D3 Energy to drill key helium, natural gas exploration well

D3 Energy has signed a rig contract for the drilling of the RBD12 well to test for helium and natural gas. Pic: Getty Images

- D3 Energy prepares to drill well to test for helium and natural gas in South Africa’s Free State

- The upcoming RBD12 appraisal well will be completed for production testing

- Company also plans to test historical RBD01 and RBD03 gold exploration holes

Special Report: ASX newcomer D3 Energy is advancing its helium and natural gas exploration plans with the signing of a contract for a rig to drill the RBD12 well in South Africa’s Free State.

D3 Energy (ASX:D3E), which listed in mid-May this year, holds the ER315, ERA341, TCP235 and TCP240 permits that cover 442,750 acres in Free State.

These permits are prospective for both helium and natural gas (methane) with confirmed free flowing gas from historical gold exploration holes.

Further de-risking the permits, they are adjacent to Renergen’s (ASX:RLT) Virginia gas project, which has the first production right for helium and liquefied natural gas (LNG) in South Africa.

ER315 shares many important geological features and conditions with the Virginia project.

More recently, the company’s first two wells RBD10 and RBD11 – drilled to confirm the geological model and gas migration as a function of faulting and associated fractures below the base of the Karoo formation at this location – returned world-class helium concentrations of 5% and 5.1% respectively.

These high helium concentrations have the potential to deliver excellent economics due to the high price commanded by the rare gas.

Helium is used in semiconductor manufacturing, nuclear energy production, solar panels, optic fibre and the cooling of superconducting magnets in MRI scanning machines.

It is often irreplaceable in these uses, which accounts for why US spot prices had ranged from US$1000 to US$2500 per thousand cubic feet in 2022.

Methane concentrations of 80-90% can be used for onsite generation and compressed natural gas (CNG) or LNG operations in energy starved South Africa.

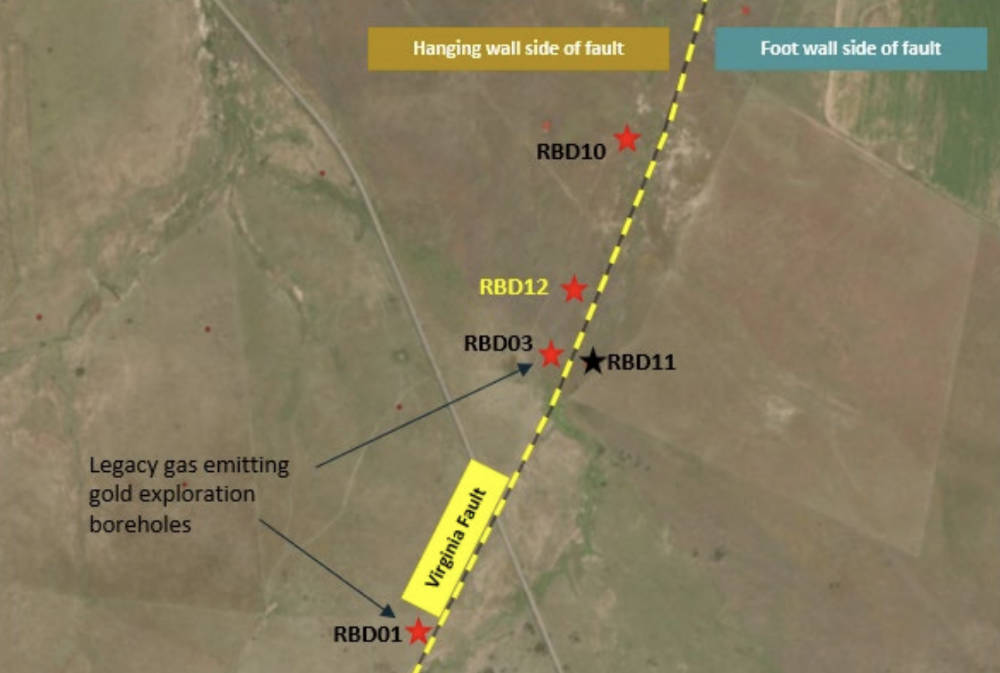

RBD10 – drilled on the west of the Virginia Fault – flowed gas at an average stabilised rate of 126,000 standard cubic feet per day for a 36-hour period without any evidence of decline while RBD11 on the east of the fault flowed gas at rates that were too small to measure.

D3E has defined best estimate contingent resources (2C) for its acreage of 475 billion cubic feet (Bcf) of natural gas and 22.4Bcf of helium.

More production testing on the cards

The planned drilling of RBD12 will take the company’s understanding of its gas permits up to a new level.

D3E plans to drill the well on the west (hanging wall side) of the Virginia Fault and close to the historical RBD03 borehole that has flowed methane and helium at measurable rates since 1984.

Should gas be intersected, RBD12 will be production tested with samples collected to determine helium and methane concentrations.

This is expected to form the basis of a larger and longer production testing program with the company planning to test the historical RBD01 and RBD03 gold exploration holes as early as July.

RBD12 is budgeted to cost ~$200,000 to drill and complete. It could be completed as a future potential development production well if successful.

“This is another strong step by the company as we move through our strategy of exploring, and then rapidly developing and commercialising what is a world class helium asset, within which we have already defined a globally significant contingent resource for helium and a substantial contingent resource for methane in energy scarce South Africa,” managing director David Casey said.

“The results gathered from our initial successful drilling program provide greatly increased confidence in RBD12, which, will consequently be followed up by an extensive production testing programme that should from the outset, form the basis of, and underpin, our first potential development opportunity in what is an extensive portfolio.”

This article was developed in collaboration with D3 Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.