Director Trades: Which coal producer just saw a director sell down more than $40 million worth of stock?

Pic: Getty Images

- Coal producer Stanmore Resources has seen non-executive director Matt Latimore sell down more than $40 million worth of stock

- Online marketplace for local services Airtasker directors are bullish on the stock with some large buys as part of a private placement

- Cloud-based accounting software provider non-executive director Clive Rabie has made a series of selldowns in the past fortnight

Director trades are often considered a good indicator of a company’s future prospects. Our fortnightly Director Trades column informs you who is buying in and who is selling down.

Often referred to as insider buying or selling, directors are legally permitted to buy and sell shares of the company and any subsidiaries. However, these transactions must be properly registered and divulged.

Insider buying or selling is not to be confused with insider trading, which is buying shares based on non-public information, a big no-no and illegal.

We troll through the ASX company announcements looking at director trades of interest over the past fortnight. It’s usually the big ones that stand out or those coinciding with company news.

Directors may get shares as part of employee incentive schemes, share purchase plans, rights issues, participate in dividend reinvestment plans or purchase on-market. It’s the on-market trades we think are worth noting, where directors directly or indirectly through entities they are associated either put up cash or cash in a stake.

When a director buys shares on-market, it can signify confidence the share price will rise in the future and if multiple directors are buying, especially at larger amounts, that is even more of an indication. Of course, it’s not a sure win that the share price will rise, so it’s always worth further research on a company.

Directors will often buy company shares after a sharp price decrease. Directors may think the stock has been oversold and represents good value, sometimes they want to show confidence in their company’s prospects, other times they’ve just got another good reason to buy or sell a stock which will be divulged, like paying the good ol’ taxman.

Fortnight Overview

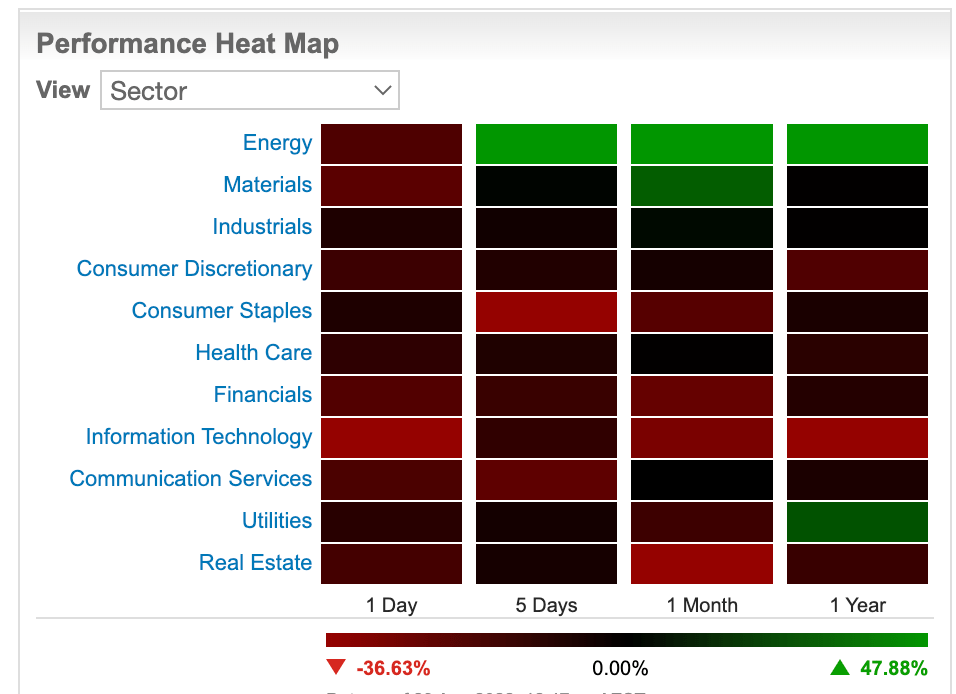

The ASX trend of volatility has continued in the past fortnight in a year which has seen economic uncertainty, rising inflation and interest rate hikes. The S&P/ASX 200 (ASX:XJO) index finished last week ever so marginally up. However, on Monday it was a sea of red with all sectors down and the S&P/ASX 200 closing more than 2% lower.

The local bourse followed Wall Street’s lead which ended Friday much weaker after US Federal Reserve chair Jerome Powell’s speech from Jackson Hole sent all three major US Indices – the Dow Jones Industrial Average, S&P 500 and the Nasdaq index – plunging.

Powell dashed Wall Street’s hopes that the Fed may ease up on high interest rates in its effort to tame inflation. The US’s annual rate of inflation in July was at 8.5% and only just starting to slip from its 40-year high of 9.1% set in June.

It’s been a marathon fortnight of director trades on the ASX. There has been some large director buys and after a while where there’s been no sells they are starting to come back with particularly hefty sale in a coal producer.

Recent large director buys

| Code | Company | Director | Direct or Indirect | Date | Volume | $ | Nature of change |

|---|---|---|---|---|---|---|---|

| APE | Eagers Automotive | Nicholas George Politis | Direct & Indirect | Aug 15,16,17 | 30,000 | $400,884.00 | On-market |

| EGG | Enero Group Limited | Ann Caroline Sherry AO | Indirect | Aug 15&16 | 31,250 | $101,318.08 | On-market |

| SCP | Shopping Centres Australasia Property Group | Michael Graeme Herring | Direct | Aug-19 | 70,000 | $199,352.46 | On-market |

| IMD | Imdex Limited | Sally-Anne Layman | Indirect | Aug-16 | 60,000 | $117,600 | On-market |

| IAG | Insurance Australia Group Limited | Simon Allen | Indirect | Aug-15 | 30,000 | $135,976.50 | On-market |

| ART | Airtasker Limited | Xiaofan (fred) Ba | Direct & Indirect | Aug-19 | 4,651,163 | $2,000,000.09 | Private placement |

| ART | Airtasker Limited | James Roland Travers Spenceley | Indirect | Aug-19 | 116,500 | $50,095 | Private placement |

| ART | Airtasker Limited | Peter Hammond | Indirect | Aug-19 | 3,488,372 | $1,499,999.96 | Private placement |

| BPT | Beach Energy | Robert Jan Jagger | Direct | Aug-19 | 70,000 | $119,000 | On-market |

| QBE | QBE Insurance Group | Yasmin Allen | Indirect | Aug-17 | 18,333 | $220,322.33 | On-market |

| ABP | Abacus Property Group | Steven Sewell | Indirect | Aug-23 | 65,104 | $179,813.63 | On-market |

| RMY | RMA Global | David Williams | Indirect | Aug-25 | 2,300,000 | $333,500 | On-market |

| BRG | Breville Group | Sally Herman | Direct & Indirect | Aug-24 | 5,000 | $104,516.35 | On-market |

| TPG | TPG Telecom | Robert Dobson Millner | Direct & Indirect | Aug 24-25 | 100,000 | $560,999.99 | On-market |

| NSR | National Storage REIT - stapled entity comprising shares in National Storage Holdings Limited and units in National Storage Property Trust | Scott Anthony Smith | Direct | Aug-24 | 100,000 fully paid ordinary stapled securities | $243,491.90 | On-market |

| SCG | Scentre Group | Catherine Michelle Brenner | Indirect | Aug-26 | 100,000 | $290,000.00 | On-market |

| NIB | NIB Holdings | David Gordon | Indirect | Aug-23 | 20,000 | $158,600.00 | On-market |

| NIB | NIB Holdings | Peter Harmer | Direct | Aug-23 | 8,200 | $65,846.00 | On-market |

| TRS | The Reject Shop | Steven Brian Fisher | Indirect | Aug-26 | 35,000 | $155,750 | On-market |

| SPZ | Smart Parking | Christopher Morris | Indirect | Aug-26 | 593,647 | $132,036.95 | On-market |

At online marketplace for local services Airtasker (ASX:ART), directors have shown they are bullish on the stock. Independent non-executive chairperson James Spenceley purchased ~1.5 million worth of stock while non-executive director Xiafan (Fred) Bai purchased $2 million with non-executive director Peter Hammond also buying ~$50k via private placement.

The company recently released strong quarterly results showing its growth. Q4 FY22 Gross Marketplace Volume (GMV) increased to $54.4m (up 38.3% on pcp). Q4 revenue increased to $9m (up 30.6% on pcp). In the US marketplace, demand was up 49% QoQ driven by SEO, organic social and PR-driven customer acquisition.

TPG Telecom (ASX:TPG) non-executive director Robert Dobson Millner bought more than $560k worth of stock in the company. The internet and mobile service provider recently announced it had missed earnings estimates in the half ended June 30.

The Reject Shop (ASX:TRS) non-executive chairman Steven Fisher has also shown he’s bullish on the company, which Datt Group managing director Emanuel Ajay reckons could be a good inflationary hedge. The TRS share price has fallen more than 40% year-to-date.

Recent large director sells

| Code | Company | Director | Direct or Indirect | Date | Volume | $ | Nature of change |

|---|---|---|---|---|---|---|---|

| RKN | Reckon Limited | Clive Rabie | Direct & Indirect | Aug 18,19,22, 23 | 390,606 | $486,801.68 | On-Market |

| SMR | Stanmore Resources | Matthew Latimore | Indirect | Aug-17 | 18,000,000 | $40,500,000 | On-Market |

Director sales have returned having been quiet during August, with the last time we reported sales being back in July. While there still hasn’t been a lot of sales in the past fortnight, there has been some large ones.

Coal producer Stanmore Resources (ASX:SMR) non-executive director Matt Latimore sold down more than $40 million worth of stock. Latimore is also founder and president of M Resources, which is involved in investment, marketing and trading of metallurgical coal, predominantly for steel making. Latimore still owns ~44 million shares in SMR indirectly.

The price of coal has hit record highs since Russia’s invasion of Ukraine with Stanmore a large supplier to international markets. The company’s share price has risen more than 230% in the past year to $2.33.

Cloud-based accounting software provider Reckon (ASX:RKN) non-executive director Clive Rabie has made a series of selldowns in the company during the past fortnight.

Reckon recently reported strong half year results including bottom line normalised Net Profit After Tax (NPAT) of $6m, up 5% on the previous corresponding period (pcp). Annual recurring revenues (ARR) of $36m marked a 5% increase on the pcp and the fully franked interim dividend was 3c per share.

The Reckon share price is up more than 31% year-to-date to $1.22.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.