Emission Control: Ark Energy nabs renewable developer Epuron and global wind power could grow by 9% to 2030

Pic: Suriyapong Thongsawang via Getty Images

Trailing behind last week’s visit of South Korean President Moon Jae-In to Australia and the strong signal that the Australia-Korea relationship is a significant one, Ark Energy Corporation – a subsidiary of Korea Zinc – has revealed its plans to acquire a 100% interest in wind and solar energy developer Epuron Holdings.

The deal, expected to be completed in the first half of 2022, sees Ark set to acquire about 4,200MW of early-stage development projects across the National Electricity Market focusing on wind and solar sites in Queensland, New South Wales and Tasmania.

It sees the company, which is aiming to be the most competitive producer of green hydrogen in the world, acquire a further investigation pipeline of 4,800MW while also continuing to deliver 5,860MW of projects under existing joint development agreement with counter-parties.

Epuron co-founder Martin Poole said the company has been part of a rapidly changing energy market for some 18 years now.

“With the energy transition accelerating, it is a hugely positive step for us to be joining a group with Ark Energy’s track record and shared vision to scale up investment in renewable energy production in Australia.”

Speaking at the Australia-Korea New Energy Forum back in October Ark Energy CEO Daniel Kim said it intends to be 100% renewable by 2025 and is helping sister company Sun Metals, owner of the Sun Metals Zinc Refinery in Townsville, Queensland, to become the first refinery in the world to produce ‘green zinc’.

Plans also include the establishment of 8GW of renewable energy capacity to feed 3.5 GW of electrolyser competence and form an export business in the long run.

Global installed wind power capacity set to grow by 9% to 2030

WoodMac reckons global wind power is expected to grow at a cumulative growth rate (CAGR) of 9% between 2021 and 2030.

By the end of the decade, expectations are that global wind power capacity will have hit over 1,756 gigawatts.

Its Q4 forecast reported a 69-GW increase in new capacity additions globally compared to the previous quarter’s outlook for the period 2021-2030 – and China is to blame.

The country’s 48-GW quarter-on-quarter (QoQ) upgrade accounts for nearly 70% of the increase to the global 10-year outlook.

WoodMac research director Luke Lewandowski attributed the major uplift to two things.

“Rapid growth in power demand driven by China’s industrial sector and the recent power shortage in September sparked China’s determination to accelerate the development of renewable energy.

“The market is expected to add 458 GW this decade and will continue to lead the global rankings in terms of new capacity added.”

The research firm says demand for power along China’s coastline “triggered a 13-GW upgrade in the offshore and wind sector”, largely concentrated from 2023 to 2026 and its commitment to net zero emissions will add even further drive – about 88 GW of additional offshore wind between 2021 and 2030.

Meanwhile, the US is currently ranked second to China in terms of global new capacity this decade, with 150 GW of capacity addition.

A 3.3-GW quarter-on-quarter upgrade in south Europe’s outlook, due primarily to wind developers winning the entirety of a 1.1-GW tech-neutral allotment in October, contributed to nearly 10 GW uplift across Europe this quarter, WoodMac said.

Minimal adjustments in the quarter-on-quarter outlook for the Middle East and Africa have been made, although advancement of wind builds in South Africa, Oman, Israel, and Egypt indicate development is on pace with the forecast.

Bucking the trend of increasing capacity additions is Japan, which dropped five positions down to 16th position in the top markets for new wind capacity rankings.

“A 2.5-GW downgrade quarter-on-quarter in Japan caused by a more conservative offshore target than anticipated resulted in a nearly 800-megawatt downgrade to the outlook for Asia Pacific excluding China,” the research firm said.

The country is now projected to add 11.7 GW of new capacity this decade.

Increasing AdBlue supplies

Severe shortages of the diesel additive product AdBlue, made from urea and used to reduce nitrous oxide in modern diesel and freight engines is beginning to wreak havoc on the transport industry and is only set to worsen in the coming quarter unless supply issues are addressed immediately.

Earlier in the week, the Morrison Government acted quickly to form a deal with $6 billion dollar company Incitec Pivot (ASX:IPL) to secure local production of refined urea for the supply of the diesel exhaust fluid.

Under this agreement, IPL will rapidly design, trial and, on completion of successful tests, scale-up manufacturing of significant quantities of Technical Grade Granular Urea (TGU), a critical component of AdBlue as needed by current suppliers.

According to the Australian Financial Review, Incitec received a $29.4 million boost from the Feds to ramp up production.

In the past, around 90% of TGU was imported into Australia to make Adblue, however, recently Australia has been forced to secure new supplies due to China curbing its exports as a response to soaring energy prices.

A world without coal by 2043

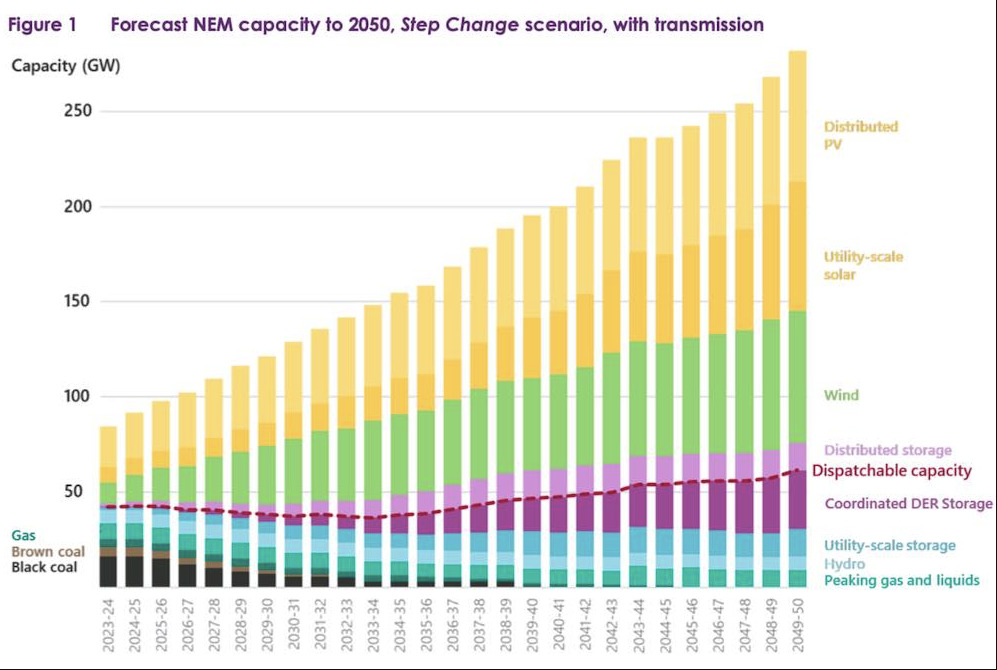

The Australian Energy Market Operator announced earlier this month its 30-year ‘optimal development path’ for electricity investment in the National Electricity Market, reflecting a ‘Step Change’ scenario where operations would run on 96% renewables by 2040 and without coal generation by 2043.

After 18 months of consultation with various stakeholders, AEMO said the Step Change is the most likely future scenario where a transformation of the NEM to 2050 could see all brown coal generation and over two-thirds of black coal generation retiring by 2032.

The scenario also includes:

- A near doubling of electricity consumed from the grid, to 330 terawatt hours (TWh) as transport, heating, cooking and industrial processes are electrified;

- Construction of nine times the NEM’s current utility-scale wind and solar generation capacity from 15GW to 140GW; and

- Installation of four times the current distributed PV capacity from 15GW to 70GW, with most coupled with an energy-storage system.

Chief executive officer Daniel Westerman said: “This requires a substantial increase in battery and pumped-hydro storage, hydrogen or gas-fired generation for peak demand, all complemented by a market that incentivises energy users to adjust demand based on system conditions.

“This transformation will efficiently deliver secure, reliable and affordable electricity while substantially contributing to national emissions objectives,” he said.

ASX Green Energy stocks

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| RFX | Redflow Limited | 0.052 | 18 | -10 | -17 | 102 | $ 71,676,672.60 |

| IRD | Iron Road Ltd | 0.205 | 8 | 8 | -25 | 32 | $ 163,079,153.33 |

| PH2 | Pure Hydrogen Corp | 0.535 | 7 | 13 | 149 | 494 | $ 172,717,272.69 |

| MEZ | Meridian Energy | 4.65 | 6 | 7 | -3 | -26 | $ 5,862,129,775.50 |

| PRL | Province Resources | 0.1475 | 5 | -11 | 9 | 1129 | $ 163,800,672.60 |

| DEL | Delorean Corporation | 0.205 | 5 | 0 | 14 | $ 36,834,047.40 | |

| HZR | Hazer Group Limited | 1.095 | 3 | -24 | 19 | 60 | $ 173,485,511.61 |

| FMG | Fortescue Metals Grp | 19.13 | 3 | 21 | -15 | -19 | $ 59,855,078,005.92 |

| IFT | Infratil Limited | 7.58 | 0 | -4 | 7 | 13 | $ 5,409,350,645.22 |

| SKI | Spark Infrastructure | 2.87 | 0 | 2 | 30 | 33 | $ 5,036,718,783.60 |

| PRM | Prominence Energy | 0.008 | 0 | -20 | -38 | 14 | $ 10,276,870.55 |

| NEW | NEW Energy Solar | 0.815 | 0 | -1 | -9 | -2 | $ 261,279,208.59 |

| HXG | Hexagon Energy | 0.07 | 0 | -22 | -7 | 21 | $ 30,328,940.24 |

| AVL | Aust Vanadium Ltd | 0.028 | 0 | 8 | 40 | 115 | $ 88,598,045.86 |

| AST | AusNet Services Ltd | 2.525 | 0 | -1 | 41 | 40 | $ 9,689,810,149.58 |

| GNX | Genex Power Ltd | 0.2 | -2 | 5 | -15 | 14 | $ 203,281,008.55 |

| CXL | Calix Limited | 6.03 | -3 | -17 | 117 | 480 | $ 966,283,600.73 |

| RNE | Renu Energy Ltd | 0.08 | -4 | -36 | 18 | 158 | $ 12,733,033.84 |

| KPO | Kalina Power Limited | 0.022 | -4 | -21 | -41 | -42 | $ 33,259,115.67 |

| LIO | Lion Energy Limited | 0.062 | -5 | -23 | 15 | 288 | $ 23,323,973.60 |

| MPR | Mpower Group Limited | 0.04 | -5 | -11 | -44 | -42 | $ 8,527,737.89 |

| BSX | Blackstone Ltd | 0.555 | -5 | -1 | 63 | 46 | $ 218,062,154.57 |

| PGY | Pilot Energy Ltd | 0.05 | -6 | -28 | -39 | 67 | $ 25,080,085.05 |

| GEV | Global Ene Ven Ltd | 0.094 | -6 | -28 | 24 | 22 | $ 50,590,183.25 |

| QEM | QEM Limited | 0.175 | -8 | -15 | 6 | 150 | $ 19,849,083.28 |

| VUL | Vulcan Energy | 10.48 | -8 | -4 | 37 | 331 | $ 1,398,988,766.74 |

| LCK | Leigh Crk Energy Ltd | 0.15 | -14 | 11 | -6 | 7 | $ 134,262,923.55 |

| ECT | Env Clean Tech Ltd. | 0.034 | -23 | -29 | 127 | 240 | $ 44,825,555.70 |

Redflow (ASX:RFX) was the biggest winner this fortnight, up 18% on no news followed by Iron Road (ASX:IRD) at 8% also up on news.

A gain of 7% was made by Pure Hydrogen (ASX:PH2) on the notice that its Serowe-5 well had been drilled to a depth of 510m in Botswana.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.