Bitumen, helium and Geothermal Energy – Greenvale Energy gets its unique, potentially lucrative ducks in a row

Greenvale is pursuing projects covering bitumen, geothermal energy and helium. Pic: via Getty Images.

- Greenvale Energy’s flagship Alpha Torbanite project is unique play seeking to produce bitumen

- Also seeking to develop a geothermal project for green renewable 24/7 baseload power

- Recently acquired EP 145 project has extremely valuable helium, hydrogen, and natural gas

Special Report: While most juniors are pursuing critical minerals such as lithium or rare earths, Greenvale Energy is taking a distinctly unique tack with its three-pronged strategy into bitumen, geothermal energy and helium – all potentially lucrative in their own right.

At first glance, the three seem to have no relation to each other but the company has carefully curated its projects to ensure that they complement each other and take full advantage of the skillset and experience brought to play by its board and management.

Led by chief executive officer Mark Turner, who has over 25 years of experience in the energy sector and a proven track record of major project delivery in the oil & gas, water, power, renewables, and nuclear industries, Greenvale Energy’s (ASX:GRV) flagship is the unique Alpha Torbanite project in Queensland.

Torbanite is a type of oil shale that is distinguished by its high-grade hydrocarbon content – up to 698ltrs per tonne, allowing for the production of high-value bitumen binding products.

Alpha has an inferred resource of 28Mt – enough torbanite and cannelite to produce some 27.7 million barrels of synthetic oil equivalent when mined and processed.

Cannelite itself is a type of bituminous coal that is also classified as terrestrial type oil shale.

Bitumen – also known as heavy (or extra-heavy) crude oil – is the heaviest, thickest form of petroleum.

Whilst often overlooked in favour of regular (lighter) crude oil that is refined into petrol and other products, bitumen is a valuable industrial commodity in its own right.

Used primarily to seal roads, which makes them more durable and weatherproof – a valuable consideration in some parts of Australia – bitumen plays a key role in infrastructure development.

Yet almost all the +1Mt bitumen used annually in Australia is imported, including a significant percentage from China, meaning that establishing a local source would go a long way towards ensuring supply security of little known but still valuable product.

A mining and petroleum hybrid

Speaking to Stockhead, chief executive officer Mark Turner noted that the Alpha project is quite unique as it is neither a mining nor oil and gas play, but rather a hybrid of the two.

“It suits my experience as the biggest part of the project is the processing side, and that is very similar to oil and gas,” he said.

“Australia doesn’t really produce heavy crude oil anymore, there are only two refineries left in Australia, one in Geelong and one in Gladstone, and they are both light crude oil refineries.

“We are in the unique position that we have got the only commercial reserve of torbanite in Australia if not the world. There is torbanite elsewhere but not in the quantities that we have got.”

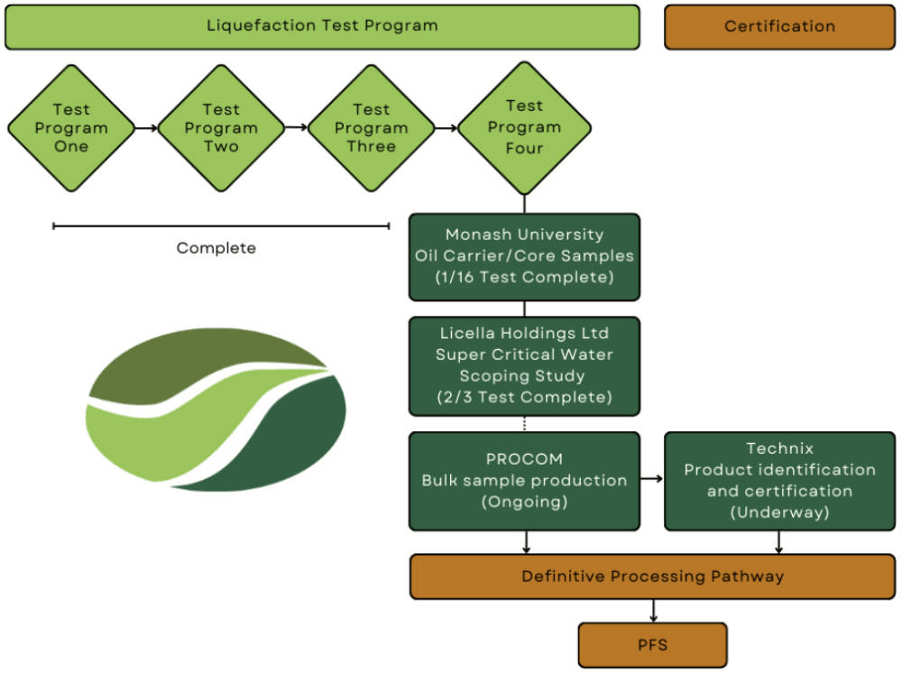

The shallow torbanite and cannelite from the project will be mined and processed using a liquefaction process, which involves feeding the material into a reactor, mixing it with a carrier oil and adding hydrogen as a pressure.

This is then heated up to about 400 degrees Celsius and when that’s finished, the carrier oil is separated, leaving the bitumen product.

“At this stage, are focus is to maximise the yield amount of heavies (heavy oils) as part of the liquefaction process, then identify what bitumen products we have got and any potential by-products as well,” Turner noted.

“We have just sent the first couple of bulk samples over to Technix in New Zealand and in the coming months they will be able to tell us exactly what we have.

“I would imagine it would take them about 3-4 weeks to analyse each of those samples, so I anticipate that we would have an indication around December.”

He adds that the process is likely to produce some light crude oil as well, which will give the opportunity for the Alpha plant to be self-powered.

Baseload renewable energy

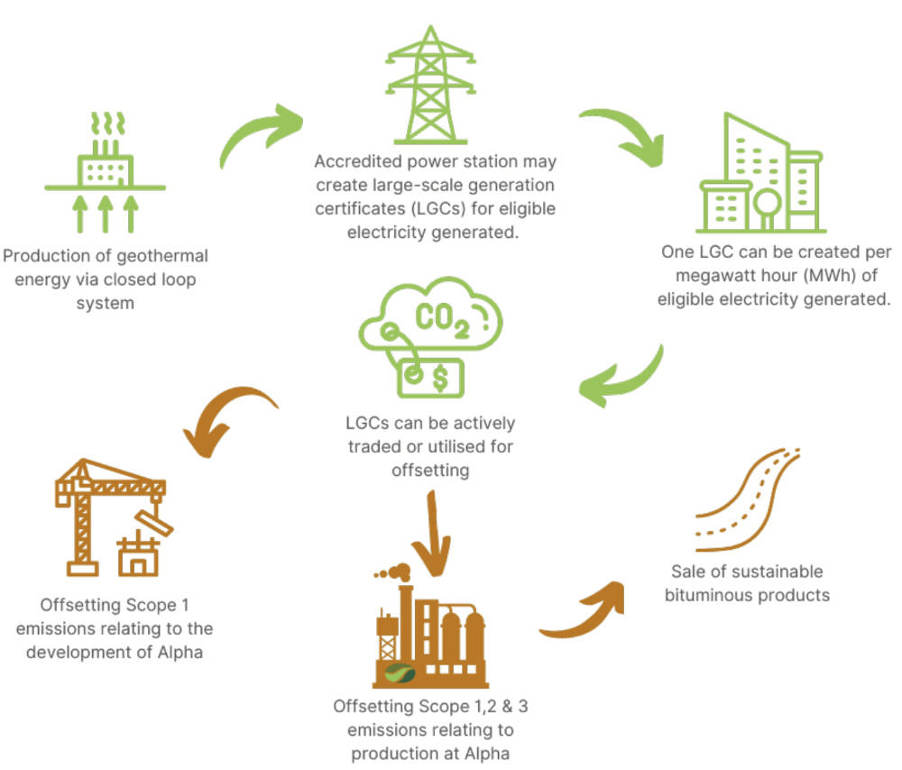

Besides the Alpha project, GRV has also partnered with geothermal energy technology provider CeraPhi Energy to pursue development of geothermal power generation in Queensland.

This seeks to use CeraPhi’s CeraPhiWell technology – a closed loop geothermal technology – to generate baseload renewable energy with no emissions.

Closed loop systems continuously circulate a working fluid down a well that has been drilled into the hot rock bed system, bringing up the hot fluid that goes into a heat exchanger then evaporates into a steam which then powers a steam turbine that generates electricity.

The working fluid remains within the system, meaning that no aquifer contamination will occur.

It contrasts with conventional open loop geothermal, where wells are drilled through the caprock at the surface to access the natural hot water reservoir, water then is continuously pumped from the aquifer to an aboveground heat exchanger and the water is then reinjected to the aquifer.

A variation of this – enhanced geothermal – requires the fracture stimulation of the target hot rock formation.

Previous testing has already proven that the CeraPhiWell technology can provide the requisite heat for powering a 4.95MWe plant, though the Longreach geothermal tenement chosen for that proved to have geothermal hot rocks that were too deep to be economic at small scale.

To address this, GRV has chosen to focus in the middle of Millungera basin, Queensland, which Turner said was chosen as a study carried out by the government across Australia to assess geothermal sites had found that the basin is potentially the most prospective.

“The reason for that is it is a hot rock bed system that has quite a shallow depth – about 2.5km,” he said.

“The location is also really good because the government’s $5bn Copperstring 2032 high voltage power transmission project (previously known as Copperstring 2.0) runs straight through our tenement in Julia Creek.

“We will have a grid connection there and there are a number of vanadium and other mines starting up, which will all require power as well.”

But besides providing 24/7 power, the planned geothermal project will receive carbon credits that can offset emissions from the Alpha project – making it carbon neutral – or be sold on the open market with Turner saying the company will probably do both.

Helium opportunity

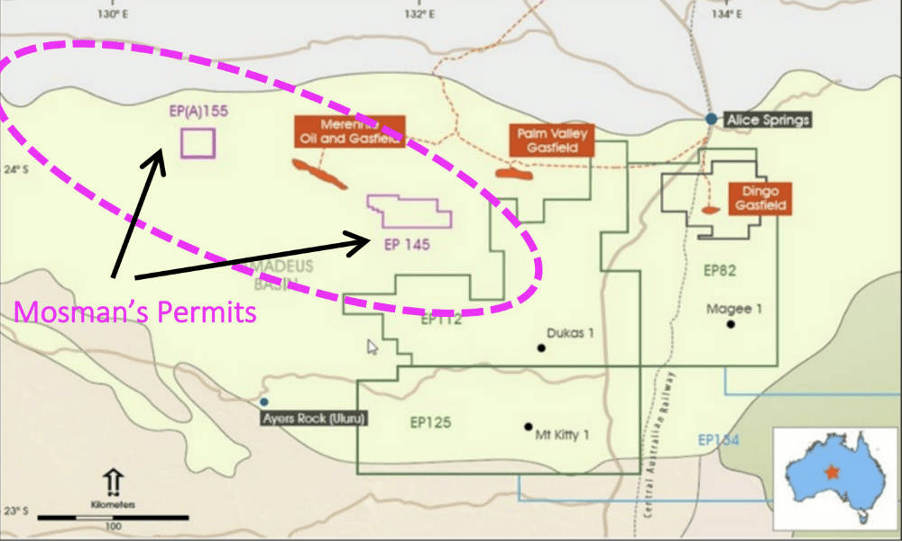

Greenvale’s final project is also its most recent acquisition, namely the EP 145 tenement in the Amadeus Basin, central Australia, that is prospective for helium, natural gas and natural hydrogen.

EP 145 sits within recognised play fairways for helium and hydrogen and contains proven hydrocarbon discoveries.

It hosts an existing best estimate prospective resource of 440 billion cubic feet of natural gas, 26.4Bcf of helium and 26.4Bcf of hydrogen and is on trend with the producing Mereenie oil and gas field.

Helium is an extremely rare, high value gas that is used in semiconductor manufacturing, nuclear energy production, solar panels, optic fibre and the cooling of superconducting magnets in MRI scanning machines and more.

However, its rarity means that demand is far higher than supply and it is not unusual to see the gas priced up to 250 times more than natural gas of the same volume depending on its purity.

“We think the helium project EP 145 fits really well with the Alpha project. It sits in the oil and gas space, it is very complementary,” Turner said.

“We are going to do some 2D seismic. That will help us determine where the best drilling location is.

“Once we finish this, which will be mid-next year, then we will move into the approvals, and then commence drilling as soon as they are granted.”

He adds that the existing infrastructure in the region makes it easy to get the natural gas into the east coast market, which is going into deficit.

“With the hydrogen play, Gladstone is looking to become the hydrogen hub. It is very early days, but by the time this project is up and running, you will anticipate that the hydrogen industry has advanced significantly,” Turner noted.

“You can separate the hydrogen out or you can transport hydrogen through the existing pipeline infrastructure.”

Experienced team

All the best projects in the world would flounder without the right management team and Greenvale certainly does not lose out in that aspect.

It is chaired by Neil Biddle, one of the founding directors of lithium powerhouse Pilbara Minerals, where he oversaw the acquisition of the Pilgangoora project and the subsequent exploration, discovery and development of a world class lithium and tantalite resource.

“He has a proven track record in finding and delivering great opportunities and projects like these,” Turner noted.

Turner himself has been in the oil and gas industry for over 20 years and 25 years in the broader energy industry.

His expertise encompasses all project phases and includes approvals, safety, engineering, procurement, contracts, scope, scheduling, cost, quality, risk, reporting, construction and commissioning.

“I have been in Australia since 2005 and have worked in the industry the whole time I have been here. I also have international experience as well having worked in the Middle East, Asia and Europe,” he added.

The remaining non-executive director Elias Khouri has extensive experience in the equity markets with expertise in corporate finance, advisory, capital raisings, joint venture and farm-in negotiations.

This article was developed in collaboration with Greenvale Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.