CSIRO: Renewables are the cheapest new-build power option in Australia

Pic: Getty

New analysis out of CSIRO has confirmed that renewables (led by wind and solar) continue to be the fastest and cheapest growing energy source in Australia — even when considering their integration costs such as storage and transmission.

In the latest 2021-2022 GenCost report – a joint initiative by the CSIRO and Australian Energy Market Operator (AEMO), findings suggest that integration costs arise due to the variable nature of renewable output, influenced by factors such as weather along with their wider distribution compared to fossil fuel generation.

But despite global COVID-19 related manufacturing shortages, integration costs remain low while forward projections for 2022-23 assume that costs reductions for all technologies will stall for 12 months because of tight global supply chains.

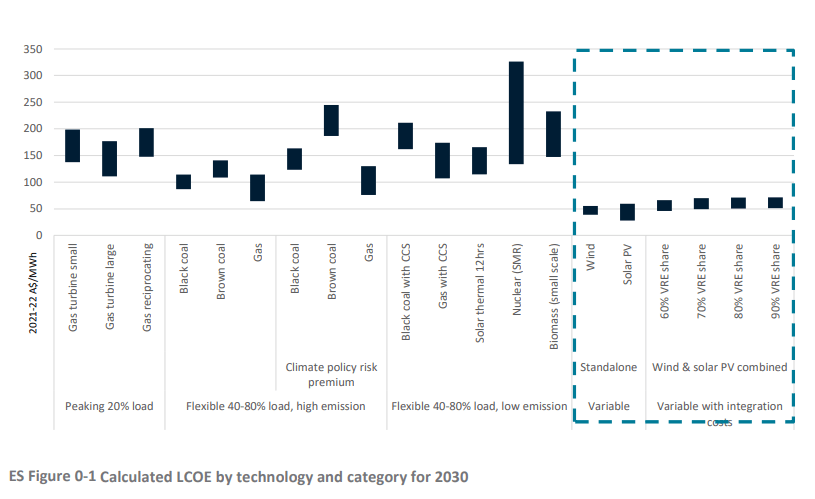

Levelised cost of electricity (LCOE) data is an electricity generation technology comparison metric – it is the total unit costs a generator must recover to meet all its costs including a return on investment.

The above table illustrates that even at levels of 90% wind and solar in the grid, the costs of electricity – including storage and transmission – are significantly below fossil fuels, and just a fraction of nuclear power.

The levelised cost of electricity using solar PV currently lies within the range of $44 to $65 per MWh, while wind power costs range from $45 to $57 per MWh.

In comparison, the estimated levelised cost of a new black coal generator is between $87 and $118 per MWh and gas generation costs between $65 and $111 per MWh.

This means the costs of fossil fuel technologies will remain largely unchanged in real terms over the next three decades and in contrast, the costs of wind, solar and integrating technologies like battery storage will continue to fall as their respective technologies continue to advance.

However, greater projected cost reductions in wind power have led to an increased preference to combine wind generation and transmission expenditure, with reduced reliance on solar PV and storage to balance energy demand.

The renewable energy shift is not going away

GenexPower (ASX:GNX) is one of the few renewable pure play companies listed on the ASX and in an interview with Stockhead, chief executive officer James Harding said the transition already underway from primarily coal fired power to renewable power is irreversible and is not going to change.

“In fact, it will probably accelerate,” he said.

“It is really just a question of time when there will be no more new coal fired power generation built for sure.

“As the plants get older maintenance costs increase, the plants become less reliable, and the prospects are that they will close earlier than planned.”

Harding said the report signifies that Genex is in the right space to be feeding into this new market and helping that transition.

“It is clear that wind and solar are the cheapest forms but because they are intermittent you do need to have storage to shift the output into times when people need it.”

The @CSIRO confirms renewables, specifically #wind & #solar are still Australia’s cheapest source of #electricity generation. As costs continue to fall, $GNX‘s portfolio of #renewable assets will likely retain their dominance in new generation investment. https://t.co/gW6Gn8bM5J

— Genex Power (@Genex_Power) December 16, 2021

Onshore and offshore wind costs drop faster than expected

Interestingly, the report found that both onshore and offshore wind costs have fallen faster than expected but while offshore wind is yet to be developed in Australia, the cost reductions achieved overseas means Australian projects are expected to be lower cost than previously anticipated.

At the same time, cost reductions for technologies not currently being widely deployed continue to lag such as in the areas of carbon capture and storage (CCS), nuclear small modular reactors, solar thermal and ocean energy, which will require “stronger global and domestic investment to realise their full potential”, the report says.

AEMO group manager of forecasting Nicola Falcon said: “Offshore wind, for example, has great potential due to resource quality, but economics are not yet proven in Australia.

“If technology costs continue to track down, as foreshadowed in this year’s GenCost, then this technology could play a greater role in the future.”

Hydrogen electrolysers

For the first time, hydrogen electrolysers were included in the report, a key component of the renewable hydrogen production.

The forecast predicts electrolyser capacity costs to fall by as much as two-thirds from current levels over the next decade and by more than 90 per cent by 2050.

CSIRO Chief Energy Economist Paul Graham said: “The energy sector is rapidly changing so we need updates like this report to ensure that our planning is based on the most up-to-date cost estimates.”

“It’s also crucial that stakeholders have an opportunity to scrutinise the changes to ensure they are consistent with direct industry experience.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.