Wen moon? Bitcoin gains for 7th straight day, reclaims 200-day EMA at $40k

Getty Images

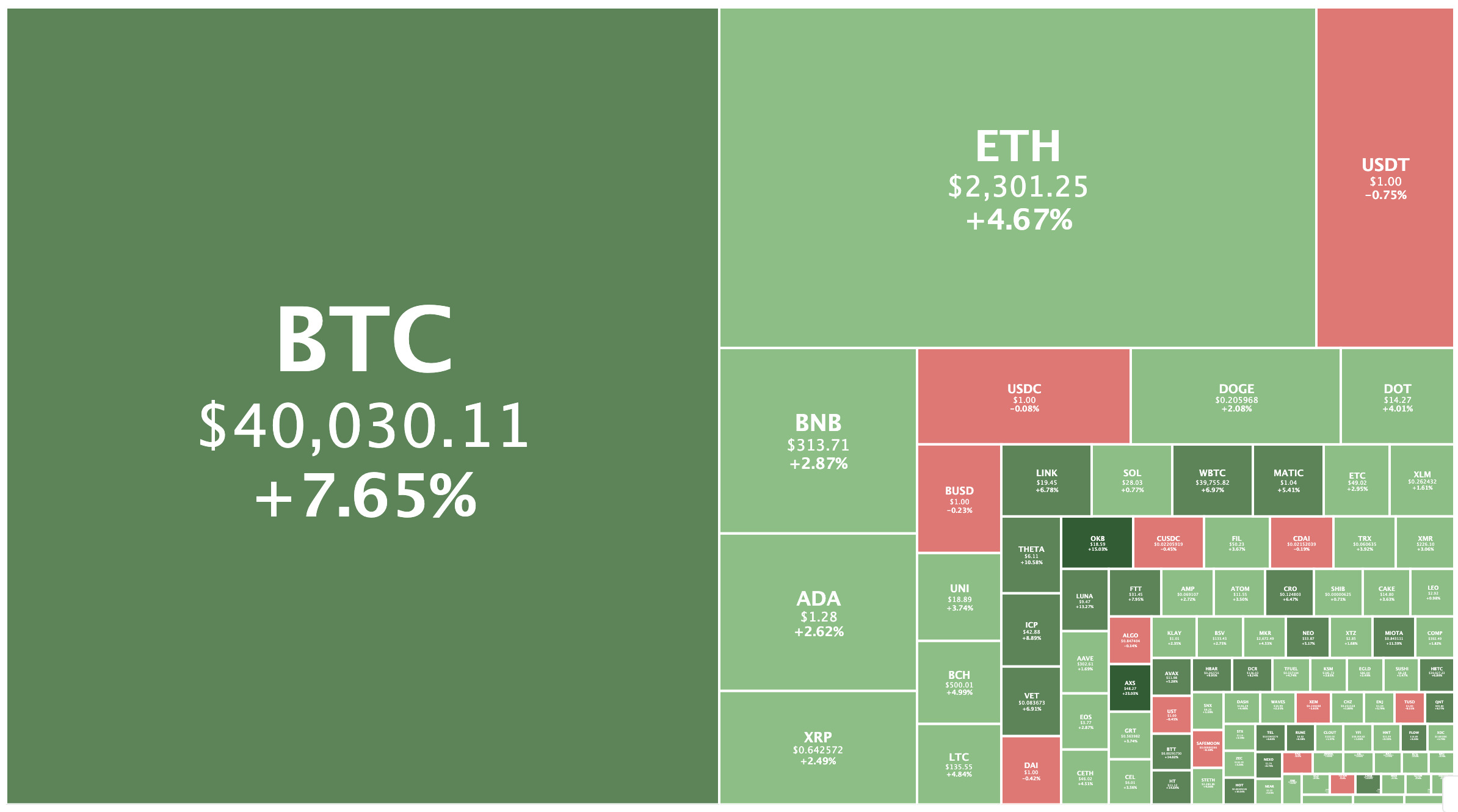

It’s beginning to look a lot like Bitcoin bull season, with the original cryptocurrency trading above US$40,000 just two days after reaching US$35,000.

At 3.41pm AEST, Bitcoin was trading at US$40,067, up 8.1 per cent from yesterday and its highest level since mid-June following seven straight days of gains.

FOURTY THOUSAND UNITED STATES DOLLARS FOR ONE BITCOIN

— K A L E O (@CryptoKaleo) July 28, 2021

“It’s great to see Bitcoin doing things that it hasn’t done in months,” wrote crypto market analyst Bitcoin Charts. “The golden cross on the 4H chart AND the close above the 200D EMA [exponential moving average]. Huge. What needs to happen now is Bitcoin needs to confirm it as support to move up, and that’s where things may get a bit messy.”

Still, if Bitcoin could break US$42,000 with volume, Bitcoin Charts wrote he’d be looking for BTC to shoot straight to US$50,000.

Wellington, New Zealand-based crypto influencer Lark Davis said in a video that he expected a lot more buyers stepping up if Bitcoin could close above the 200-day simple (not exponential) moving average.

“That is only 11 per cent away from the current price action,” he said. “We need to see a candle basically closing around $45,000 to reclaim the 200-day moving average.

“When that happens — I’m not gonna say if — when that happens, it’s going to be a very bullish moment for the market,” he said. “That will signal for a lot of players that the bull market’s back on.”

The Crypto Fear and Greed index, which measures sentiment on a scale of 1-100, had swung from fearful “32” to a neutral 50 – by far its highest level since May 12.

There were still some unconvinced. Hex founder Richard Heart tweeted that he was expecting Bitcoin to crash to US$10,000 before heading back up to set new all-time high above $65,000.

“(My analysis remains identical. Nothing has changed. At all. Bull traps are in the game. JUST LIKE THE CHART SHOWS!!!” Heart wrote.

Overall the crypto market was up 5.9 per cent from yesterday, to US$1.6 trillion.

Ethereum was trading for US$2,300, up 4.1 per cent from yesterday.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.