Three Ts: The Big One, mean reversion plays, waiting for the king

It doesn't go back in the cone, buddy. Picture: Getty Images

Welcome to the Three Ts with CoinJar. Each fortnight we explore a big Theme, an interesting Trade and some good, old-fashioned Technical Analysis (courtesy of Tom from trading gurus FX Evolution).

The Big One

I have been reading, writing and tracking crypto for a long time. I have seen explosive booms, apocalyptic busts and multi-year periods where so little happened it seemed to violate the laws of physics.

With all that in mind, I’m placing last week’s LUNA-UST meltdown in the top 5 most consequential things to ever happen in crypto. At the beginning of the month, LUNA’s market cap was in excess of US$30 billion. Now it’s US$1 billion and even that’s probably overstating things. The Luna Foundation Guard (LFG), protectors of UST, who proudly bought US$3 billion in Bitcoin last month, now own less than US$10 million.

While the causes, effects and chains of responsibility in this unmitigated catastrophe have been well prosecuted elsewhere, our main concern is whether this could be the harbinger of The Big One – the long prophesied reckoning where 95% of all crypto projects go to zero.

Super ironic thing about alt-coin "investors" (term used lightly)

98% will become worthless

but,

98% of alt-coin traders believe their pet rock is among the 2% that have real worth

Some people are only fooling themselves pic.twitter.com/28xryz6qRy— Peter Brandt (@PeterLBrandt) May 12, 2022

Certainly the macro conditions are right. Speculative plays are being pummelled as interest rates ratchet up in the face of runaway inflation. Regulators, already circling crypto, will be emboldened by the destruction of US$45 billion of investor value. Hacks, scams and ransomware have polluted crypto’s image. At a certain point people are simply asking: are enough people actually using crypto to justify that trillion dollar economy? When will hype become reality?

A cautionary tale can be found in the 2000 Super Bowl, when dotcom startups splashed tens of millions on glossy adverts only to go bankrupt within the year. Crypto was all over Super Bowl 2022. Will history repeat?

I don't make the rules. pic.twitter.com/RgGcqKXuit

— Steven (@Dogetoshi) May 9, 2022

Make mine a mean

In the meantime, there’s space for some short-term optimism – if you still have any funds left to invest – because this downturn is officially breaking records. Bitcoin just closed its seventh straight week in the red, a phenomenon that has never occurred before. The LUNA crash also saw Bitcoin retest the weekly 200 EMA for only the third time in its history.

The only indicator that you REALLY need is the 200ema on the weekly chart.

Above it: we are still in a multi-year bullish trend with healthy corrections inbetween.

Below it: would you like some fries with you order? $BTC pic.twitter.com/mBNK3PREPx

— Teddy (@TeddyCleps) May 16, 2022

It’s a classic example of mean reversion (AKA you can only ignore gravity for so long) and it’s why patient investors reap the greatest rewards. However, with markets so dramatically overextended to the downside, another mean reversion seems likely – this time to revisit some of those lesser EMAs and resistance levels that we crashed through as if they weren’t even there.

While “the pain can’t go on forever” isn’t exactly an investment thesis to have you swinging from the rafters, at this stage in the market we have to take what we can get.

Think we get some relief rally in the coming weeks on these thin books, followed by everyone calling for a bottom / bull euphoria, and then eventually bleeding back down

If I buy anything, it’s to quickly sell it back.

Not interested in high conviction longs here yet

— Psycho (@AltcoinPsycho) May 15, 2022

A pause in hostilities

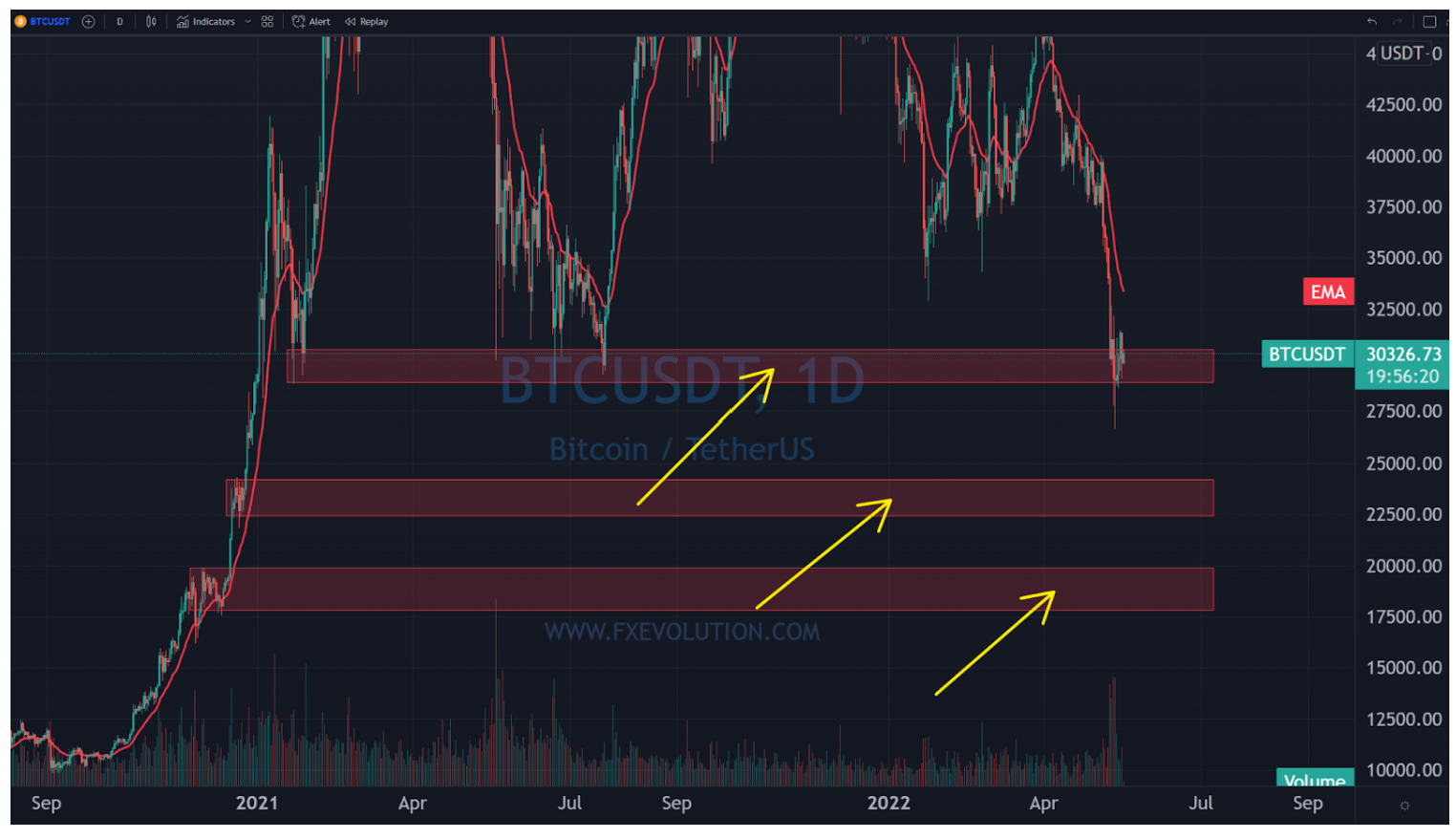

The markets have reached an uneasy peace after the violence we witnessed last week. Having ruptured a number of previous support zones in the face of the LFG’s Bitcoin fire sale, we’ve finally come to rest around the US$30k supply zone.

According to Tom from FX Evolution, we should hope it stays that way because there’s only two levels between there and US$19k – and those are thinly defended.

On the two-hour chart, we can see that the price is making a series of high lows. While it’s a positive movement for the moment, any proper relief rally is on hold until we can break through the US$32k supply zone with conviction.

Similarly to Bitcoin, Ethereum also finds itself at a long-standing support zone. Any upward momentum for ETH – and for the alt market more broadly – probably depends on Bitcoin rallying, so (for now) all eyes on the king.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.