An oil price ‘Armageddon’ could hit in January – and these ASX small caps are braced for impact

Pic: Thana Prasongsin / Moment via Getty Images

Oil is not the average ASX investor’s first pick for a lively small cap investment, but a change in shipping fuel in 2016 may be about to create an investment opportunity.

The International Maritime Organisation (IMO) stipulated in 2016 that on January 1, 2020, all ships must use fuel with dramatically lower levels of sulphur.

In other words, the entire global maritime industry will need fuel made from a type of oil known as ‘light sweet crude’ to be compliant.

The US shale oil boom has been flooding the world with light sweet crude, but the imminent changes in global shipping fuel have analysts speculating that a price surge is coming in the early 2020s.

And that could be interesting news for the ASX’s handful of light sweet crude explorers and producers, says investor Chris Robertson of Arthur Austin Advisory.

“A lot of investors look at the headline oil prices West Texas Intermediate or WTI and Brent. But the oil market is made up of many different components and sometimes you need to look at the underlying supply and demand dynamics to identify investment ideas,” he said.

Get your sugar hit

Light sweet crude is a type of oil that contains small amounts of hydrogen sulfide and carbon dioxide. It’s the most sought after version of crude oil as it can be most easily turned into petrol, kerosene and high quality diesel.

It’s ‘light’ because it has low levels of sulphur, and ‘sweet’ because those low levels mean it has a pleasant smell and a mildly sweet taste.

The US is the largest producer. Nigeria comes in at number two and Norway in the North Sea is the third largest. The others in the top 10 are the UAE, Saudi Arabia, Kazakhstan, Algeria, Iran, Russia, and Qatar.

Of those countries, Australian companies operate mainly in the US which has been flooding the global markets with light sweet crude — thanks to its shale oil boom.

Stockhead found 19 that are currently trading on the ASX which have operations in the midwest and Gulf regions of the US — the areas where light sweet crude is found.

| Ticker | Name | Price May 7 ($) | 1 year % change | 6 month % change | Market Cap |

|---|---|---|---|---|---|

| ABL | ABILENE OIL AND GAS LTD | 0.004 | -33 | -20 | $1,590,457 |

| AOW | AMERICAN PATRIOT OIL & GAS L | 0.21 | -34 | -8.7 | $7,600,000 |

| ATS | AUSTRALIS OIL & GAS LTD | 0.3 | -25 | -24 | $305,400,736 |

| BRK | BROOKSIDE ENERGY LTD | 0.012 | 0 | -8 | $11,990,662 |

| BYE | BYRON ENERGY LTD | 0.305 | -21 | 20 | $205,135,152 |

| EEG | EMPIRE ENERGY GROUP LTD | 0.019 | -44 | 12 | $39,322,432 |

| E2E | EON NRG LTD | 0.006 | -32 | 13 | $4,619,334 |

| FDM | FREEDOM OIL AND GAS LTD | 0.055 | -83 | -68 | $57,082,196 |

| FPL | FREMONT PETROLEUM CORP LTD | 0.009 | 13 | 29 | $14,322,738 |

| GGE | GRAND GULF ENERGY LTD | 0.005 | 25 | 25 | $3,837,494 |

| HE8 | HELIOS ENERGY LTD | 0.185 | 320 | 23 | $261,567,296 |

| MAY | MELBANA ENERGY LTD | 0.015 | 36 | -6 | $24,381,576 |

| ODY | ODYSSEY ENERGY LTD | 0.043 | -28 | -16 | $14,083,810 |

| OEL | OTTO ENERGY LTD | 0.054 | -13 | 12 | $132,865,096 |

| PSA | PETSEC ENERGY LTD | 0.066 | -29 | -49 | $26,306,802 |

| SUR | SUN RESOURCES NL | 0.002 | -50 | -33 | $1,724,615 |

| SEA | SUNDANCE ENERGY AUSTRALIA LT | 0.39 | -38 | -52 | $281,859,552 |

| TMK | TAMASKA OIL & GAS LTD | 0.001 | -67 | -50 | $1,960,000 |

| WEL | WINCHESTER ENERGY LTD | 0.026 | -24 | 8 | $10,776,305 |

The ‘Armageddon’ scenario

Shipping uses about 5 per cent of global oil for fuel, according to the US Energy Information Administration (EIA), and come next year must switch from cheap, heavy crudes to fuel that has less than 0.5 per cent sulphur.

MIT economist Philip Verleger speculated in a paper last year the shipping industry’s unpreparedness could lead to $US200 oil and “an economic crash of horrible proportions in 2020… [for] want of low-sulfur diesel fuel”. He called it the “Armageddon” scenario.

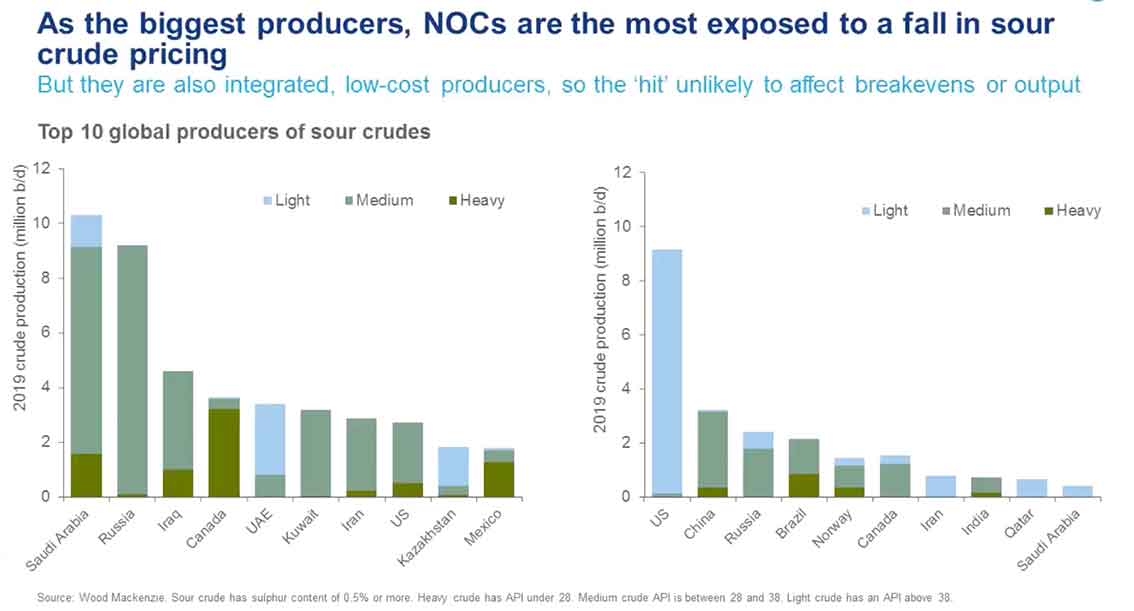

The main issue, he says, is that the bottom will fall out of the market for high-sulphur oil, much of which is produced in the Middle East and Persian Gulf, causing further refinery closures around the world.

Verleger says half of the world’s oil refineries can’t turn high sulphur oil into low sulphur oil, and to meet maritime demand the world needs to produce 100m barrels of oil a day. Currently total production is just over that figure, according to the EIA.

Relax, the asteroid is going to miss

But local analysts aren’t so sure the consequences are going to be nearly as drastic.

Wood Mackenzie research director Sushant Gupta said during a webinar on the topic yesterday they expect more than 2000 ‘scrubbers’ to be fitted to ships — equipment that scrubs the sulphur from fuel.

Furthermore they expect about 15 per cent noncompliance with the IMO rule.

Wood Mackenzie upstream oil research Angus Rodger says there is likely to be a short-term oil price shock in 2020 as demand for heavier crudes drops away, before recovering.

He pointed out that the biggest heavy crude producers are also the lowest cost and already have sophisticated refinery networks to turn their heavy oil into lights.

In response to questions from Stockhead, Rodger said it would be difficult to predict what impact the IMO ruling would have on US oil prices.

“It is very hard to quantify the exact impact on US crude prices, in part due to transportation bottlenecks – particularly around Permian tight [shale] oil — that have their own impact on US crude realisations. It’s not a simple exercise to calculate the possible upside given the other domestic factors affecting the price and volumes in that market,” he wrote.

Furthermore, there is the US shale oil boom to take into account which, although volumes are flattening, is sending over 12m barrels of oil a day into global markets, according to the EIA.

“US shale oil production is still increasing, but the rate of growth has risen and dipped depending on price signals and corporate budgets and strategies,” Rodger said.

“Putting it simply, the tight oil juggernaut cannot be stopped now, and the huge plans from companies like Chevron and ExxonMobil to raise output significantly from the Permian will only underpin the industrialisation of the play and its continued growth.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.