Carbon prices are on the rise and businesses already decarbonising are ahead of the pack

Pic: Matthias Kulka / The Image Bank via Getty Images

Remember the carbon tax?

Back in 2012 PM Julia Gillard got slammed for putting a price on carbon emissions, and the heat is on current PM Scott Morrison with the issue set to be a hot topic at the Glasgow Climate Conference later this month.

Many governments around the world have either introduced an Emissions Trading Scheme (ETS) or imposed carbon taxes – because carbon pricing is one of the most effective ways of reducing greenhouse gas emission levels on the domestic and international level.

With ETS, governments set the quantity of emissions permitted and let the market find the market-clearing price.

For carbon taxes, governments impose a tax on emissions and then let the market find the market-clearing quantity of emissions.

According to CRU Group research analysts Clifton Hoong and Frank Eich, ETSs come out on top.

“When comparing their respective contributions in addressing greenhouse gas (GHG) emissions, ETS does come out top, covering 16.1% of global GHG emissions, almost three times the 5.5% that carbon taxes cover,” they said.

The UK and Europe have adopted emissions trading schemes and even China – the world’s largest carbon emitter – launched a nationwide ETS in July after experimenting with regional ETSs.

And in Singapore, a new global carbon exchange, Climate Impact X, is expected to launch by the end of the year.

Carbon prices are set to rise

The analysts said that the sharp increase of the carbon price on the EU ETS over recent months gives an idea what might be in store in the years and decades ahead.

“In 2021, European carbon taxes averaged $42/tCO2, which is relatively cheaper compared with the $56/tCO2 average that has been traded in the EU ETS so far in 2021,” the analysts said.

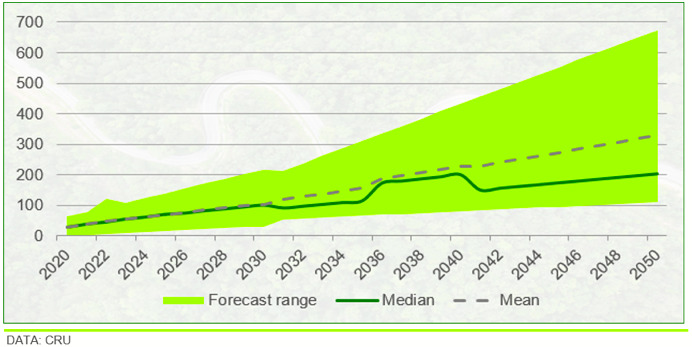

“We have conducted a survey of recent carbon price forecasts published by international organisations, governments, think tanks and corporates to get a sense of where carbon prices are headed.

“The range of forecasts is huge, but we should not be surprised to see a global carbon price of around $100/tCO2 by 2030 and around $300/tCO2 by 2050 if the world gets serious about climate change mitigation.”

And as carbon prices keep rising, commodity markets across the value chain will need to adapt.

“In some markets, carbon prices have been rising rapidly over the recent past and are forecast to do so for years to come,” Hoong and Eich said.

“The commodities markets across the value chain will need to prepare for and adapt to these new prices.”

EU and UK carbon market outlook

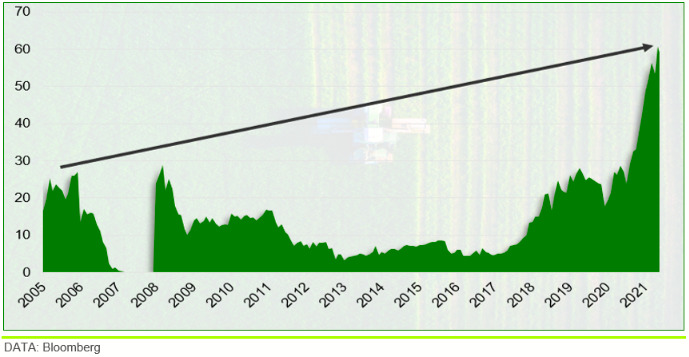

The EU was first to launch a major ETS in 2005 and by making carbon permits an increasingly scarce ‘good’, the EU is raising the market-clearing carbon price.

“These measures appear to be delivering,” CRU said.

“Having in the past frequently been criticised for being too low to make a difference, the EU ETS carbon price has increased sharply since the beginning of the year, reaching a new record €65/tCO2 (i.e., $75/tCO2) on 26 September.”

And word on the street is that the UK Government might have to step in and intervene in its national carbon market in December if crises remain elevated through November, given the current energy crisis causing the prices to average £58.36 per metric tonne in September.

“Even small increases in energy or fuel costs frequently lead to protests or even social unrest,” Hoong and Eich said.

“How to sell the necessity of increasing the price of energy to the electorate in the name of climate change mitigation when increasing prices are deeply unpopular and – often – also considered to be socially unfair?

“The latest spike in European natural gas prices is a reminder of that.

“Finding a way through this conundrum will be one of the biggest challenges for policymakers in the years ahead.

“As the recent outcome of the Swiss referendum on tougher climate change legislation forcefully demonstrates, we should be ready for major setbacks on the way to net zero over coming years.”

Commodities markets will have to adapt

“Major setbacks are not the same as abandoning the ambition and the commodities markets – just like all other sectors of the global economy – will need to prepare for and adapt to higher carbon prices,” the analyst said.

“The likely dramatic increase in carbon prices in the future will have fundamental implications for many parts of the economy, more so for businesses in the carbon-intensive industries.”

But not all players will be affected equally.

“For those industries where switching electricity to a low-carbon alternative is a solution (e.g., mine sites, aluminium production), the transition could be ‘relatively’ simple and at lower cost,” Hoong and Eich said.

“By contrast, changing the way how a key raw material is produced (e.g., hydrogen for ammonia) will likely prove more challenging and, almost certainly, more costly.

“Where a wholesale shift in technology is needed (e.g., hydrogen steel production), the transition will potentially be painful.

“Even operations that are already low carbon as a result of access to low-carbon electricity (e.g., hydro feeding aluminium smelters) will see cost inflation as supply contracts are renegotiated in the context of rapidly rising electricity prices.”

Businesses already decarbonising will benefit

The analysts said that often implementing decarbonisation plans means a significant upfront investment in electrifying energy inputs, integrating renewables and reducing the carbon footprint.

That cost is a barrier to transformation for many businesses – but inaction isn’t the way to go,” Hoong and Eich said.

“Implementing these decarbonisation plans often incurs substantial upfront investment cost, which can act as a barrier to transformation.

“Up to now this made the alternative route of action – doing nothing – attractive to many.

“But as the opportunity cost of doing nothing increases as carbon prices go up, this alternative route will become increasingly unattractive.

“Those who have already placed their bets on hefty investments to decarbonise their production operations are starting to reap the benefits as the cost of carbon continues its way up.

“We should expect others to follow suit.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.