Australian Carbon Credit Units doubled in price last year… and there are no signs of slowing down

Pic: Getty

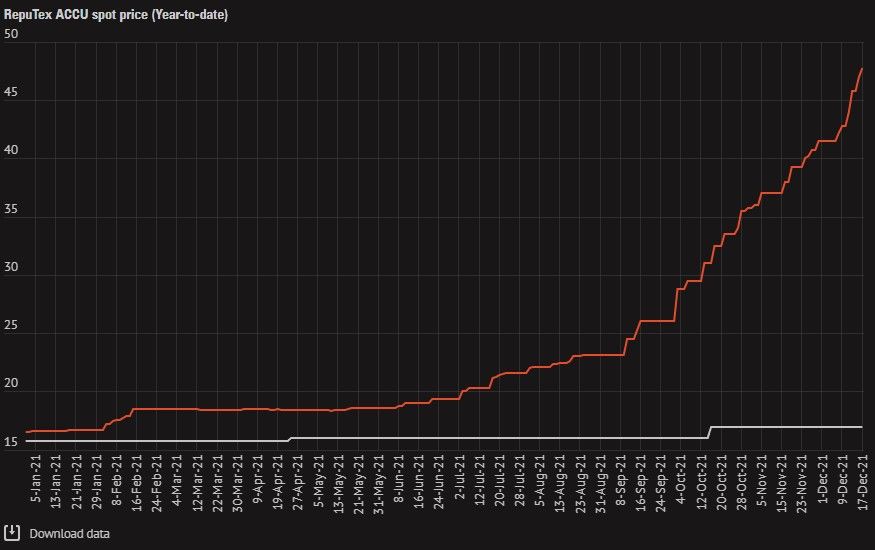

It’s been a hell of a bull run for the Aussie carbon market over the past year, as prices for Australian Carbon Credit Units (ACCUs) surged 209% from ~$15/t at the start of 2021 to ~$49 at the end of December, more than doubling in value.

The market isn’t showing any signs of slowing down this year with prices climbing even further, sitting at a comfortable $54/t at the time of writing.

This Australian carbon boom has been even bigger than the 146% rise in the lucrative European carbon market, where prices – backed by government policy – have reached up to €90 ($142) before dipping back to €80 ($126).

Unlike Europe, Australia’s biggest polluters are not obliged to reduce their emissions under current regulations or in step with the national ‘net zero emissions by 2050 plan’.

The price hike has largely been driven by a growth in demand from voluntary corporate buyers looking to strengthen their ESG credentials to attract the growing number of ethical investors in the market.

High prices anticipated throughout 2022

Because Australia is an export intensive economy, buyers downstream across markets like Southeast Asia – who themselves have net zero emission targets – are also increasingly putting pressure on companies to deliver on things like carbon neutral cargos, which is currently impacting LNG shipments.

“In effect large corporates under a bit of stakeholder pressure from investors and downstream consumers are setting net zero emission targets and as part of that they are beginning to procure offsets to meet those voluntary commitments,” Reputex Energy executive director Hugh Grossman said.

“When corporates do that, they have the flexibility to use international or Australian credits – so what we are seeing now is a lot of companies are beginning to stockpile ACCUS and contract for ACCUS over a forward delivery timetable.

“That increase in forward contracting has basically led to a bit of a supply squeeze in the spot market.”

A ‘super cycle’ is now highly likely for carbon as a standalone commodity class, Grossman explains, meaning demand will structurally outpace supply for the foreseeable future.

“As that occurs a sustained period of high prices is anticipated throughout 2022,” he said.

This move by Australian corporates to “lock up forward supply” is a solid strategy from a regulatory risk perspective, Grossman says.

“Obviously corporates are wary that prices are increasing quite quickly, and they are also conscious that they will most likely need ACCUS at some point over the next decade, because the reality is that the regulatory environment is going to get tighter rather than looser,” he said.

“We are probably at the point of the weakest regulation that Australian companies will face today and the screw will only get tightened in that context, so companies are saying ‘let’s go to market and buy our ACCUS now’.”

Inflated prices for voluntary buyers

The tight supply of credits is due to the large volume of ACCUs contracted to the Commonwealth’s Emissions Reduction Fund, where most of these credits are kept from private buyers under ‘fixed delivery’ contracts with the Clean Energy Regulator.

This has resulted in an inflated price for voluntary buyers faced with a smaller pool of available ACCUs, created through emission reduction projects like vegetation management, agriculture, energy consumption, transport, waste, and coal and gas production.

In October 2021, the Morrison government expanded the program, allowing carbon capture storage (CCS) and carbon capture use and storage projects (CCUS) to be eligible to generate carbon credit units under the Emission Reduction Fund, which uses taxpayer funds to award the credits.

The move ran into immediate flack and criticism from experts including Tim Buckley, director of energy finance studies at the Institute for Energy Economics & Financial Analysis (IEEFA) due to more subsidies being provided to fossil fuel companies.

“This is completely untenable and an entirely false use of taxpayer funds for the private gain of fossil fuel firms,” he said.

“Any pretence the government is looking to level the playing field or promote new technology is ridiculous.

“It is all about providing more taxpayer subsidies for CCUS, a technology that has been widely deployed at the cost of billions per project for the last three to four decades and almost every one of these projects have been clear failures.”

Back in November, Santos (ASX:STO) and Beach Energy decided to go ahead with its controversial $220 million Moomba carbon capture and storage project in South Australia following the rule change under the Emission Reduction Fund.

But while this new methodology has been implemented, at this point no ACCUs have been created using this process.

Potential to unlock supply

Grossman suggests the Clean Energy Regulator could allow project developers to break their carbon offset contracts with the federal government, enabling them to unlock supply initially promised to the Commonwealth and instead re-direct it to private sector buyers.

“This is likely to avert the need for project owners to trigger non-delivery clauses under their fixed delivery contracts, maintaining the integrity of the ERF contracting scheme while enabling the Regulator to better control the availability of new supply,” he said.

“While this may provide some relief to the current heatwave, optionality is not likely to materially impact prices, with short-term demand to continue to outpace supply.”

Another reason why the ACCUs market has shot up is, in part, due to the fact that polluters can choose to voluntarily offset their emissions instead of cutting them directly.

But when there’s a carbon offset price at ~$50 a unit, at some point it becomes more economical to invest in reducing emissions at your own operations rather than purchasing a carbon offset.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.