A helium boom is fast approaching … and there aren’t many stocks to choose from

Pic: Matthias Kulka / The Image Bank via Getty Images

Special Report: The world’s largest helium producer will shut up shop in 2021 – but global shortages of this vital gas are already upon us.

It’s not the party balloons we should be worried about, either.

Helium is used in space exploration, rocketry, high level science, in the medical industry for MRI machines, fibre optics, electronics, telecommunications, superconductivity, underwater breathing, welding, and nuclear power stations.

And for a lot of these applications, helium is irreplaceable.

Edison Investment Research writes that helium prices were arguably kept artificially low by BLM which gave buyers a consistent supply for the past 10 years.

This, and the fact helium is traded on confidential long-term private contracts which keeps pricing opaque, has reduced incentives for helium exploration.

But times are rapidly changing.

“In our view, helium will likely be subject to steady, price inelastic demand growth,” Edison writes.

Price inelastic means that buyers will keep buying even as prices rise.

New supply is largely a by-product of planned oil and gas mega projects, but these are often delayed. This, growing demand, and rising prices creates opportunity for smaller explorers.

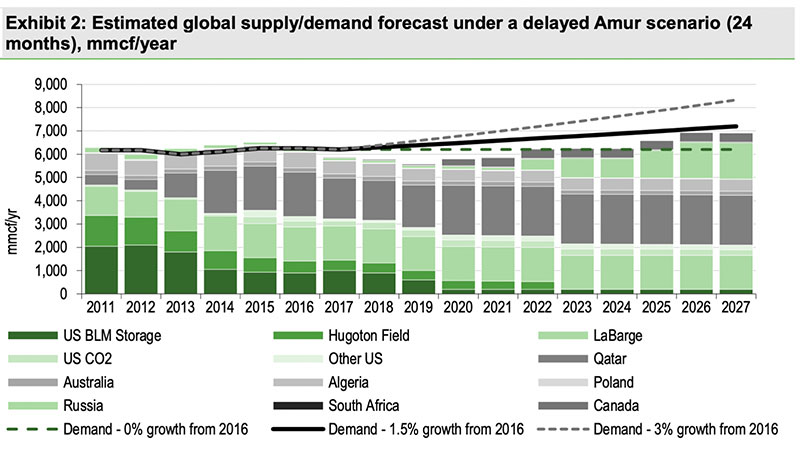

“If readers were to assume a 3 per cent demand growth, deficits would grow even if Amur and Qatar [gas projects] came online as currently expected, while any delays would leave the deficit at around 1bcf/yr by 2027,” Edison writes.

Gianni Kovacevic, executive chairman at Canadian company CopperBank is far more bullish.

In a June interview, Kovacevic called helium the new “boom commodity”.

“Right now, for a truckload of helium, you are paying $US900,000 to a $US1million,” he says.

“Going forward, this is a boom commodity growing by about 7 per cent CAGR growth rate every year – where’s this helium going to come from?”

How can investors get exposure?

Right now, there are limited options for helium exposure on the ASX.

Big Star Energy (ASX:BNL) is one explorer offering investors direct access to the world’s largest helium market in the US.

Big Star is accelerating its new helium gas exploration initiative at the exciting “Enterprise” prospect, and has initiated a leasing program over 5000 gross acres.

The first leases from this package are expected to be signed imminently, the company says.

Geochemical and geophysical programs are already underway, targeting helium anomalies at surface for upcoming in-field activity.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

This story was developed in collaboration with Big Star Energy, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.