Emission Control: Could waste-based biofuels be the key to unlocking the energy transition?

Pic: Getty Images

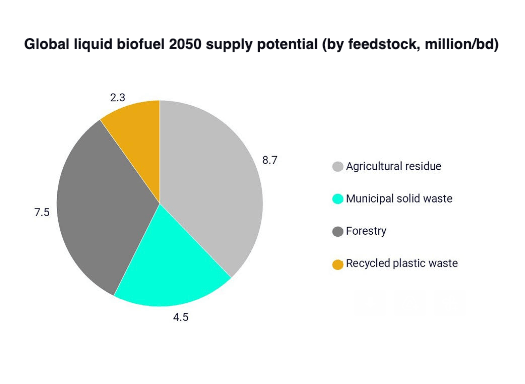

- Developing new technologies that drive biofuel production could supply an additional 20m barrels per day (b/d) of liquid biofuel by 2050

- This process will give rise to a circular economy, WoodMac says

- Woodside collaborates to drive hydrogen market

Emission Control is Stockhead’s fortnightly take on all the big news surrounding developments in renewable energy.

As the world transitions to new, sustainable energy sources the somewhat neglected biofuel sector may have a crucial part to play.

Developing new technologies that drive biofuel production from municipal waste, agricultural residue and recycling plastic wastes could supply an additional 20m barrels per day (b/d) of liquid biofuel by 2050, global research and consultancy group WoodMac says.

While many governments have pulled away from using food-based biofuels due to a range of issues from carbon emissions, deforestation, the ‘food vs fuel’ debate, and the effect on water resources, WoodMac vice president Alan Gelder says there is still plenty of opportunity for growth – especially when looking at waste-based alternatives.

“For some areas of the transport sector, such as air travel, there is little alternative to liquid fuel, making decarbonising difficult.

“This source of biofuel could be tremendously beneficial, providing a cleaner fuel alternative that addresses both future power and environmental needs.”

Bio-based diesel and aviation fuels from plant-based feedstock could emit 80% less carbon than the crude oil-based products that dominate today’s global market and could curb carbon emissions at a similar rate for industries that are hard to electrify, Gelder explains.

And according to the International Energy Agency, the net-zero pathway demands that nearly half of biofuels consumed in 2030 – 45 per cent – must be produced with waste.

“This process will give rise to a circular economy,” he says.

“As moving solid wastes over distance is expensive, supply chains will be local, where products can be collected and processed at small-scale facilities outside of cities and towns.

“We are already seeing large petrochemical companies develop impressive chemical waste plastic recycling programs, proving that these technologies can be deployed.

“If the refining sector begins to process waste for biofuels and governments support the initiative, we could be on a viable pathway to a circular economy, that is compatible with mitigating climate change. It’s a win-win scenario.”

Woodside collaborates to drive hydrogen market

Woodside Energy (ASX:WDS), BGC, and Centurion are looking to accelerate the uptake of hydrogen fuelled transport in Western Australia with a proposed self-contained production, storage, and refuelling station in the Rockingham Industry Zone, roughly 50km south of Perth.

Named the Hydrogen Refueller @H2Perth, the project would be located adjacent to Woodside’s proposed H2Perth project – a proposed domestic and export-scale hydrogen and ammonia production facility currently under development.

The project was selected from more than 20 expressions of interest submitted for the WA Government’s Hydrogen Fuelled Transport Program and has a target to deliver hydrogen fuel at a globally competitive price of $11 per kilo for a 10-year period.

BGC will purchase and operate five to 10 hydrogen fuel cell concrete agitator trucks, while Centurion will purchase and operate two hydrogen prime movers.

Woodside also plans to lease and refuel two Hyundai Nexo vehicles at the refuelling facility.

With a $10 million grant from the McGowan Government and matched funding from WDS, the project is expected to produce around 235kg of hydrogen per day, with the potential to scale up to a targeted 800kg of hydrogen per day and supply more than 50 vehicles.

‘We need an entirely new supply chain’

WDS CEO Meg O’Neill said the Hydrogen Refueller @H2Perth demonstrated Woodside’s support for the continued development of Western Australia’s hydrogen market.

“The proposed refuelling facility would deliver on our commitment to make low cost, lower-carbon hydrogen-based energy available to local customers, while also progressing export opportunities such as H2Perth.

“We don’t just need new sources of energy; we need an entirely new and integrated supply chain for successful energy transition.”

Hydrogen will be produced using a 2-megawatt electrolyser, powered by renewable energy sourced from the Southwest Interconnected System and production timed to occur during periods of excess solar in the grid and stored on-site.

All of this sounds great!

But hold up, not too fast.

Stockhead senior energy reporter Bevis Yeo says its credentials might not be entirely green – find out why here.

Black Rock acquires energy storage developer

On Tuesday, BlackRock Real Assets – a leg of the US$10 trillion ($14 trillion) investment firm, revealed its acquisition of Australian energy storage developer Akaysha Energy and its plans to inject $1 billion to support the build out of more than 1GW of battery storage assets across nine projects in the National Electricity Market (NEM).

At full capacity, Akaysha’s projects will help accelerate the roll-out of a further 4,000MW (megawatt) of supply of clean, affordable renewable energy across Australia.

This is the first battery storage investment made by BlackRock’s Climate Infrastructure business (part of BlackRock Real Assets) in the Asia-Pacific region.

Established last year, Akaysha has long term plans such as developing future energy storage projects in Japan and Taiwan as well as adding adjacent renewable energy opportunities (including developing green hydrogen assets) to its portfolio across multiple markets.

BlackRock APAC co-head of Climate Infrastructure Charlie Reid said as renewable energy infrastructure continues to mature in Australia, investment is required in battery storage assets to ensure the resilience and reliability of the grid, especially with the continued earlier-than-expected retirement of coal-fired power stations.

“For our clients, we see tremendous long-term growth potential in the development of advanced battery storage assets across Australia and in other Asia-Pacific markets and look forward to working with Akaysha to ensure an orderly transition to a cleaner and secure energy future.”

Biden signs bill to tackle climate change

Earlier this week, US President Joe Biden signed into law the much anticipated US$430 billion ($604 billion) climate package, designed to cut greenhouse gas emissions as well as lower prescription drugs and high inflation.

The bill, also known as the Inflation Reduction Act, includes nearly $370 billion in climate and clean energy investments like wind and solar, and support for households to make them run on clean electricity.

According to Morningstar equity strategist Seth Goldstein, it also provides subsidies for electric vehicles and plug-in hybrids, as long as a minimum proportion of critical minerals – including lithium – comes from the US or its free trade partners.

Here’s how renewable energy companies are tracking:

| CODE | COMPANY | LAST | 1 MONTH RETURN % | 1 WEEK RETURN % | YESTERDAY RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|

| TNG | TNG Limited | 0.125 | 89% | 25% | 14% | $152,726,004 |

| DEL | Delorean Corporation | 0.1175 | -10% | -2% | 7% | $23,729,301 |

| EDE | Eden Inv Ltd | 0.008 | -20% | -11% | 7% | $19,396,710 |

| LNR | Lanthanein Resources | 0.032 | 113% | 10% | 3% | $29,847,593 |

| FHE | Frontier Energy Ltd | 0.32 | 73% | 14% | 3% | $71,108,623 |

| PH2 | Pure Hydrogen Corp | 0.33 | 40% | -24% | 3% | $110,150,011 |

| GNX | Genex Power Ltd | 0.235 | 81% | 7% | 2% | $318,590,742 |

| CNQ | Clean Teq Water | 0.55 | 15% | -7% | 2% | $24,119,734 |

| AST | AusNet Services Ltd | 0 | -100% | -100% | 0% | $9,919,608,019 |

| HXG | Hexagon Energy | 0.018 | -18% | 6% | 0% | $9,232,486 |

| IRD | Iron Road Ltd | 0.135 | -10% | -7% | 0% | $107,981,276 |

| LIO | Lion Energy Limited | 0.04 | 14% | 3% | 0% | $17,044,409 |

| MPR | Mpower Group Limited | 0.023 | -15% | 5% | 0% | $6,391,009 |

| NEW | NEW Energy Solar | 0.88 | 7% | 0% | 0% | $282,117,428 |

| PGY | Pilot Energy Ltd | 0.02 | 33% | 25% | 0% | $12,047,806 |

| PRL | Province Resources | 0.145 | 75% | 0% | 0% | $171,135,256 |

| PRM | Prominence Energy | 0.003 | 50% | 20% | 0% | $7,273,826 |

| QEM | QEM Limited | 0.225 | 22% | 2% | 0% | $28,146,055 |

| SKI | Spark Infrastructure | 0 | -100% | -100% | 0% | $5,036,718,784 |

| KPO | Kalina Power Limited | 0.019 | -10% | -5% | 0% | $28,788,310 |

| NRZ | Neurizer Ltd | 0.145 | -9% | 0% | 0% | $152,535,095 |

| SRJ | SRJ Technologies | 0.43 | 0% | 0% | 0% | $33,756,303 |

| MR1 | Montem Resources | 0.04 | 25% | 0% | 0% | $10,302,443 |

| FGR | First Graphene Ltd | 0.145 | 23% | 4% | 0% | $83,276,326 |

| M8S | M8 Sustainable | 0.007 | 0% | -13% | 0% | $2,936,360 |

| LPE | Locality Planning | 0.061 | 9% | -3% | 0% | $10,441,293 |

| CWY | Cleanaway Waste Ltd | 2.735 | 5% | 0% | 0% | $5,652,008,309 |

| PV1 | Provaris Energy Ltd | 0.0785 | 40% | 8% | -1% | $43,314,157 |

| IFT | Infratil Limited | 8.19 | 13% | 0% | -1% | $5,989,940,338 |

| FMG | Fortescue Metals Grp | 19.03 | 17% | 1% | -1% | $59,208,495,373 |

| EOL | Energy One Limited | 5.22 | 5% | 2% | -1% | $145,385,180 |

| MEZ | Meridian Energy | 4.8 | 9% | 6% | -1% | $6,132,748,415 |

| HZR | Hazer Group Limited | 0.72 | -5% | -3% | -1% | $122,885,317 |

| NMT | Neometals Ltd | 1.33 | 41% | -2% | -2% | $748,429,518 |

| CXL | Calix Limited | 6.66 | 22% | -7% | -2% | $1,097,086,808 |

| RNE | Renu Energy Ltd | 0.05 | 25% | -14% | -2% | $18,592,867 |

| LIT | Lithium Australia | 0.076 | 7% | -7% | -3% | $80,761,927 |

| AVL | Aust Vanadium Ltd | 0.0485 | 31% | -8% | -3% | $197,242,797 |

| BSX | Blackstone Ltd | 0.23 | 31% | 0% | -4% | $113,574,054 |

| RFX | Redflow Limited | 0.043 | 0% | -12% | -4% | $69,071,236 |

| ECT | Env Clean Tech Ltd. | 0.02 | 33% | -9% | -5% | $36,041,285 |

| VUL | Vulcan Energy | 8.24 | 43% | -7% | -5% | $1,244,150,413 |

| CPV | Clearvue Technologie | 0.255 | 11% | -4% | -7% | $58,311,095 |

| EGR | Ecograf Limited | 0.44 | 80% | 10% | -7% | $213,908,393 |

To ASX renewable energy news

GENEX POWER (ASX:GNX)

Earlier this month the board of GNX rejected the takeover bid by Skip Essential Infrastructure Fund headed by Kim Jackson, the wife of Atlassian-co founder Scott Farquhar and Stonepeak Partners LLC (together forming the Consortium).

Shares in the company skyrocketed heavenwards on the indicative offer to acquire shares at 23c a share last week, valuing the company at more than $320 million – a 70% premium to the company’s closing price.

Yet, GNX said the takeover offer undervalued the company and therefore was not in the best interest of shareholders.

However, on Wednesday the renewable energy generation company said it had received a revised conditional, non-binding, indicative proposal from the Consortium to acquire all of the Genex shares on issue for A$0.250 in cash per Genex share by way of a scheme of arrangement.

Other than the increased price, the material terms of the Revised Indicative Proposal are the same as the Indicative Proposal.

The board considers that it is in the interests of Genex Shareholders as a whole to engage further with the Consortium.

GNX has decided to provide the Consortium with the opportunity to conduct confirmatory due diligence in order to assist the Consortium to provide a binding proposal to the board.

SILEX SYSTEMS (ASX:SLX)

SLX says following the passage into law of the Inflation Reduction Act, the company has received US$700m to carry out the HALEU Availability Program for the next four years.

HALEU (High Assay Low Enriched Uranium) is the fuel required by many of the emerging advanced Small Modular Reactors (SMRs) – the next-generation of nuclear power technology.

Global Laser Enrichment (GLE), the exclusive licensee of the SILEX laser technology for uranium enrichment, will explore opportunities to be a potential participant in the HALEU Availability Program.

According to SLX, there is currently no commercial source of HALEU fuel in the US today, and many SMR developers had planned to source their early HALEU fuel requirements from Russia.

Given the growing concern over energy security and supply chains in the wake of Russia’s invasion of Ukraine, those plans may no longer be realistic, creating significant urgency in establishing the HALEU Availability Program.

TYMLEZ (ASX:TYM)

TYM has been selected to collaborate with Lloyd’s Register Maritime Decarbonisation Hub and Safetytech Accelerator to undertake a feasibility study for the guarantee of origin of green hydrogen and green ammonia in the maritime industry.

The global maritime industry currently contributes 3% of global CO2 emissions and while the industry has taken steps in recent years to reduce its carbon footprint, major change is still needed to meet the industry’s goal of a 50% reduction in greenhouse gas emissions by 2050.

This ambitious target, which was set by the International Maritime Organization (IMO), is considered achievable by combining gains in efficiency with new technologies.

Lloyd’s Register Maritime Decarbonisation Hub and Safetytech Accelerator reached out to companies offering guarantee of origin solutions for green gasses.

After presenting its solution to their Executive Leadership Teams, TYMLEZ was chosen to collaborate with the two companies to conduct a commercial feasibility study to determine the best process for assuring the greenhouse gas footprint of these new low carbon fuels.

FRONTIER ENERGY (ASX:FHE)

Frontier has identified a pathway to increasing green hydrogen output at its Bristol Springs project less than two weeks after announcing some of Australia’s lowest production costs.

Results from the Renewable Expansion Technical Assessment completed by Xodus Group, which incorporated the total 846ha of land under the company’s control, found that a solar-only solution could produce at least 438 megawatts of power.

This is nearly four times higher than the planned 114MW Stage One solar farm and could deliver a corresponding increase in green hydrogen production.

NOW READ: Frontier highlights potential for big boost to green hydrogen production

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.