Big Game Hunting in Zimbabwe 2.0

Pic: Vertigo3d / E+ via Getty Images

Special Report: When looking for elephants in elephant country, there is no better position to be in than the one Invictus has found itself in – with a project that has already been substantially de-risked and a now supportive Zimbabwe government.

And there’s a fair bit going for the company. Its flagship Cabora Bassa gas-condensate project in Zimbabwe was first explored by Mobil in the 1980s and early 1990s.

“They saw potential there quite clearly, but at that time there wasn’t a gas market. Since the Mobil exit however, South African conglomerate Sasol have built one of the biggest gas to liquids (GTL) plants in the world – and their gas supply from the Pande-Temane onshore gas field is projected to commence decline 2023,” Invictus (ASX:IVZ) chairman Dr Stuart Lake told Stockhead.

Mobil’s decision back then to surrender the permit has certainly been Invictus’ gain, with the Australian junior benefiting from the $30m spent in today’s money by the major on 2D seismic, gravity and aeromagnetic data.

Lake, who has a string of 272 discoveries from 300 wells during his 34-year career, said that while recent discoveries in Kenya and Uganda were in younger rocks, older Permian-Triassic aged basins – about 200 million to 300 million years ago – like those targeted at Cabora Bassa have also hosted successful hydrocarbon systems.

“These older aged rocks have worked in Ethiopia where more than 5 trillion cubic feet of gas has so far been discovered, in Madagascar where several fields with billions of barrels of oil in place have so far been discovered, and recently in the Perth Basin, Australia,” he said.

“Mobil exited the area in 1993 due to the perceived gas risk and no gas market. We have already demonstrated that there is now a massive market for gas as evidenced by Invictus signing an MOU with Sable Chemical Limited in May 2019. There are also other domestic and regional markets that need urgent resources.

“Two source rocks were known, with the Triassic largely a source for gas and light liquids, however the new independent geochemical analysis completed by Geomark Research in the US for Invictus confirms that the other source rock –the Permian aged Mkanga Formation — has oil potential and has been now been typed to nearby oil seeps in the neighbouring Mid Zambezi basin.

“Thus, we now believe the Invictus acreage has both significant oil and gas potential given both source rocks are present and is not just a gas condensate play.

“Our 3D modelling of the region has also confirmed that there is a recent post structure hydrocarbon charge event over the last 20 million years that further de-risks the potential of the acreage.

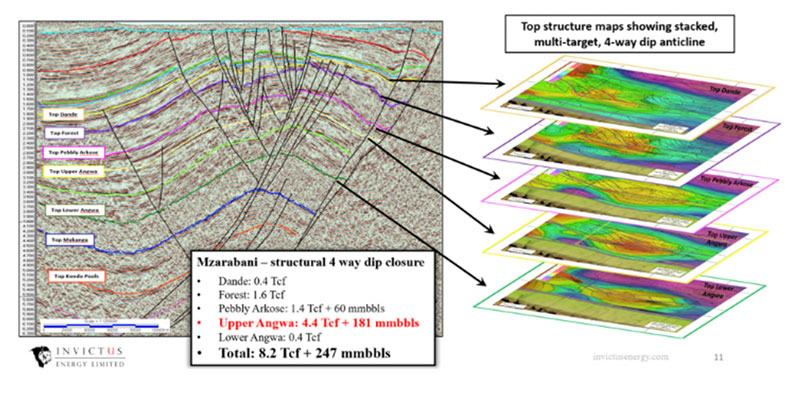

“Additionally, we have stacked objectives, some with AVO (amplitude versus offset) anomalies that are an encouraging pre-drill indictor of possible hydrocarbons off the newly reprocessed Mobil seismic data, and at least five reservoir levels.

“Thus, if one level doesn’t work you have other levels to drill and assess in the same well bore. Multiple stacked objectives and AVO support further reduce the pre-drill risk.”

Lake is also emphatic about how supportive the current Zimbabwe government is for foreign investment in the country.

“There have obviously been a lot of challenges over the last 20 years but the new government is very much pro-business and basically offers 100 per cent foreign ownership of the assets, an investor rights guarantee and special economic zone status, so we have legal and fiscal stability,” he said.

“We have a quality board, a CEO – Scott Macmillan – whose family has been in Zimbabwe since 1897, so he knows how the country ticks, and our complementary skills within Invictus will be very beneficial to the company going forward.”

A little comparison

So just how far can Invictus go in the event of a success?

One-time Australian junior Hardman Resources could be a possible analogue.

The company started exploring in Mauritania back in the 1980s before turning its attention to the deep waters off the country’s coast, which were very much a frontier exploration area at that time.

Hardman’s shares were trading at about 5.5c at the time when it brought in Woodside Petroleum (ASX:WPL) as partner for the offshore Mauritania project.

The partners’ belief in this area was validated by the discovery of the Chinguetti oil field, which was brought into production in 2006.

Hardman were also early movers into the Albertine Graben in onshore Uganda. Hardman were exploring in an area that had also been passed over by the majors years earlier where it was perceived as having limited potential.

Hardman carried out a very focused exploration program and brought in Tullow Oil as a farm in partner which lead them to drill the first oil discovery in Uganda, Mputa-1.

The success in Uganda led swiftly to Tullow Oil making a $1.47 billion, or $2.02 per share, takeover offer for Hardman later that year.

While there is no certainty that Invictus will make a discovery or necessarily follow in Hardman’s footsteps, it does provide a hint of what is possible.

The road ahead

With much of the early work de-risking the project already done by Mobil, the supportive government and the examples of companies like Hardman as an inspiration, Lake is confident that Invictus and Zimbabwe are poised to fly.

“What I like about Invictus is that it is a quality asset in a country where there has been no production yet has oil seeps. The country, the people, the assets both above and below ground are good, it just needs support from the private sector to help the country move forward,” Lake said.

“I have seen that work very well in Ghana where I have worked for 10 years and I believe we can do the same in Zimbabwe.”

He added that with Zimbabwe importing close to 40,000 barrels of oil per day and purchasing half of its electricity because of a lack of investment in generation capacity, any domestic production would be a game changer for the country and its neighbours.

There is also significant regional demand with South Africa expected to need 1.1 billion cubic feet of gas per day in the coming years, as much gas as Western Australia consumes on a daily basis.

Lake also noted that the available infrastructure, including black top tarmac roads from the country’s capital, Harare, to Zambia that pass near the project site, meant that exploration at Cabora Bassa would be low cost compared to other onshore African countries where infrastructure had to be built and particularly compared to offshore deepwater exploration – a current industry focus.

“Drilling an onshore well here will probably cost $10m or less while doing more seismic will cost between $4m and $5m,” he said.

Deepwater wells typically cost between $30m and $100m around Africa depending on water depth and pressures and can exceed $350m in the Gulf of Mexico.

Invictus is currently seeking to bring in a strategic farm-in partner to fund the forward work program and recover Invictus’ proportionate share of past costs.

“We think that a farm-in partner working jointly with Invictus on acquiring some seismic infill and drilling some wells could actually see this asset work very successfully,” Lake said.

Read more:

Invictus’ Cabora Bassa Project oozes oil and gas potential

This story was developed in collaboration with Invictus Energy, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.