe of that electrolyser manufacturing capacity announced in Q4, up 72% from the previous quarter, De La Cruz said OEMs have responded so swiftly that there is a risk of significant manufacturing overcapacity by 2025, particularly if production projects fail to progress.

“However, OEMs are ramping up manufacturing output slower than nameplate capacity given the additional time required to develop labour and skills as well as securing machinery and materials,” De la Cruz added.

Who’s got news out?

REDFLOW (ASX:RFX)

Redflow, the developer of zinc bromine flow batteries for small commercial installations as well as multi-megawatt hour storage systems, says it has seen a rapid increase in the industry’s focus on alternative energy storage systems to lithium chemistries over the last 12 months.

Lithium shortages and safety concerns, longer duration requirements and an increasing focus on energy security has accelerated market awareness of commercially ready, operationally proven energy storage solutions like Redflow, the company said in its half-year results presentation.

Its sales pipeline now includes “multiple GWh of qualified opportunities” and significant opportunities at the prospect stage, with several key deals in advanced stages representing multi-Mwh contracts.

The Brisbane-based firm said while some of these opportunities have taken longer than originally expected to convert to sales, based on its most recent customer and partner engagements, the company remains confident it will receive these orders.

“Once received they will represent a critical scale up and reference point against our growth strategy and builds on our industry positioning to achieve further market success.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.