Bain: Energy stocks with a renewables focus have been ‘more resilient’ than oil & gas companies

(Getty Images)

The disruption from COVID-19 has put the brakes on the shift towards renewables among some of the world’s largest energy companies, Bain consulting firm says.

Milan-based Bain partner Peter Parry says the sharp decline in traditional revenue sources – most notably the oil-price crash – has left a lot of companies suffering from an “existential crisis” in how they budget for energy products which are typically capital-intensive in nature.

“Most have had to slash operational costs by at least 25 per cent and reduce 2020 capital expenditures by as much as 30 per cent — cuts that make it extremely difficult to invest at a scale that can produce significant outcomes in carbon reduction at the pace needed,” he said.

However, responding to the crisis by narrowing their focus back on existing fossil fuel projects would be a “strategic misstep”, Parry said.

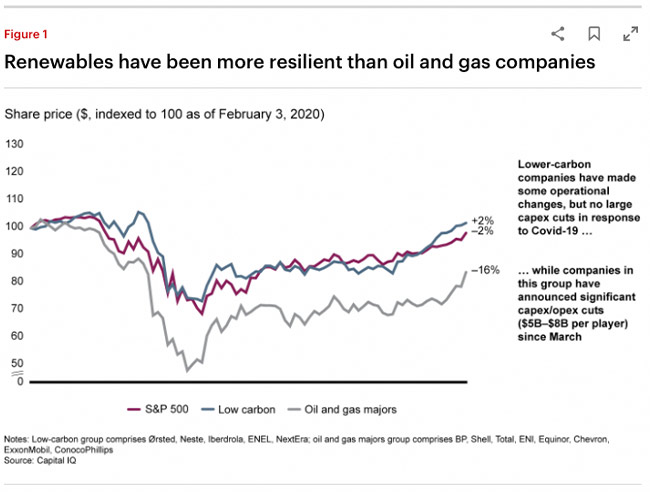

For evidence, he pointed to the post COVID-19 investment performance of oil & gas centric energy companies on the S&P 500, compared to competitors that have more resources allocated renewable projects.

“Even as the world’s attention has focused on the coronavirus pandemic, investors have kept their attention on longer-term viability,” Parry said.

In addition, while many companies are focused on reducing risk, the cost of doing so may be more damaging than an enterprising approach to opportunity amid the crisis.

Using the 2008 financial crisis as a comparison, Parry cited Bain’s analysis of more than 3,800 companies which showed those that took decisive investment action during the downturn outperformed companies that stayed put over the following decade.

Pro-active approach

Given that “standing still is not an option”, Parry said companies should focus on more renewables projects based on their capacity to deliver “greater effects in less time”.

That may divert resources away from multi-year projects such as large-scale hydrogen infrastructure, energy storage and biomass production facilities.

Instead, near-term opportunities may be more apparent in carbon capture and recycling operations for plastics and lubricants.

Global greenhouse gas emissions reduced by around 17 per cent when major economies were in lockdown in April.

However, between 2014 and 2018 the eight biggest energy companies in the world only reduced their collective emissions by an average of 5.6 per cent, Parry said.

In that context, companies should take advantage of the disruption to focus on achievable short-term targets over 12-month, two-year and five-year timeframes, rather than broader concepts such as the net-zero emissions target in 2050.

“Sector leaders who retool now for a more sustainable future will position themselves more competitively, for both funding and project approvals, ahead of those who hesitate or try to recreate the conditions that existed previously — and these are key elements in generating investment returns,” Parry said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.