Coal’s revival could be just one freezing Asian winter away

Pic: Vertigo3d / E+ via Getty Images

Last week Adani Mining said it had the cash to self-finance construction on its Carmichael thermal coal project in Queensland, just as analysts began speculating that Aussie thermal coal prices were due for a bounce.

The original development was going to cost $16.5 billion to build and with production of 2.3 billion tonnes of thermal coal, would’ve been the biggest coal mine in Australia, but the company had troubles getting the finance.

Now, following changes to develop a smaller open cut mine comparable to many other Queensland coal mines, Adani Mining boss Lucas Dow said construction of the mine will now begin.

If they manage to get this plan up and running (the company has form in saying Carmichael is “shovel ready” and then backing down) it comes as prices for Australian thermal coal is in for a revival.

Prices for thermal coal – the stuff used in power stations — have seen several months of declines, and analysts say that could be over if the Asian winter is a cold one.

>> Scroll down for a table showing the performance ASX stocks with thermal coal exposure over the past year

Prices for the high quality 6,000 kcal NAR thermal coal are down to about $130 per tonne, from about $170 per tonne in mid-July, according to data from S&P Global Platts.

The lower quality 5,500 kcal stuff now sells for about $80 per tonne from $112 per tonne over the same period.

NAR stands for “net calorific value”, or heating value, of the coal in kilocalories per kilogram.

Higher quality coal means power stations can burn less to produce the same amount of energy.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

A market source told S&P that prices had dropped about $20 per tonne over the last month due to “market fundamentals” and reduced Chinese imports.

Demand from Japan, which likes the higher quality 6000 kcal coal, also fell after a September earthquake caused a fire at a major power plant.

A big chunk of capacity at Japan’s 1.65GwH Tomato-Atsuma power plant, which uses up to 600,000 tonnes of coal a month, mostly from Australia, was out of action until early October.

“Since we’ve had such a big fall in prices it would not surprise to see a correction at some point,” sources said.

“However, a sustained rally will likely only be driven by a colder-than-expected northern hemisphere winter which will start to erode the very large stockpiles in Europe and China.”

But… higher export prices also drive up Australian power prices

Increased demand for Australian thermal coal in Asia is pushing up power prices back home, according to BloombergNEF (BNEF) analysis.

The cost of coal power generation in Australia’s National Electricity Market (NEM) has doubled from 2016 levels, in line with thermal coal export prices.

Black coal makes up about 54 per cent of the NEM’s energy mix — up from 51 per cent in 2016 – which makes higher cost of coal generation “one of the most important, yet overlooked, factors driving up power prices”.

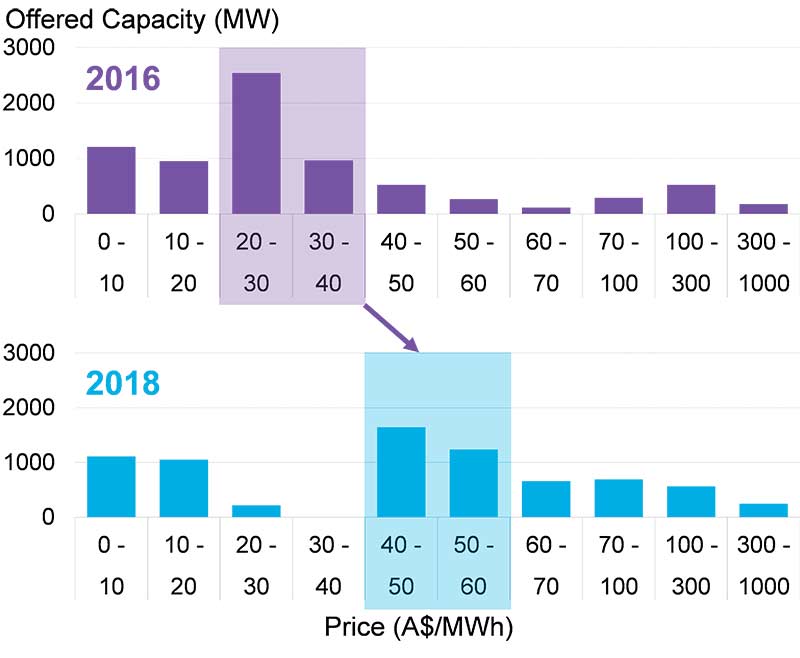

“Thousands of megawatts of coal capacity that was offered at A$20-40 per megawatt-hour of electricity during most of 2016 is now made available for A$40-60 per MWh,” said Ali Asghar, lead author of the BNEF analysis.

“Since black coal makes up such a large portion of the NEM’s energy mix, this change in the cost of coal generation is perhaps the most important reason behind the 60-100 per cent hike in average wholesale power prices over the last two years.”

Here’s a list of ASX stocks with exposure to thermal coal:

Swipe or scroll to reveal full table. Click headings to sort

| ASX code | Company | 6-month price change | 12-month price change | Price Nov 30 | Market Cap |

|---|---|---|---|---|---|

| KRL | Kangaroo Resources | 174.5% | 460% | 14c | 498M |

| TER | Terracom | 68% | 183% | 59.5c | 226.2M |

| NHC | New Hope Corp | 39% | 43% | $3.35 | 2.7B |

| REY | Rey Resources | 14% | -15% | 25c | 53M |

| SMR | Stanmore Coal | 38% | 67% | $1 | 249M |

| WHC | Whitehaven Coal | -17% | 14% | $4.26 | 4.5B |

| NCR | Nucoal Resources | 0% | 71% | 1.2c | 9.2M |

| IEC | Intra Energy | -15% | 57% | 1.1c | 4.3M |

| AHQ | Allegiance Coal | 4% | 49% | 5.2c | 26.5M |

| YAL | Yancoal | -36% | -19% | $3.25 | 4.1B |

| AQC | Australian Pacific Coal | -10% | -33% | 66.5c | 33.6M |

| EQE | Equus Mining | 58% | -61% | 1.4c | 12.1M |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.