Emission Control: Seawater breakthrough could cut green hydrogen production costs

Pic: Getty Imgaes

Emission Control is Stockhead’s fortnightly take on all the big news surrounding developments in renewable energy.

Much has been made about the high cost of green hydrogen and how that is due to the cost of electrolysers and the renewable energy needed.

However, there’s another cost associated with its production that doesn’t seem to get as much attention and that’s in the water used as feedstock.

Typical methods of electrolysis require clean water in order to operate, which could result in additional costs related to purifying the water or in the case of seawater, desalination, which requires additional energy and hence cost.

This is especially true since it takes something like nine litres of water to produce about 1kg of H2 (hydrogen gas).

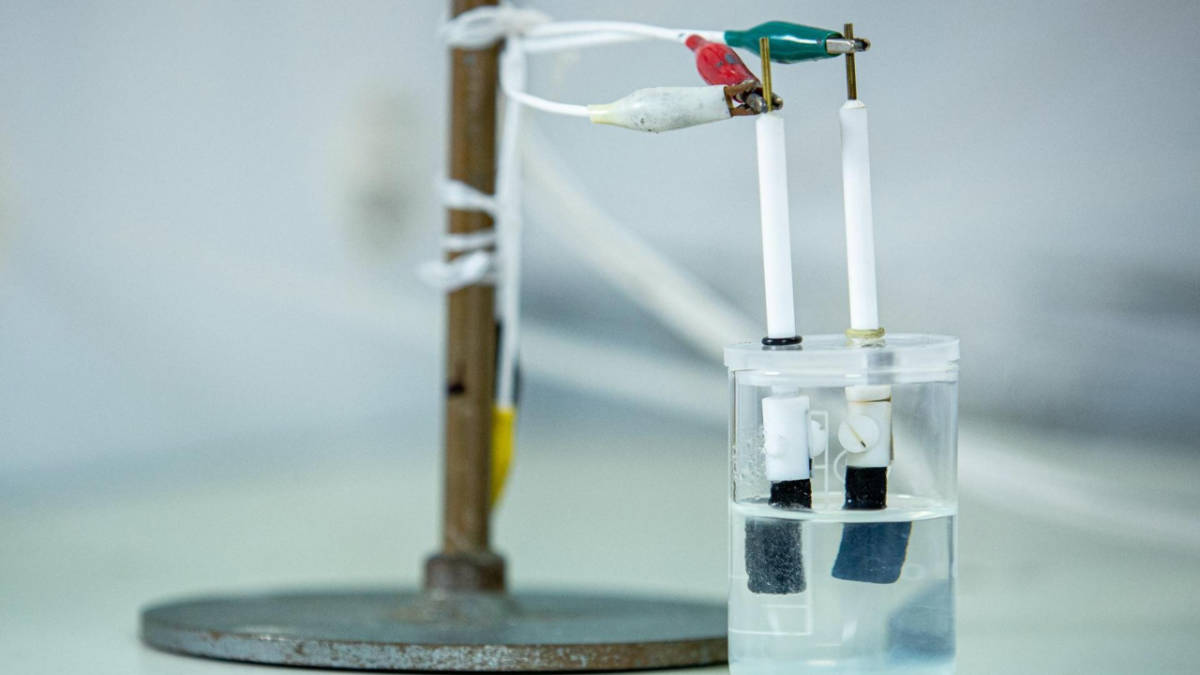

But researchers at RMIT University have developed a more energy efficient way to make hydrogen directly from seawater, skipping the need for desalination altogether.

The new approach devised by a team in the multidisciplinary Materials for Clean Energy and Environment (MC2E) research group at RMIT uses a catalyst composed of nitrogen-doped porous nickel molybdenum phosphide sheets.

These highly efficient, stable catalysts take little energy to run and could be used at room temperature.

Lead researcher Dr Nasir Mahmood, a Vice-Chancellor’s Senior Research Fellow at RMIT, said the method is simple, saleable, and far more cost-effective than any green hydrogen approach currently in the market.

“The biggest hurdle with using seawater is the chlorine, which can be produced as a by-product,” he said.

“If we were to meet the world’s hydrogen needs without solving this issue first, we’d produce 240 million tons per year of chlorine each year – which is three to four times what the world needs in chlorine.

“Our process not only omits carbon dioxide, but also has no chlorine production.”

Mahmood said the technology had promise to significantly bring down the cost of electrolysers – enough to meet the Australian government’s goal for green hydrogen production of $2/kilogram, to make it competitive with fossil fuel-sourced hydrogen.

A provisional patent application has been filed for the new method, detailed in a lab-scale study published in Wiley journal, Small.

The researchers at RMIT are working with industry partners to develop aspects of this technology.

Here’s how ASX renewable energy stocks are tracking:

CODE COMPANY PRICE % WEEK % MONTH % 6 MONTHS % 1 YEAR MARKET CAP AVL Aust Vanadium Ltd 0.031 -6% 15% -42% -14% $135,272,382 BSX Blackstone Ltd 0.14 -10% -7% -44% -72% $68,640,845 DEL Delorean Corporation 0.06 -8% -20% -48% -76% $12,943,255 ECT Env Clean Tech Ltd. 0.011 0% 5% -52% -52% $18,878,768 FMG Fortescue Metals Grp 22.26 -1% 0% 15% 5% $68,722,496,970 PV1 Provaris Energy Ltd 0.056 -8% 12% -22% -44% $30,759,706 GNX Genex Power Ltd 0.155 -3% 7% -30% -11% $214,702,457 HXG Hexagon Energy 0.017 -6% -6% -6% -69% $8,719,570 HZR Hazer Group Limited 0.57 -5% -10% -25% -44% $101,414,027 IFT Infratil Limited 8.08 -1% 2% -2% 12% $5,813,588,163 IRD Iron Road Ltd 0.105 0% -5% -25% -42% $84,360,818 LIO Lion Energy Limited 0.036 0% 0% -14% -33% $17,896,629 MEZ Meridian Energy 4.99 2% 4% 5% 8% $6,165,950,453 MPR Mpower Group Limited 0.02 0% 11% -13% -51% $6,167,769 NEW NEW Energy Solar 0.065 0% 0% 33% 34% $20,838,219 PGY Pilot Energy Ltd 0.018 0% 13% -22% -67% $14,506,697 PH2 Pure Hydrogen Corp 0.185 -5% -12% -45% -54% $67,479,223 PRL Province Resources 0.054 -2% -14% -63% -57% $63,800,630 PRM Prominence Energy 0.0015 0% -25% -50% -89% $3,636,913 QEM QEM Limited 0.2 -7% 8% -15% 18% $27,704,432 RFX Redflow Limited 0.19 -7% -22% -59% -55% $35,943,872 SKI Spark Infrastructure 0 -100% -100% -100% -100% $5,036,718,784 VUL Vulcan Energy 6.12 -17% -13% -33% -34% $889,298,866 CXL Calix Limited 5.23 2% 0% -24% -3% $941,067,057 KPO Kalina Power Limited 0.014 0% 0% -26% -30% $21,212,741 RNE Renu Energy Ltd 0.054 -4% -7% -10% -27% $23,346,613 NRZ Neurizer Ltd 0.082 -2% -17% -45% -45% $91,915,303 LIT Lithium Australia 0.044 -6% -10% -46% -62% $53,732,434 TVN Tivan Limited 0.081 4% -10% -33% 21% $112,461,876 SRJ SRJ Technologies 0.115 -18% 5% -73% -73% $10,701,030 NMT Neometals Ltd 0.815 -1% -11% -42% -38% $456,011,470 MR1 Montem Resources 0.04 0% 0% 0% -11% $12,913,190 FGR First Graphene Ltd 0.1 -5% 0% -38% -46% $58,131,639 EGR Ecograf Limited 0.22 -12% -4% -55% -63% $101,325,028 EDE Eden Inv Ltd 0.005 0% -9% -29% -71% $14,657,135 CWY Cleanaway Waste Ltd 2.69 -2% 0% -1% -6% $6,121,500,330 CPV Clearvue Technologie 0.185 -14% -16% -33% -54% $40,156,350 CNQ Clean Teq Water 0.38 -7% -17% -34% -39% $21,929,913 M8S M8 Sustainable 0.009 0% 13% 29% -47% $4,418,176 EOL Energy One Limited 4.495 3% -1% -18% -36% $132,022,258 FHE Frontier Energy Ltd 0.44 0% 0% 44% 238% $106,594,771 LPE Locality Planning 0.051 -2% 2% -19% -54% $9,085,970 GHY Gold Hydrogen 0.5 0% -15% 0% 0% $25,500,000

Who’s got news out?

CALIX (ASX:CXL)

A project led by Windship Technology in partnership with Leilac, Calix’s 93% owned subsidiary focuses on the decarbonisation of cement and lime, and has been awarded $8.73m by Innovate UK to demonstrate a novel route to zero carbon shipping.

CXL says the project aims to demonstrate a low-cost route to decarbonise shipping with a combination of renewably powered propulsion and a lime-based carbon capture solution for remaining emissions.

The objective is to design, develop, build and demonstrate a novel drive train system consisting of a single powerful wind propulsion device, working together with a trial carbon capture system to pave the route to zero emission propulsion for bulkers and tankers.

CXL says the shipborne carbon capture system will ultimately be designed to use highly reactive low emissions intensity lime, produced in an on-shore Leilac reactor, to capture CO2 from the ship’s exhaust gases.

FRONTIER ENERGY (ASX:FHE)

Optimisation work has identified a $9.5m reduction in capital costs for Frontier Energy’s 114MW solar farm (stage one) at its Bristol Spring green hydrogen project in WA.

The Pre-Feasibility Study (PFS) released last year estimated the total capital cost of the solar facility to be $166m.

This is mainly through the relocation of the Point of Connection (POC) to within 1km of the Landwehr terminal (compared to the original design that was at the same location as the solar farm and required 5km of power lines) which reduces the capital cost by approximately 50% or $9.5m compared to the PFS estimate of $19.1m.

ORIGIN ENERGY (ASX:ORG)

Origin Energy’s half yearly results reported a statutory profit of $399m compared to a $131m loss in the prior corresponding period as underlying profit declined by $224m to $44m.

ORG CEO Frank Calabri said the first half result is mixed, reflecting a higher earnings contribution from Integrated Gas, and contrasting with more challenging conditions for the Energy Markets division, which has resulted in lower earnings from that business.

However, the retail business performed well, driven by “significant growth of community energy services and the addition of 30,000 customer accounts”, he said.

“Origin Zero is making good progress in partnering with business customers to optimise their demand and supply lower carbon energy solutions.

“We continue to focus on executing our strategy, including accelerating investment in renewable and cleaner energy and customer solutions.”

Calabri added the company’s virtual power plant is growing strongly with the proposed Eraring battery progressing towards a final investment decision as Origin continues to explore potential hydrogen projects.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.