Emission Control: Global EV sales to jump more than 80pc in 2021, BloombergNEF says

Pic: Matthias Kulka / The Image Bank via Getty Images

While the Australian government struggles to come up with adequate policies to support the transition to net zero emissions by 2050, highlighted by the recent release of an underwhelming Future Fuels and Vehicle Strategy, BloombergNEF says global EV sales are set to jump more than 80% in 2021 to 5.6 million units.

In the first half of 2021, the Zero-Emission Vehicles Factbook has reported that sales of passenger electric vehicles (including battery electric, plug-in hybrid, and fuel cell vehicles) were 140pc higher than the same period in 2019, reaching 7pc of global passenger vehicle sales.

This compares with just 2.6pc in 2019, the year of the last UN Climate Change Conference.

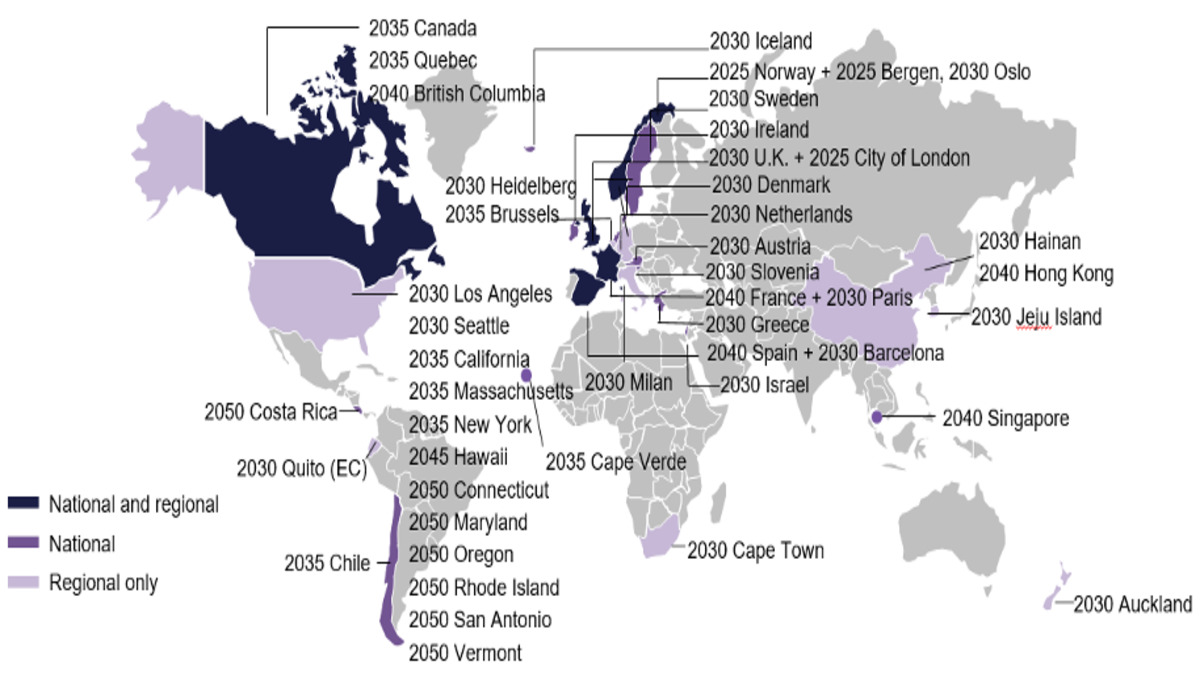

And while governments around the world continue to make exceptional commitments, setting ambitious targets and matching them with regulations to stimulate market growth of zero-emission vehicles (except for Australia), new data shows the total global fleet of passenger electric and fuel cell vehicles has reached nearly 13 million.

The industry leaders, China and Europe, saw electric car sales accounting for 11pc and 17pc respectively during the first half of 2021, the report said, in contrast to 1pc in Japan and 3pc in North America.

In fact, EV sales between the first half of 2019 and the first half of 2021 increased in other countries too, such as in Germany from 3pc to 22pc, in France from 2.8pc to 16pc in France, and in Italy from 0.5pc to 8pc in Italy.

Automakers have also collectively “committed to sell around 40 million EVs per year by 2030” the authors said, with planned phase outs of combustion engines now accounting for 27pc of the global auto market.

National EV strategy ‘a joke’ while NSW announces further boost

Back in Australia, the Morrison government’s Future Fuels and Vehicle Strategy has been dubbed ‘a missed opportunity’ by some and ‘a joke’ by others.

A day after it revealed its plan to “drive consumer choices and uptake of low-emission vehicles” with $178m in new funding for public electric charging and hydrogen refuelling infrastructure, the New South Wales government announced an additional $105m to boost the uptake of EVs among fleet operators in the state.

This is on top of the $490m already committed by the NSW government, which comprises initiatives such as waiving stamp duty on electric vehicle purchases and providing subsidies for new purchases.

This new funding announced by NSW takes it total investment in driving electric vehicle uptake to $595m, while the federal government has said it will spend $250m across all states and territories.

Billon-dollar fund to drive low emissions tech

Amid criticism over weak efforts to meet international obligations, Morrison released a billion-dollar fund on Wednesday to “drive low emissions technology investment.”

The Low Emissions Technology Commercialisation Fund will combine $500 million of new capital for the Clean Energy Finance Corporation (CEFC) with $500 million from private sector investors.

Prime Minister Scott Morrison said the fund would back Australian early stage companies to develop new technology.

Although it didn’t say what the technology would be, it is assumed the money will be invested in carbon capture and storage (CCS) – an expensive and widely disputed method for reducing carbon emissions.

While Chevron was meant to bury an average of 80 per cent of its (rather substantial) emissions over a five-year period from 2016, the system only started emissions storage in 2019 – and even after it came online, more issues ensued.

“We haven’t seen carbon capture and storage get cheaper, we’ve seen it, if anything, get less efficacious. In other words, it doesn’t work,” Robertson said.

Could amending 2030 targets be a possibility?

As COP26 draws to a close, news organisations are beginning to report on the likelihood that governments will be urged to reconsider their 2030 targets – if a draft COP26 agreement released by the United Kingdom yesterday gets the green light.

The draft includes a seven-page document put together by COP president Alok Sharma, which will be negotiated by representatives from close to 200 countries to form a final agreement.

One of the more pressing points in the document stated that “the impacts of climate change will be much lower at the temperature increase of 1.5 degrees compared to 2” with efforts being pursued to limit the temperature increase to 1.5C.

The Climate Action Tracker, an independent scientific analysis that tracks government action and measures it against the globally agreed Paris Agreement, released a report on Tuesday saying that all current international pledges will lead to warming of 2.4C by the end of the century.

“There has been insufficient momentum from leaders and governments to increase 2030 climate targets ahead of, and at Glasgow,” it said.

And contrary to the Paris Agreements requirement that each nationally determined contribution (NDC) update constitutes as a progression beyond the last, several countries have stalled the process further by resubmitting the same target as 2015 (Australia, Indonesia, Russia, Singapore, Switzerland, Thailand, and Vietnam).

Even with all new Glasgow pledges for 2030, the report said “we will emit roughly twice as much in 2030 as required for 1.5 – therefore all governments need to reconsider their targets.”

China and US announce climate co-operation

The world’s two biggest CO2 emitters, the US and China, decided to join forces in a declaration to work together on achieving the 1.5C temperature goal set out in the 2015 Paris Agreement.

While the details are still unclear, CNN reports that the two countries have agreed to steps on a range of issues such as methane emissions, the transition to clean energy, and decarbonisation.

Director of energy finance studies at the Institute for Energy Economics & Financial Analysis Tim Buckley said this move looks very promising, particularly in the context of the ongoing trade war between the two.

“This could be a defining moment where Europe-Asia-North America have come together, and so now belatedly we are seeing a clear global ratcheting up in ambitions,” he said.

“I would also like to highlight the power of US$130 trillion of collective capital in the global finance alliance for 1.5 degrees.

“I am seeing serious strategic intent by key corporates to have a pathway to decarbonise – this can and will be accelerated as technology, policy and economics all collectively improve, so now we are debating the rate of change, not the direction,” he said.

Buckley expects rising capital costs of fossil fuel investing to compete with declining capital costs in terms of risk-reward metrics, which he said will be a huge catalyst for rising cost differentials on zero emissions alternatives.

“China yesterday talked of providing a massive capital cost of debt subsidy and discount to spur on development,” he said.

“So, we exit 2021 with enormous momentum – the science says this is not enough, but I would suggest financial markets will pivot aggressively, so the speed of change will continue to surprise all.”

Australian students win funding to progress carbon removal tech

Three Australian student-led teams have been awarded US$250,000 ($338,000) as part of a Carbon Removal Student Competition – an award program supported by the Musk Foundation.

The program aims to fund early-stage concepts from the next generation of carbon removal innovators with winners announced in 10 countries and 31 education institutions.

Australian winners include the following:

- Blue Symbiosis from the University of Tasmania – setting out to help oil and gas companies address sustainable development goals by repurposing decommissioned oil and gas infrastructure to grow seaweed;

- Sydney Sustainable Carbon from the University of Sydney – the team has developed a technology that uses renewable solar power to remove CO2 from the atmosphere. Once removed it could then be used to support sustainable agriculture and horticulture; and

- Monash Carbon Capture and Conversion (BioTech) from Monash University in Melbourne – this biologically-assisted carbon capture and conversion method focuses on the capture of CO2 from the ocean and air.

Rooftop solar reaches 3m in Australia

This week the Feds revealed rooftop solar installation will contribute to 7pc of the energy into our national electricity grid.

Minister for Industry, Energy and Emissions Reduction Angus Taylor said: “Australia’s 3 million rooftop solar installations are reducing Australia’s emissions by over 17.7 million tonnes in 2021 and will only increase in the future.

“More than 1.4 houses and many non-residential buildings have installed small-scale rooftop solar,” he said.

Now that lockdowns are easing, the Clean Energy Regulator is expecting installation rates to pick up pace and set a new annual record of 3.2 gigawatts installed for the full year, up from the 3-gigawatt record set in 2020.

ASX green energy stocks

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | SIX MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ECT | Env Clean Tech Ltd. | 0.037 | 85.0% | 184.6% | 85.0% | 270.0% | $36,108,640 |

| PH2 | Pure Hydrogen Corp | 0.745 | 65.6% | 231.1% | 282.1% | 843.0% | $216,574,345 |

| PRM | Prominence Energy | 0.009 | 28.6% | -35.7% | -30.8% | 50.0% | $9,941,853 |

| QEM | QEM Limited | 0.23 | 24.3% | 58.6% | 12.2% | 132.3% | $23,251,783 |

| TOU | Tlou Energy Ltd | 0.073 | 19.7% | 46.0% | 30.4% | 12.3% | $37,212,340 |

| AVL | Aust Vanadium Ltd | 0.027 | 17.4% | 22.7% | 22.7% | 145.5% | $75,458,986 |

| HXG | Hexagon Energy | 0.115 | 15.0% | 59.7% | 4.5% | 144.7% | $49,061,521 |

| KPO | Kalina Power Limited | 0.028 | 12.0% | -15.2% | -24.3% | -12.5% | $40,885,710 |

| PRL | Province Resources | 0.17 | 9.7% | 17.2% | -8.1% | 1380.5% | $197,690,467 |

| HZR | Hazer Group Limited | 1.675 | 8.8% | 68.3% | 36.2% | 163.8% | $269,887,286 |

| FMG | Fortescue Metals Grp | 15.45 | 7.4% | 8.4% | -37.7% | -12.2% | $43,967,619,029 |

| LIO | Lion Energy Limited | 0.088 | 4.8% | 125.6% | 27.5% | 486.7% | $28,371,736 |

| CXL | Calix Limited | 6.12 | 4.1% | 4.6% | 140.0% | 574.4% | $958,020,769 |

| IRD | Iron Road Ltd | 0.2 | 2.6% | -9.1% | 0.0% | 34.4% | $154,945,107 |

| BSX | Blackstone Ltd | 0.605 | 2.5% | 24.7% | 72.9% | 53.2% | $222,631,692 |

| NEW | NEW Energy Solar | 0.84 | 2.4% | 5.0% | 5.7% | -10.2% | $271,998,241 |

| IFT | Infratil Limited | 7.9 | 2.1% | -0.1% | 12.9% | 55.8% | $5,720,732,275 |

| RFX | Redflow Limited | 0.057 | 0.0% | -6.6% | 2.8% | 113.2% | $80,109,222 |

| SKI | Spark Infrastructure | 2.83 | 0.0% | 0.7% | 28.1% | 37.4% | $4,948,971,070 |

| AST | AusNet Services Ltd | 2.58 | -0.4% | 3.2% | 36.9% | 31.0% | $9,919,608,019 |

| MEZ | Meridian Energy | 4.61 | -1.5% | -1.5% | -7.8% | -19.7% | $5,889,297,090 |

| DEL | Delorean Corporation | 0.21 | -2.3% | 5.0% | -8.7% | 0.0% | $37,606,439 |

| GNX | Genex Power Ltd | 0.2 | -2.4% | -7.0% | -16.7% | 13.6% | $208,630,509 |

| MPR | Mpower Group Limited | 0.064 | -7.2% | 6.7% | -28.9% | 42.2% | $14,650,216 |

| VUL | Vulcan Energy | 10.65 | -7.5% | -8.8% | 34.6% | 660.7% | $1,269,304,783 |

| GEV | Global Ene Ven Ltd | 0.145 | -9.4% | 64.8% | 57.6% | 52.6% | $70,861,329 |

| PGY | Pilot Energy Ltd | 0.066 | -12.0% | 32.0% | -19.5% | 127.6% | $32,102,509 |

Pure Hydrogen (ASX:PH2) is the clear winner this fortnight, up 231pc after announcing plans to build three waste to hydogen plans on Australia’s east coast.

In an agreement with CAC-H2, PH2 says the plants will use timber waste that would otherwise be consigned to landfills for conversion into renewable hydrogen.

Environmental Clean Technologies (ASX:ECT) is up 184.6pc for the fortnight on no news, as is Lion Energy (ASX:LIO) at 125.6pc.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.