Yessss, SEC approves Bitcoin ETF… no, wait it didn’t… ‘Jesus Christ, Gary – you had one job’

Live dramatisation of the cryptoverse right now. (Pic via Getty Images)

Bitcoin and crypto holders are currently flummoxed/sceptical after an apparent official tweet from the SEC appeared to confirm the approval of spot Bitcoin ETFs in the US, only to be told it was fake news.

Our headline says it all, really. Jeez… only in crypto?

Here was the tweet, now deleted by the US Securities and Exchange Commission (via crypto commentator/YouTuber Lark Davis)…

— Beav53 (@Beav53) January 9, 2024

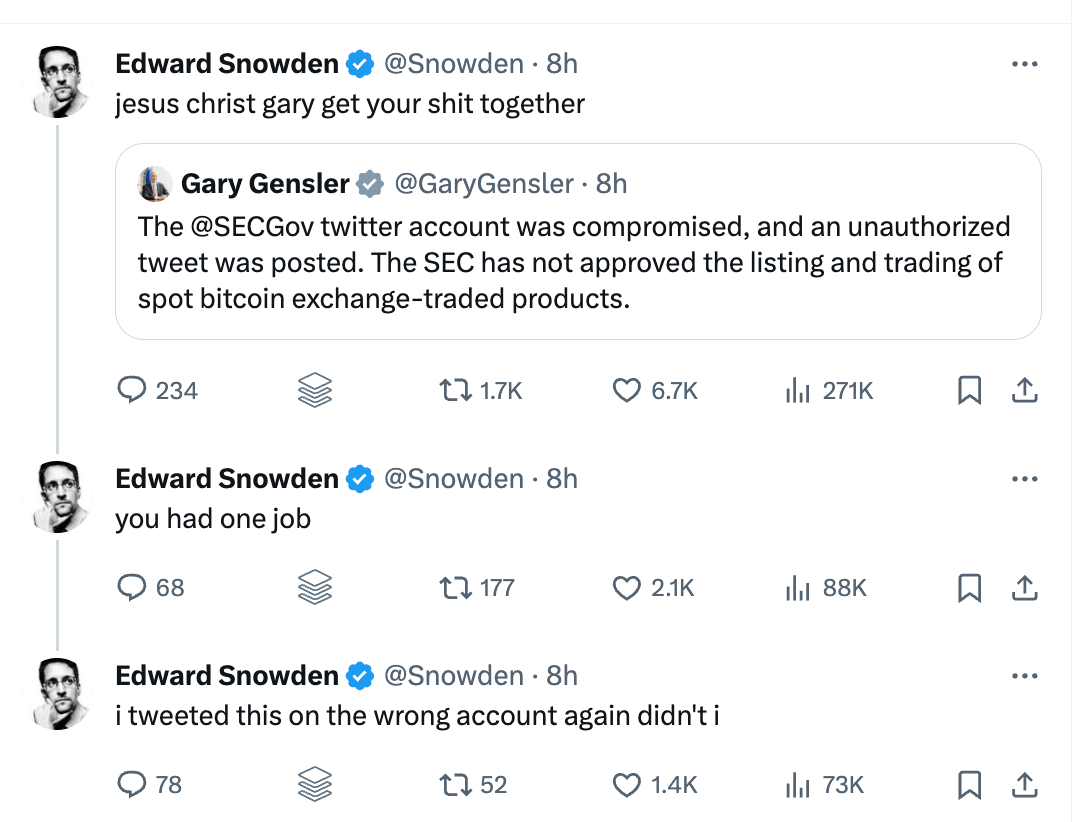

And here is SEC chair Gary “Fun Police Commissioner” Gensler’s last response on the matter…

The @SECGov twitter account was compromised, and an unauthorized tweet was posted. The SEC has not approved the listing and trading of spot bitcoin exchange-traded products.

— Gary Gensler (@GaryGensler) January 9, 2024

Yeeeeahhh… the crypto community and others meanwhile aren’t convinced…

It would great if the @SECGov would stop manipulating the Bitcoin market.

— Cameron Winklevoss (@cameron) January 9, 2024

SEC was able to recover their "compromised' account in 15 minutes. Impressive. pic.twitter.com/YNI6u56g4w

— Bob Loukas 🗽 (@BobLoukas) January 9, 2024

And how’s this one from famed US whistleblower and naturalised Russian citizen Edward Snowden…

Unfortunately the news was quickly spread far and wide this morning by various news mainstream and crypto-specific outlets, including Reuters, Cointelegraph and Blockworks, with Reuters releasing its report before Gensler’s statement.

Meanwhile the cryptoverse seems amazed/sceptical that the SEC was able to gain control of its supposed compromised X account so quickly – with another SEC tweet and Gensler’s tweet coming within about 15 minutes after.

The US regulator has yet to provide any details about how exactly its social account was compromised.

Spot Bitcoin ETFs in the US have been widely expected to receive reluctant approval from the SEC this week, with the final deadline for a decision set for January 10 in the US.

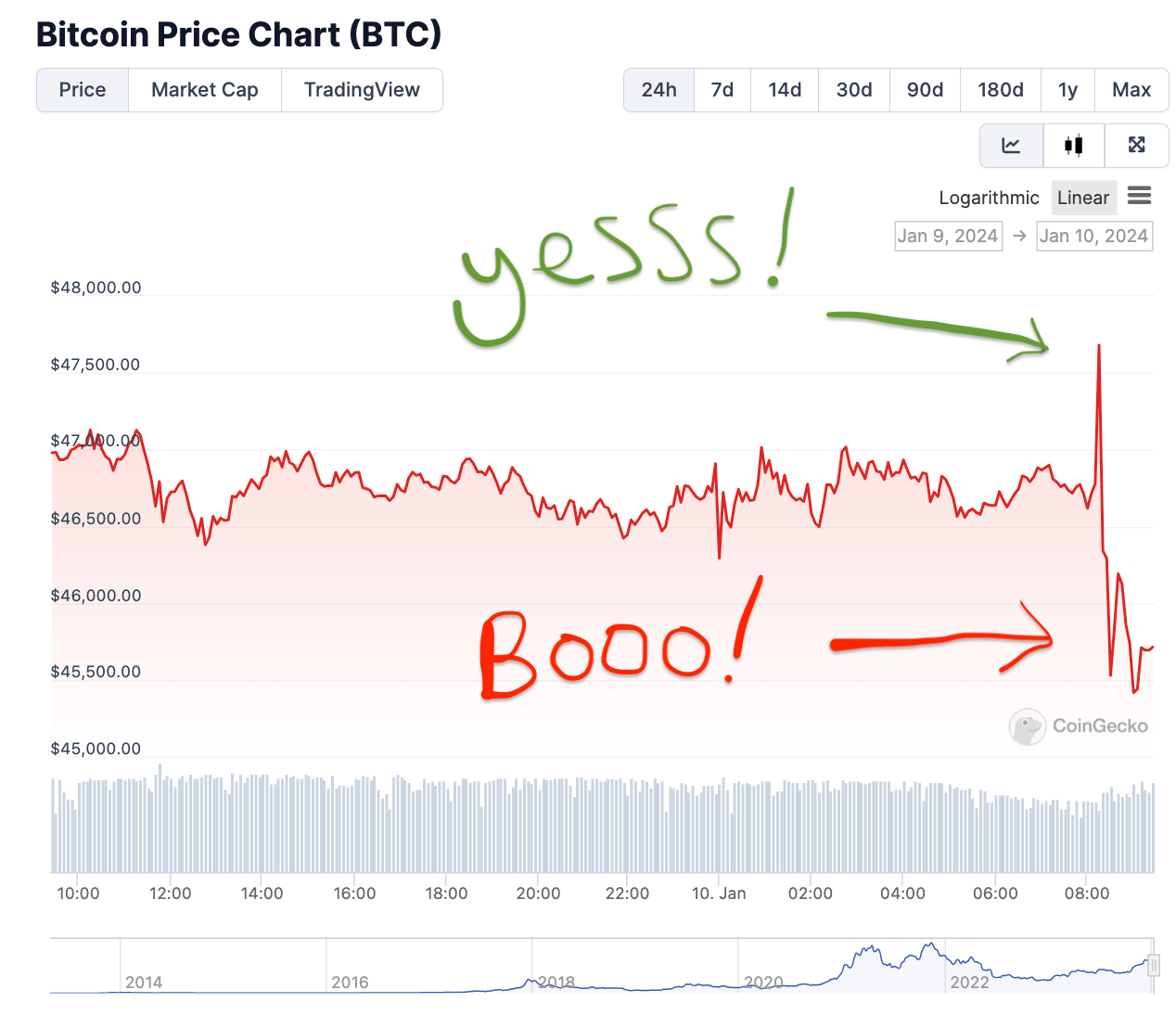

Currently, the price of Bitcoin seems more volatile than an arvo of shirtless boozing and pill popping at Summernats.

This morning, BTC spiked as high as US$47,700 on the fake news, before tanking to about US$45,400 – roughly from where it’s looking to stage a recovery as we type.

Ah well, at least it allows investment titans to quickly grab a few more BTC at slashed prices, eh?

https://twitter.com/WhaleWire/status/1744835572772839504

Read more about the impending (possible) spot Bitcoin ETFs, including BlackRock’s involvement, here.

Meanwhile, a couple of takes from Bloomberg’s ETF analyst Eric Balchunas:

Damn, it's totally taken over our homepage. It's a national emergency! pic.twitter.com/AYC6PoKOR7

— Eric Balchunas (@EricBalchunas) January 9, 2024

On TV right on talking about this.. and yes, I think someone prepped a planned tweet and put wrong date, bc the tweet would have made PERFECT sense tomorrow at this time. The language sounds legit SEC-ish IMO vs a crypto knucklehead pulling a prank but I guess we'll see.. https://t.co/lP6Nghi6fq

— Eric Balchunas (@EricBalchunas) January 9, 2024

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.