Earths Energy’s geothermal projects offer potential valuation upside

There’s plenty of upside potential for Earths Energy’s market valuation. Pic: Getty Images

- First generation Australian geothermal players Petratherm and GreenRock Energy had higher historical valuations than Earths Energy

- Valuations of the two companies reached up to 11 times and 2.5 times higher than the company

- Its Paralana and Flinders West projects are now more valuable than they were historically due to better EGS economics

Special Report: Geothermal’s renaissance in Australia has yet to draw the attention of the general investment community if Earths Energy’s current market valuation is any indicator.

Shares in the company are currently priced at 1.6c, valuing Earths Energy (ASX:EE1) at just under $8.5m.

By comparison, the historical valuations reached by first-wave geothermal players Petratherm (ASX:PTR) and GreenRock Energy – the previous owners of the Paralana and Flinders West projects respectively that are now owned by the company – reached up to 11 times and 2.5 times higher than EE1.

At the upper end of the scale, Geodynamics reached a market valuation of more than $400m in 2011 before high costs associated with the depths of Australian hot rocks and competition from cheap coal-fired electricity led to the sector’s demise.

New technology breathing new life

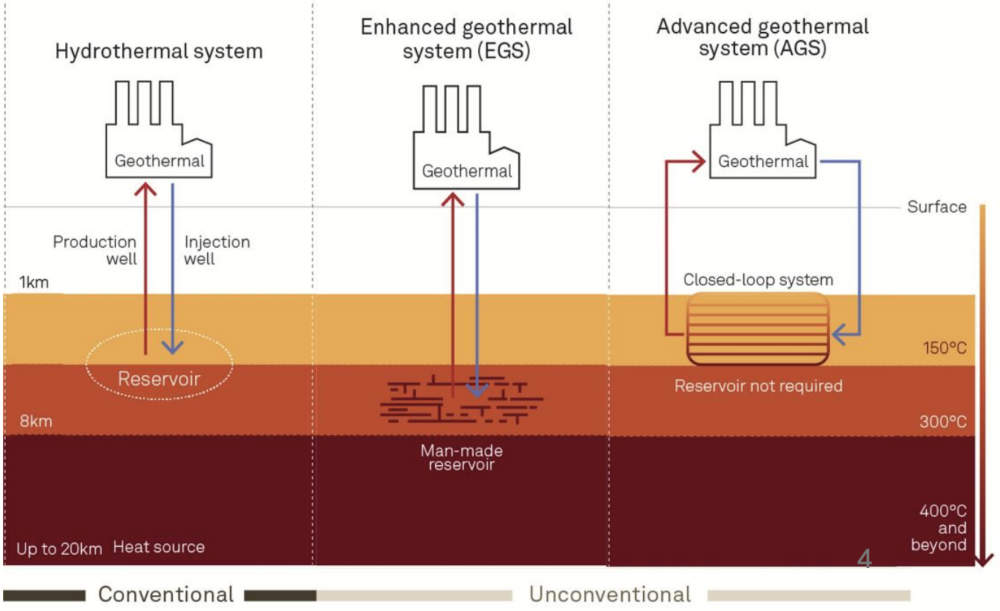

However, new developments borrowed from the oil and gas sector and implemented by companies such as Fervo Energy have breathed new life into the case for geothermal energy – particularly the enhanced geothermal systems (EGS) pioneered by Australian companies more than a decade ago.

EGS forces a liquid – typically water – into fractured hot rocks, bringing the resulting hot liquid to surface to generate power.

The use of technology from oil and gas including lateral (horizontal) wells, which exposes more of the actual surface area of the hot rock to the well, has resulted in a drastic reduction in costs associated with drilling.

This is coupled with advances that have increased accuracy in the interpretation of data and resolution of seismic data used to model reservoirs and fractures.

EE1 believes these advances mean that both Paralana and Flinders West are now more valuable than they were historically as the economics of developing EGS is now markedly greater that it used to be.

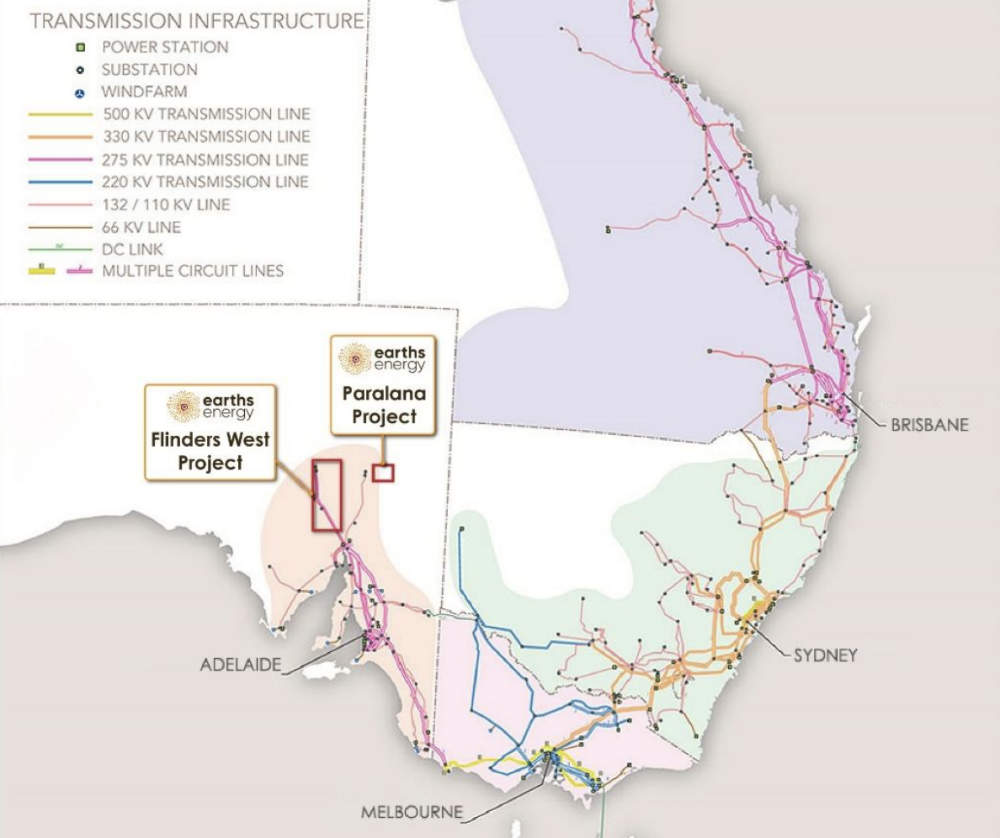

Paralana is 300km northeast of Port Augusta and was once one of the most advanced EGS projects in Australia.

Previous work had measured bottom hole temperatures of 171 degrees Celsius with a temperature gradient of 46C per km of depth, ~1.84x the Australian average.

However, the project was never completed due to a lack of funding and was not revisited in the 13 years until EE1 picked it up.

The Flinders West project, about 45km northwest of Port Augusta, has also seen previous work, with drilling reaching a depth of 1,934m and encountering bottom-hole temperatures of 85C along with a high gradient of 43C per km.

A recent review found that Paralana had the potential to produce between 97 and 233 gigawatt hours of power per annum based on conventional analogues in the US while Flinders West could have an upper range of power density of about 7MWe/km2 – sufficient for commercial power generation.

A peek overseas

In its presentation released to the ASX today, EE1 pointed to North American companies Fervo Energy and Eavor as representing the current state of investment and demand into EGS and advanced geothermal systems.

Both companies are aided by having intellectual property to leverage into operating projects.

While both are private companies, Fervo last raised US$244m ($373m) on February 22, 2024, while Eavor was last valued at US$564.46m in June 2023 when it raised US$65.65m, providing a hint of just how much upside valuation is possible for EE1 in the event of success.

This article was developed in collaboration with Earths Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.