Costs could eat into Sundance’s chance of profiting from higher oil prices

Pic: Matthias Kulka / The Image Bank via Getty Images

Oil and gas explorer Sundance Energy is making money from its Eagle Ford US shale operations in Texas — but not enough to cover its costs or hedge losses.

Sundance reported first quarter revenue that increased 3.5 per cent to $US24 million — up from $US23 million.

But higher costs pushed a $6.6 million profit to $6.7 million and impairments meant they made a $15.6 million loss.

Eagle Ford is unfashionable right now because the US shale oil sector is being driven by companies operating in the Permian Basin to the northwest.

The amount of oil sold dropped 8 per cent, but was made up for by higher realised oil prices.

On average they got $US55.15 a barrel and $40.59 per barrel of oil equivalent for their gas and liquids production.

Prices for West Texas Intermediate (WTI), the benchmark for US oil, hovered between $US60 and $US67 from January to March.

Costs are going up.

Sundance (ASX:SEA), which operates in southern Texas, says cash costs rose 38.4 per cent last quarter, a fact it blamed on well workover expenses and efforts to convert wells from rod to gas lift — different version of an artificial lift to increase the pressure in an oil reservoir.

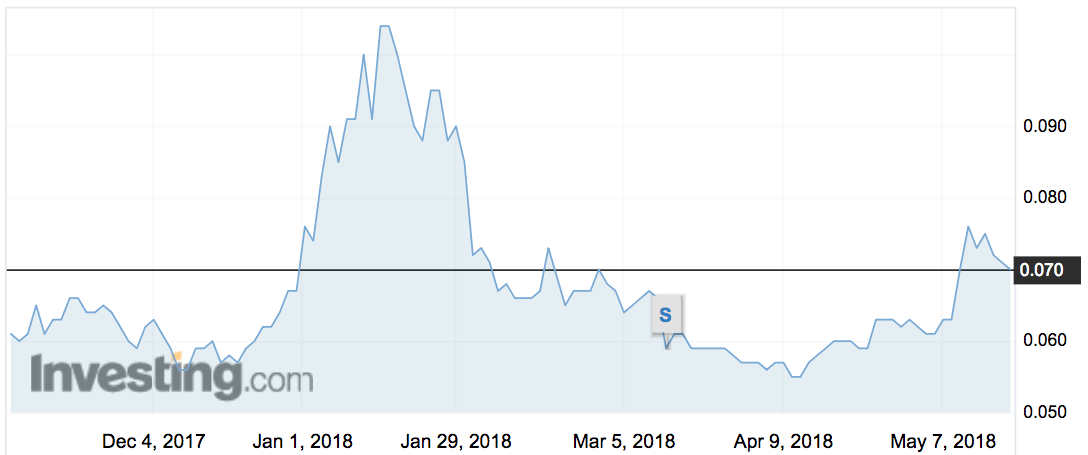

Sundance’s ASX shares were down 1.4 per cent by midday to 70c.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.