American Patriot ups its game as it works to become major oil producer

Special report: American Patriot Oil and Gas has increased oil production ten-fold to 300 barrels a day setting it up to become a leading US based producer.

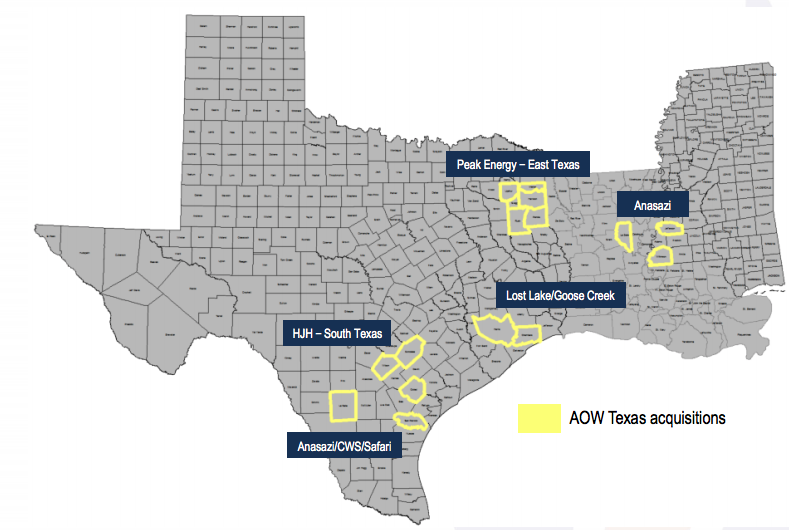

The boost comes as American Patriot (ASX:AOW) completes the acquisitions of Peak Energy and Magnolia & Burnett, resulting in an extra 270 net barrels of oil equivalent (boe) — gas and oil together – per day.

At current oil prices that delivers operating revenue of $US5m ($7.1m) and projected EBITDA earnings of $US3m in 2019.

The Peak Energy and Magnolia/Burnett petroleum acquisitions add total reserves of 1.908 million boe — bought for $US5.4m but with a present value 10 per cent (PV10) of $US15.683m.

“We are now well on the path to becoming a significant conventional production company in Texas with 300boe/d of production, and the potential to introduce a number of new acquisition targets to rapidly build scale and increase production,” CEO Alexis Clark said.

“Both Peak Energy and the Magnolia and Burnett Petroleum assets are conventional, long life oil and gas projects with infrastructure in place and significant proven behind pipe and infill drilling opportunities to grow the production significantly for low capex expenditure.”

The program includes work-overs and recompletions which will commence immediately after close of the transaction.

Fully fledged

A subsidiary of Vertua (NSX:VERA), a major shareholder of American Patriot, is providing extra funding to settle these transactions early and start work on the new assets. The company has also successfully raised an extra $7 million since July via a placement and a rights issue.

As a result of the settlement of these three assets, American Patriot is now a fully operational oil and gas producer with a production rate of approximately 300 boe/d, and 1.9 million barrels of 1P reserves, bringing total 1P reserves to 2.6 million barrels.

Oil and gas reserves are measured as 1P, 2P and 3P. ‘1P reserves’ are proven while 2P reserves and proven and probable.

Finalising Foothills

American Patriot is finalising the settlement of the Foothills asset, having signed a $US17m debt term sheet.

Due diligence is expected to be completed in the next few weeks.

The Foothills assets are expected to increase the production profile to 750 boe/d, which at current oil prices will deliver operating revenue of $US18m and EBITDA of $US13m in 2019.

Funding for the Foothills acquisition is a combination of debt and equity. To date AOW has paid a deposit of $US900,000.

“We are set to close the remaining asset, Foothills Resources Inc, in the coming weeks, deciding to split the transactions in order to finalise the bonding and regulatory requirements on each asset,” Mr Clark said.

“The Foothills assets will set the scene for the transformation of AOW into a significant oil and gas production company with a growing reserve base.”

American Patriot Oil and Gas is a Stockhead advertiser.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.