Emerging Energy Virtual Conference keeps flame burning for gas

Natural gas still plays a major role in the energy transition. Pic: Getty Images

- Natural gas remains an important source of energy through the energy transition

- Importance of gas acknowledged by Government’s Future Gas Strategy but concrete action needed to secure supplies

- Gas demand also strong in South East Asia, South Africa and other parts of the world

Special Report: A key point highlighted at the recent Emerging Energy Virtual Conference organised by Jane Morgan Management and Alpine Capital on September 2, is the need for new gas investments in Australia and abroad.

Speaking at the end of the conference, Australian Pipeline and Gas Association chief executive officer Steve Davies said there was a major opportunity for the gas industry to be providing energy throughout the energy transition, noting that while the Federal Government had acknowledged the importance of gas in its Future Gas Strategy, it did not have a lot of concrete action on how to secure supplies.

“And something that I know the government and industry is really turning its mind to now is what can we do to secure gas supply and develop our future gas industries,” he added.

He pointed out that while the scale of gas consumption remains uncertain throughout the energy transition, particularly in relation to gas usage for electricity generation, all scenarios presented by the Australian Energy Market Operator (AEMO) in its 2024 Gas Statement of Opportunities identified the urgent need for new investments to maintain supply adequacy.

The AEMO had flagged that eastern Australia could experience shortfalls on extreme peak demand days from 2025, small seasonal supply gaps from 2026, and the controlled reduction of electricity supplied to homes and business during periods of peak demand from 2028.

“This is something that is an immediate issue for governments around the East Coast. How are we going to secure the next wave of investment in natural gas?” Davies queried.

“The sooner it happens, the better off we will be in the 2030s, but we are yet to see real action being taken on that.

“And that’s something that APGA, as an industry association, works closely with other industry associations in the gas supply chain to put forward to government genuine solutions that we can all act on, to move this forward quickly, because this is very strong language from the Australian Energy Market Operator.”

He also expressed his belief that while importing LNG might help meet demand during periods of extreme gas use, industrial users would not be comfortable paying LNG netback prices for their primary source of gas.

“I think governments need to turn their attention to the opening up of a couple of new onshore basins. That’s what we really need to secure gas over the next 20 years,” Davies added.

Emerging gas area

Omega Oil & Gas (ASX:OMA) is one such company operating in an emerging area – namely the Taroom Trough within Queensland’s Bowen Basin.

Its chief executive officer Trevor Brown followed up on Davies comments, saying that the need to find new gas supplies was an urgent issue that could undermine Australia’s economy if something wasn’t done about it.

He pointed to the company’s assets, which currently have best estimate (2C) contingent resources of 1.51 trillion cubic feet (Tcf) of gas and 68.6 million barrels of liquids, as having the potential to help address this particularly since the existing resource is based on the few zones it is testing within its area.

“This area – the Taroom Trough – has the potential to supply tens of Tcf of gas into the Australian market, and that would be more than enough to satisfy the domestic market, and also help the undersupply through the Gladstone LNG plants,” Brown said.

He added that OMA was testing this play with three main points – the first being that it would be going into a high-price market for many years to come.

The second was that the company had a really good understanding into the geological and geomechanical aspect, enough that the company could apply the third point, which is using modern horizontal drilling and fracture stimulation.

Brown highlighted fellow Australian company Elixir Energy’s (ASX:EXR) efforts, noting that it had drilled a vertical well and was testing several of the intervals in this stack of sediment with current operations being perforating zones and flowing back from all of them combined.

He noted that EXR had already seen some good gas flows to surface from one of the deeper zones, which underscored that this is an underexplored basin with some surprises.

“We should be drilling from September, be done by early October and then we will have a three-month or so break before we do the fracture stimulation and flow-back program,” Brown added.

“There’s a lot of gas hosted in these deep, tight rocks and it’s a geo engineering challenge to get it out.

“We think that the key to this is going to be ultimately, horizontal wells that develop these resources and that’s what we are testing.”

OMA has mobilised the rig to re-enter the Canyon-1 well that was drilled early this year and will drill a long horizontal section up to 1100m before undertaking a fracture stimulation and flyback program to test one of several potential zones.

“In the long-term, we can reduce the cost per well by drilling those multilateral wells in the same vertical wellbore and that concentrates all of the surface facilities in one area,” Brown said.

“And then because it’s in such close proximity to the gas network, it’s a low cost to get this to market.”

Meanwhile, private company King Energy is chasing up its 3H (hydrogen, helium and hydrocarbon) strategy in the Officer Basin, South Australia, where its permits cover ~20,000km2.

“We’ve got about three or four very large, ranked leads or prospects and we will be able to drill the lead prospect within the next 12 months, which we call the Rickerscote project,” executive director Richard King said.

“We’ve already got a lot of really good data that hydrocarbons, hydrogen and helium are present … we’re looking at 4.1Tcf of gas and 620 million barrels of oil at Rickerscote.”

The company plans to carry out infill seismic survey early next year as the existing 2D seismic is sparse. This is aimed at identifying where the company should drill.

“We want to try and hit the crests of the three reservoir seal pairs, that we have identified,” King added.

The first reservoir seal pair is at a depth of 1200m, the second at 1600m and the deepest, which is expected to host the hydrogen and helium has a thick 150-200m salt seal – the only seal mechanism that works to hold both gases – with reservoir that sits on top of uranium, thorium and ancient granite.

Offshore Australia in the Otway and Gippsland Basins, 3D Energi (ASX:TDO) has been developing a portfolio of highly prospective exploration permits close to existing gas fields and associated infrastructure that offers access to the East Coast gas market.

The company is focused on the VIC/P79 and T49P permits offshore from Victoria and Tasmania respectively, which it shares with ConocoPhillips (80%) that is fully carrying it on a $15m seismic survey, exploration well and $3m in cash on each of the two permits.

“We have 4000km2 of 3D seismic, which is very important in this area as it really unlocks the potential of this area like no other place in Australia,” executive chairman Noel Newell told the conference.

“We will be drilling two wells next year, fully carried by ConocoPhillips, and then we may drill a further four wells in the area post 2025 and 2026.

“Our focus on this drilling campaign is to target the lowest risk gas we can and bring it to market as quick as we can.”

He noted that one of the things that the area is famous for is its very high success rate of 88% in two decades.

“The reason it works so well is we just have the planets in alignment in terms of getting amplitude anomalies on seismic and related to gas, and Conoco are very excited about this.”

Waste coal gas in the mix

Another potential source of gas involves tapping coal mine waste gas, which is what Queensland Pacific Metals’ (ASX:QPM) Moranbah project achieves.

The project has been running for about 20 years and includes an electricity generation business.

While the company had originally acquired the project to secure gas for its TECH nickel refinery project in Townsville, the deterioration of the nickel market in the six months led QPM to pivot to focusing on its gas asset.

“Effectively what we’re doing with the project is continuing to develop it and progress towards a commercialisation step,” chief executive officer David Wrench said.

“To that end, we’ve been assisted through about $16 million of government funding, half of that from the Federal Government, half of that from the state, and that puts us in a really strong position to continue to develop the project.

“We produce gas, we process and compress it. We supply gas to customers, and also we run a large power generation asset in Townsville.”

He added that while the company was currently producing 30 terajoules of gas a day, this was trending up as it was a fairly large field with 125-130 producing wells.

The Moranbah project has a resource of about 330 petajoules of gas with just over 200PJ already contracted.

“It’s a mature field, but with a very stable production profile. And the more that we can operate efficiently and effectively and continue to keep wells online and producing, the more production we get,” Wrench added.

He added that the company had completed about 70-80% of the planned drilling and expected to see production from the new wells really start to contribute towards its Q1 results.

Wrench also pointed out that the Townsville power station is perfectly set up to run as a peaking power station to support the electricity market’s transition to a more renewable generation base, which reduces its annual fixed cost burden.

“We can really focus on driving both production and gas supply growth, we have a large contracted reserve position, and that’s what we’re now focused on,” he noted.

“We’re looking at increasing our gas-fired power generation capacity both in Moranbah and in Townsville. We’re also looking at starting to establish smaller-scale, micro LNG facilities to allow gas to be delivered to more local, industrial uses of gas.”

South East Asia gas

Looking beyond Australia, Conrad Asia Energy (ASX:CRD) has been making waves in South East Asia, which is even more gas hungry than Australia.

The company is currently close to commercialising its Mako field in the Natuna Basin offshore Indonesia after signing a binding export gas sales agreement early this month with Singaporean utility Sembcorp Gas, which complements its existing domestic gas sales agreement with PGN.

Collectively, the two agreements locks in all of the current 376 billion cubic feet of 2C contingent gas resources at Mako into sales agreements, placing the company well on the route towards a final investment decision in Q4, 2024.

Nor is Mako CRD’s only asset.

The company assets in Aceh province hold some 11Tcf of prospective gas, which has the potential to be hugely lucrative in the long-run given that Indonesia is the fourth most populous country in the world with strong GDP growth.

“There’s huge energy demand and there’s also the other problem is that Indonesia is one of the fastest-growing carbon-emitting countries in the world,” non-executive director Mario Traviati told the conference.

He added that the region (South East Asia) has been pushing in the past few decades to move away from coal to natural gas with Indonesia looking to double its gas output by 2030.

Traviati noted that Mako is one of the largest gas fields in the Natuna Sea and that its location on gas trunk lines into Malaysia and Singapore was about as good as it gets.

It’s move towards development is also well timed as the Natuna Sea fields have been supplying gas to Singapore for about two to three decades and are poised to run out in 2028 on the existing gas contracts.

On Aceh, Traviati said the company has over 20,000km2 of acreage and that the deeper water structures are giant, four-way dip closures that could host 2-8Tcf of gas.

“We are pretty excited about the exploratory potential,” he added.

Rest of the world

Outside of Australia and South East Asia, Kinetiko Energy (ASX:KKO) and Condor Energy (ASX:CND) have been progressing their respective projects in South Africa and Peru.

KKO’s namesake gas project in South Africa has 2C contingent resources of 6Tcf of gas and a maiden gas reserve of 6.4 billion cubic feet assessed over the pilot production field that sits next to existing infrastructure and a multitude of clients.

“South Africa’s, coal-based power load is in absolute decay and cannot be recovered and the other source of energy, which has been gas, which comes from Mozambique, is entering a period of steep decline. And there are no other, obvious, energy solutions on the horizon,” executive chairman Adam Sierakowski said.

“We think Kinetiko has got a really important opportunity for the country to try and bring this asset out of the ground as quickly as possible.

“A big part of this is the five-well drilling program that we are about to commence in just a couple of weeks and that test program, we expect to be highly impactful and produce a lot of news flow, which is going to bolster the existing, enormous resource that the company

already has.”

He added that the company has the opportunity to develop production clusters right next to the existing infrastructure and right next to the clients that need it most.

KKO also has a non-binding agreement with ITC to develop an LNG project in South Africa in two phases, the first of which is a 50-megawatt equivalent opportunity that will be grown to a 500MW opportunity in the second phase.

As part of this, the company expects to drill ~20 production wells to feed a micro-LNG train that is expected to be rolled out and completed over the next 18 months to deliver first revenues.

Meanwhile, CND is focused on progressing its 4858km2 technical evaluation agreement area in the highly prospective Tumbes Basin offshore Peru, which hosts more than 20 prospects and leads that it is continuing to mature.

Advisor to the board Alan Stein pointed out that while there were a lot of oil and gas discoveries in the Basin, which is covered in a lot of 3D seismic, only one exploration well has been drilled using this data.

“So here you have what is for a geologist an intriguing possibility. You have a proven basin with a proven petroleum system. You know that the plumbing works,” he added.

“We’ve got over 3800km² of 3D seismic data, which if we went to acquire today, would cost us considerably north of $50 million. But only one well has been drilled with the benefit of that 3D seismic data.”

Adding interest, French super major Total recently snapped up all the acreage around CND’s projects right up to the Ecuador border, which validates the company’s decision to move into the Tumbes Basin.

Stein noted that the company had picked three areas of particular interest and reprocessed data over them using new algorithms.

These include Piedra Redonda, which is technically not a prospect but a proven discovery with several wells, a long-term production test, and a contingent resource of just over 400Bcf of gas.

“It’s in shallow water and quite easy to develop, so that’s something that we’re looking at,” Stein said.

He added that the company is building a prospecting lead portfolio and benefitting from having access to technology that no one in the Basin had before.

“You’re going to see some resource estimates coming out, some news flow about JVs to take this project forward and we’re going to convert them into regular exploration and get to the bit that everyone is really focused on, which is drilling some of these tremendously exciting prospects offshore Peru.”

Future-facing gas

Besides natural gas, the conference also touched on hydrogen with HyTerra Limited (ASX:HYT) and its plans to explore for and develop natural sources of the decarbonising gas in the US Mid West taking central stage.

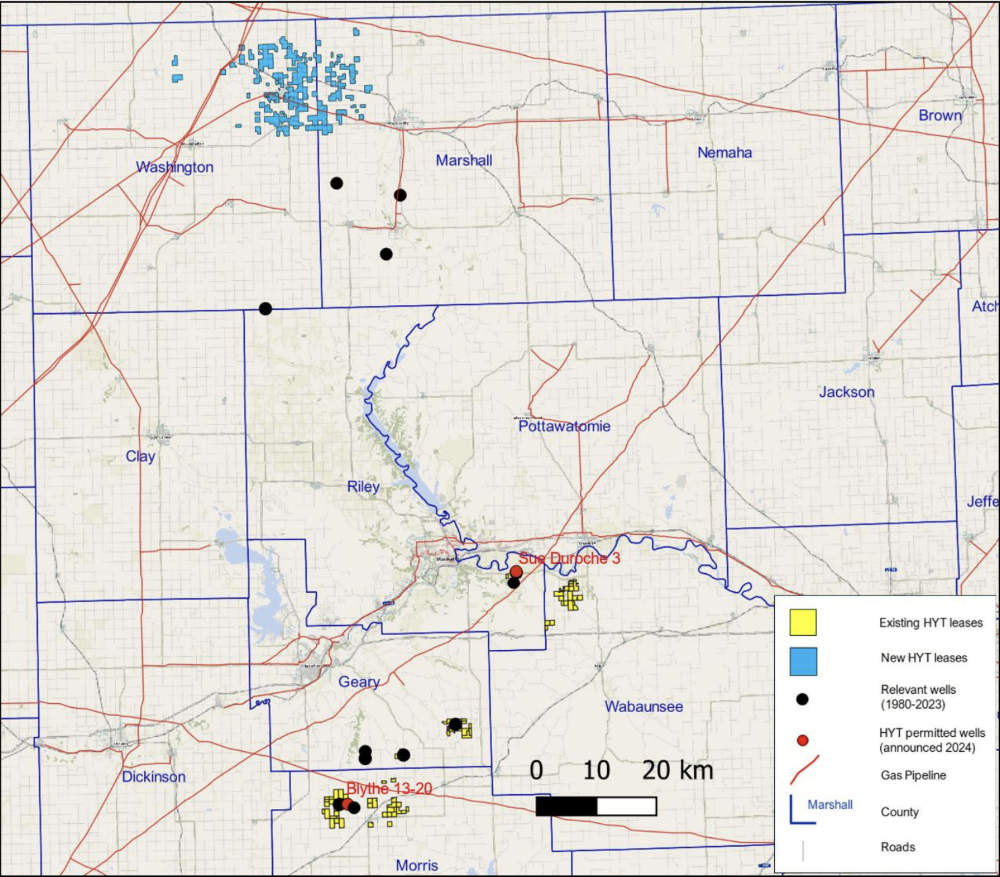

The company has just tripled the footprint of its Nemaha hydrogen and helium project in Kansas from 2,880 to 39,000 acres with plans to continue infill leasing, leasing of new exploration areas, and securing additional well permits.

This comes as it moves to drill the Sue Duroche 3 and Blythe 13-20 wells deeper than historical wells to test the predicted primary targets with better hydrogen and helium potential.

Its prospects were also boosted recently by Fortescue (ASX:FMG) acquiring a strategic 39.8% interest in the company for $21.9m in late August, which executive director Benjamin Mee said allows the company to aggressively pursue natural (white) hydrogen to accelerate global decarbonisation efforts.

“You can’t electrify everything,” Mee added.

“Only 20% of the energy that we use today actually comes from electricity. So the molecules are here to stay.

“The issue is that +99% of the hydrogen we use comes from fossil oil and gas, so a replacement for this must not only compete in terms of carbon, but a real alternative is probably similar in terms of cost of supply, if not cheaper.”

To replace hydrogen produced from fossil fuels, HYT is exploring for naturally occurring hydrogen (and helium) near major industrial hubs.

This is best demonstrated by the company’s Nemaha project, which sits within a major industrial and manufacturing hub between Kansas City and Wichita, and which notably produces more than 25% of America’s ammonia – a compound of hydrogen and nitrogen that’s used as a fertiliser amongst other things.

Mee added that the company’s number one focus was to achieve commercial production of hydrogen, which is no different from what oil and gas companies would do.

He noted that the planned six well program will have different drill locations, different drill depths and objectives.

“That’s what drives commercial success.”

This article was developed in collaboration with Conrad Asia Energy, HyTerra, Omega Oil and Gas and Queensland Pacific Metals, who were Stockhead advertisers at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.