The Three Ts: Green crypto, midterm mania, and don’t mess with Mr In-Between

Picture: Getty Images

Welcome to the Three Ts with CoinJar. Each fortnight we explore a big Theme, an interesting Trade and some good, old-fashioned Technical Analysis (courtesy of Carl Capolingua of Thinkmarkets Australia).

You can keep your carbon

Well, the Merge is done and dusted and we’re all still alive and here to talk about it, so that’s something.

While everything appears to be going swimmingly so far (apart from some off-putting tendencies towards centralisation), the big story has been the almost total elimination of the Ethereum network’s electricity usage.

"The merge will reduce worldwide electricity consumption by 0.2%" – @drakefjustin

— vitalik.eth (@VitalikButerin) September 15, 2022

While the significance of this drop has been much discussed elsewhere – it’s as if Chile just disappeared! – what it really does is sharpen the lines of division between Bitcoin and, well, everyone else. (And no, Bitcoin Cash and Litecoin don’t count.)

Proof-of-Work is a fundamental part of Bitcoin’s value proposition. It’s the purest expression of collaborative, competitive security imaginable. But with the majority of the non-Bitcoin crypto ecosystem now firmly ensconced on blockchains that require almost no energy to run, we can expect an increasing amount of scrutiny to fall on Proof-of-Work chains.

Early glimmers can already be seen in the White House’s recently mooted crypto mining standards. The EU came whisker close to banning Proof-of-Work back in March. China has obviously straight up banned mining.

While it’s unlikely that many places will follow China’s lead, the regulatory burden on Bitcoin miners is only going to increase. By the same token, it’s going to become harder and harder for companies and institutions to invest in or use Bitcoin when there’s a green crypto alternative on hand.

This is certainly a narrative that will take years to play out, but it could become one of the defining stories of the next crypto bull run.

Make mine a midterm

You may or may not be paying much attention to America’s midterm elections on November 8. However, there’s a strong argument that you should be 100% paying attention to what it might do to the markets.

#Bitcoin OBV says we go up, historic #Midterm data from 1931 says we go up, fear index is high, and max pain in liquidations would be if we go up.#CryptoTwitter says $10k, CNBC says crypto is dead.

Pick your team.

— IncomeSharks (@IncomeSharks) September 19, 2022

Essentially, every midterm election since 1930 has been preceded by a distinct low (usually in October) and then followed by a blistering stock market recovery. If you look at the results all the way back to the 1870 midterms, the effect is even more pronounced: on average returns were 15% better in the months after these elections than at any other time.

The prevailing theory is that markets hate uncertainty and elections, especially if the result is decisive, are awfully good at resolving the tension. By this point it may also be a self-fulfilling meme.

It’s been a dismal year for all markets and with the spectre of recession looming it’s hard to be hopeful. But markets are nothing if not emotionally driven and if the regular indices find a reason to rally, expect crypto to leave them in the dust.

Holding out for a hero

The news from Carl Capolingua’s corner isn’t exactly reassuring. Of the approximately top 130 cryptos by market cap, perhaps fewer than six were NOT in a coincident short- and long-term downtrend as measured by his dual-trend ribbon system.

That’s a pretty simple system, btw. Double greens are candidates for longs, double pinks are candidates for shorts. Don’t mess with Mr In-Between.

All is not lost, however. Here are his thoughts on the majors, three of which are still flickering:

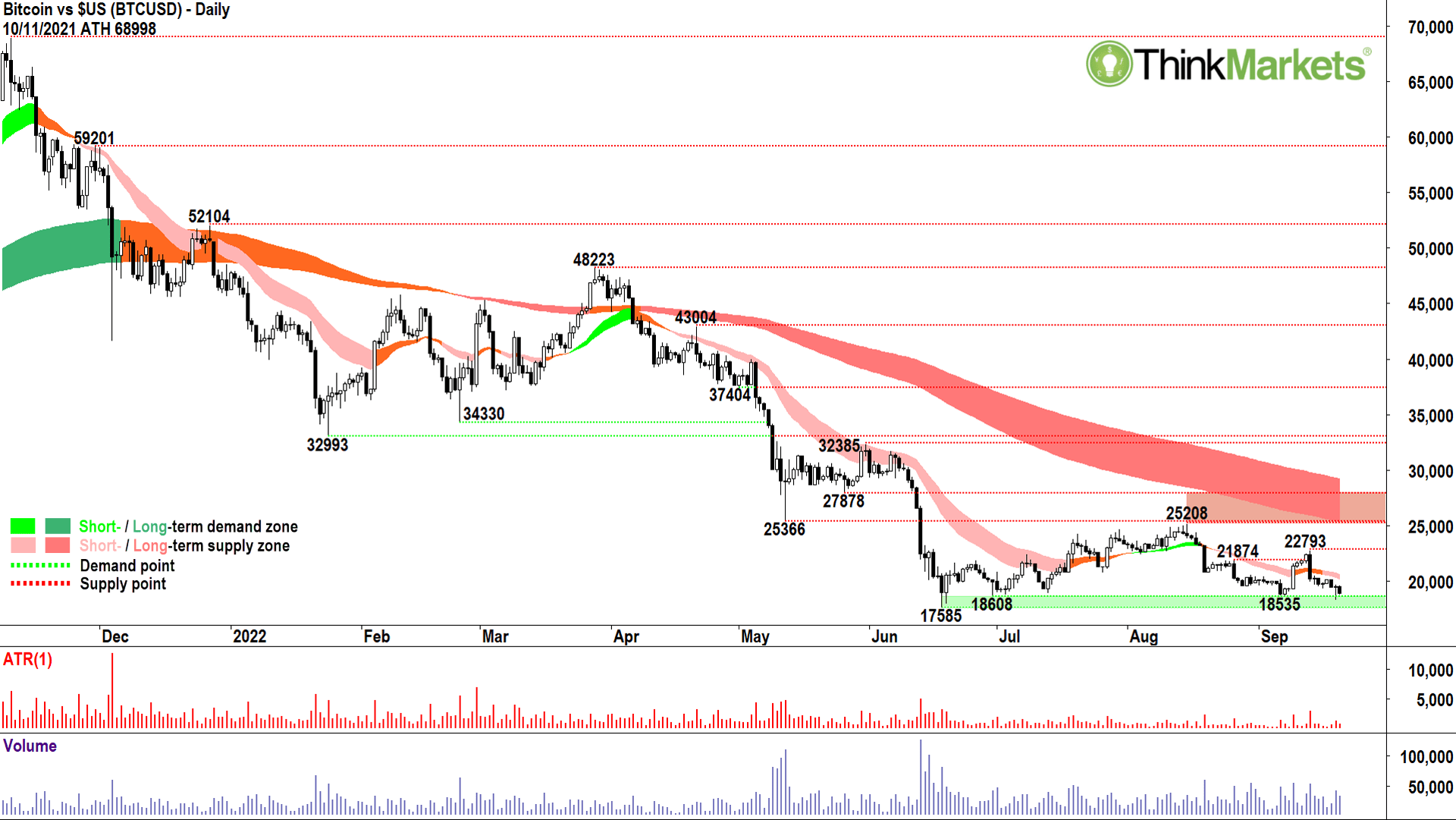

Bitcoin

Plenty of volatility since my last update, but zero traction in either direction. I do get the feeling, however, the more stuffing around Bitcoin does in the 17,585 (June low) to 25,366 (May low) range, the greater the magnitude of the break out of this range either way. Which way? There’s nothing in the trends, price action, or candles to indicate this, and therefore I reiterate my previous assertion: There is nothing to see here! Trend traders wait for a trend to establish itself. Everyone else just gets chopped up in the meantime.

Prefer to refrain from longs until a close above 25,366, vs no shorts until a close below 17,585.

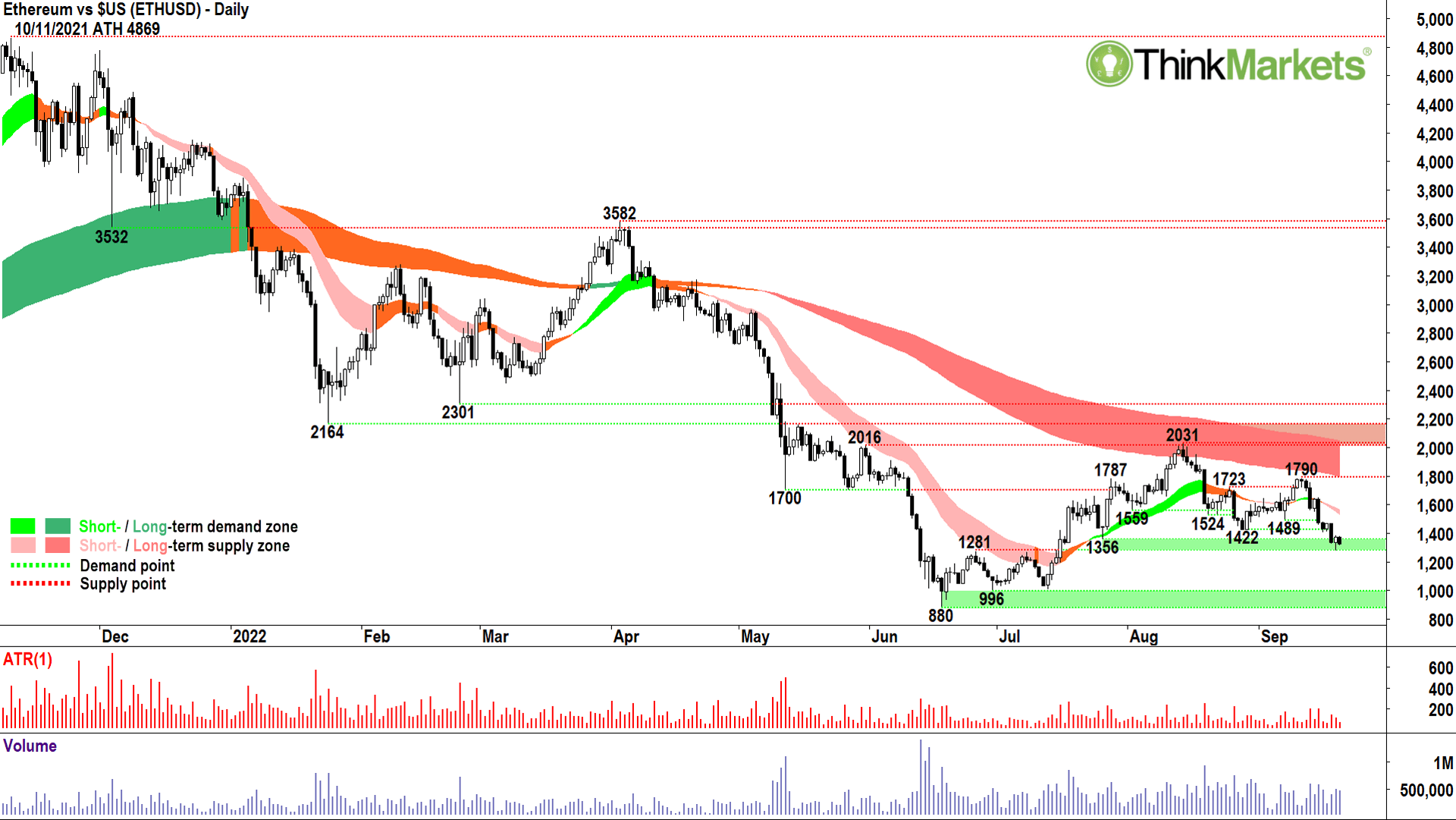

Ethereum

After some merge mania, rejoins Bitcoin in the doghouse. The long-term trend (dark-pink zone) never really looked challenged. The lower swing high at 1790 (vs 2031), plus a number of forceful supply-side candles from there, demonstrate resolute control from the supply-side. It also indicates a demand-side which is unable, or unwilling to get in their way. If 1281 goes, then we will likely see a vigorous and unsupported break lower to the 1000 handle thus re-establishing the short-term downtrend.

An upside scenario? Hmmm… a miracle occurs, 1281 somehow holds, and we might see the 1500 handle again… but it’s the next resistance point now.

The 3 bright sparks among the darkness of this crypto winter

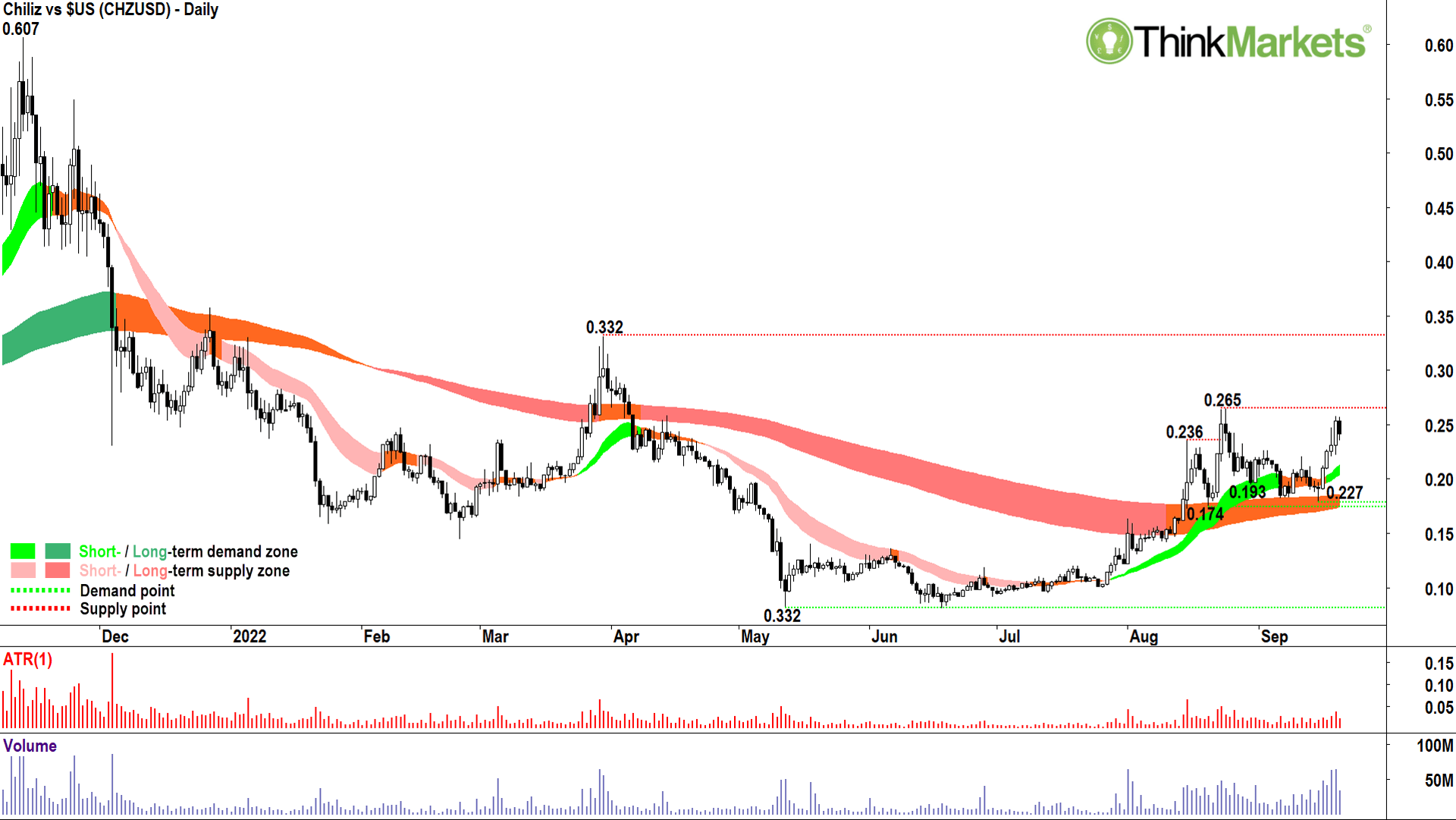

Chiliz (CHZ)

Keeps signing major sporting organisations to create their fan tokens. Plenty of new releases in the pipeline… and regardless of the state of the global economy (or the freezingness of crypto winterr) you still gotta support your team! This means buying some CHZ to exchange for an NFT of your favourite league footballer! The only crypto in my watch list which is not in a long-term downtrend, in fact, I would say a close above the August high of 0.265 will confirm the only long-term uptrend in the entire Top 130.

Solid short term trend and candles (a bit of a setback last candle, but mild compared to the broader universe). I remain a BUY on this one.

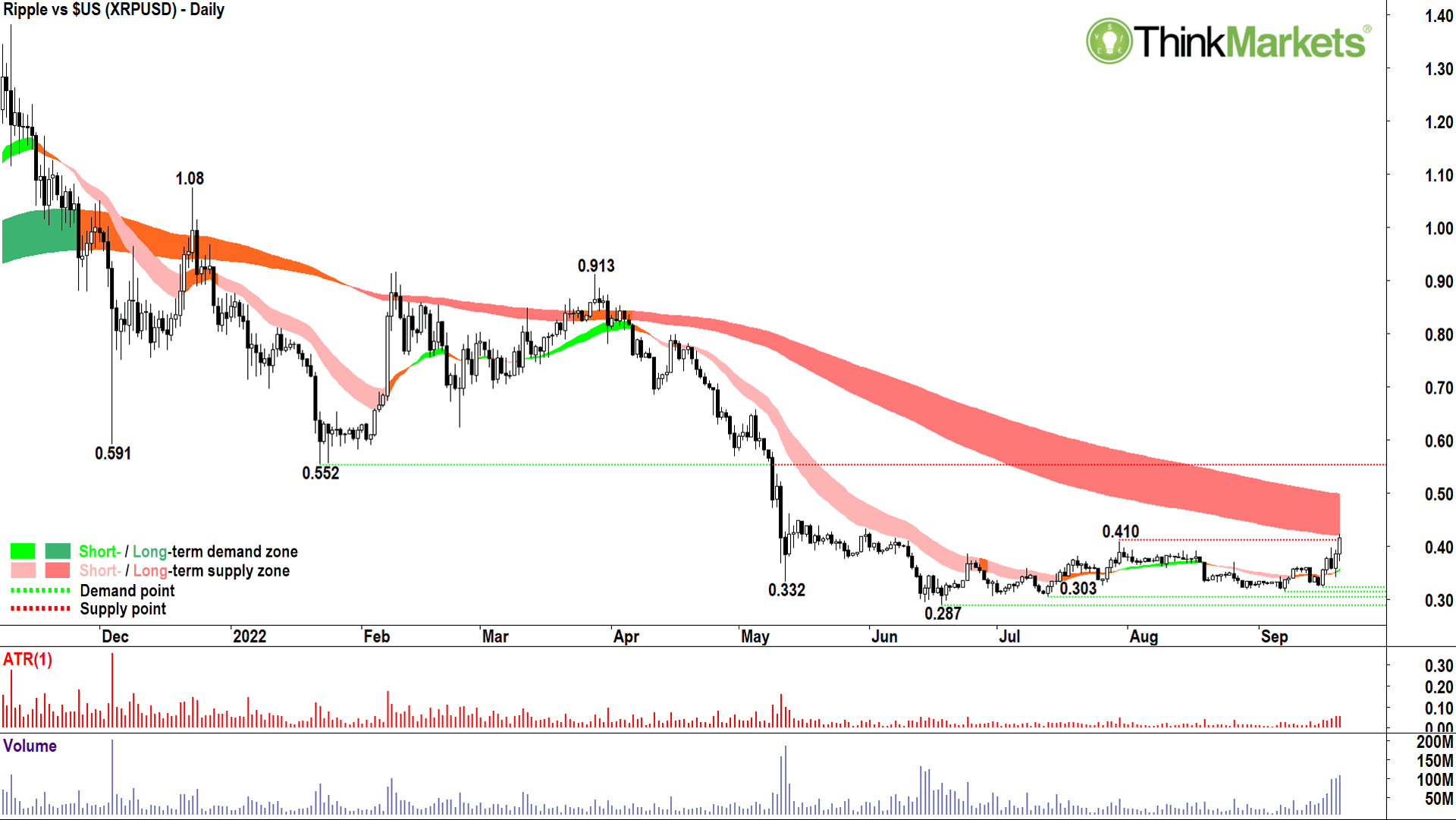

Ripple (XRP)

As old as the hills…good old Ripple. A pulse! This fledging short-term rally looks like it’s got some legs. The price action has swung back to higher peaks and higher troughs and the last 4 out of 5 candles are solid demand-side shows. The 20 Sep close above the key resistance level of 0.41 is a clincher for calling this a (very) speculative BUY. A swing to 0.552 is a possibility.

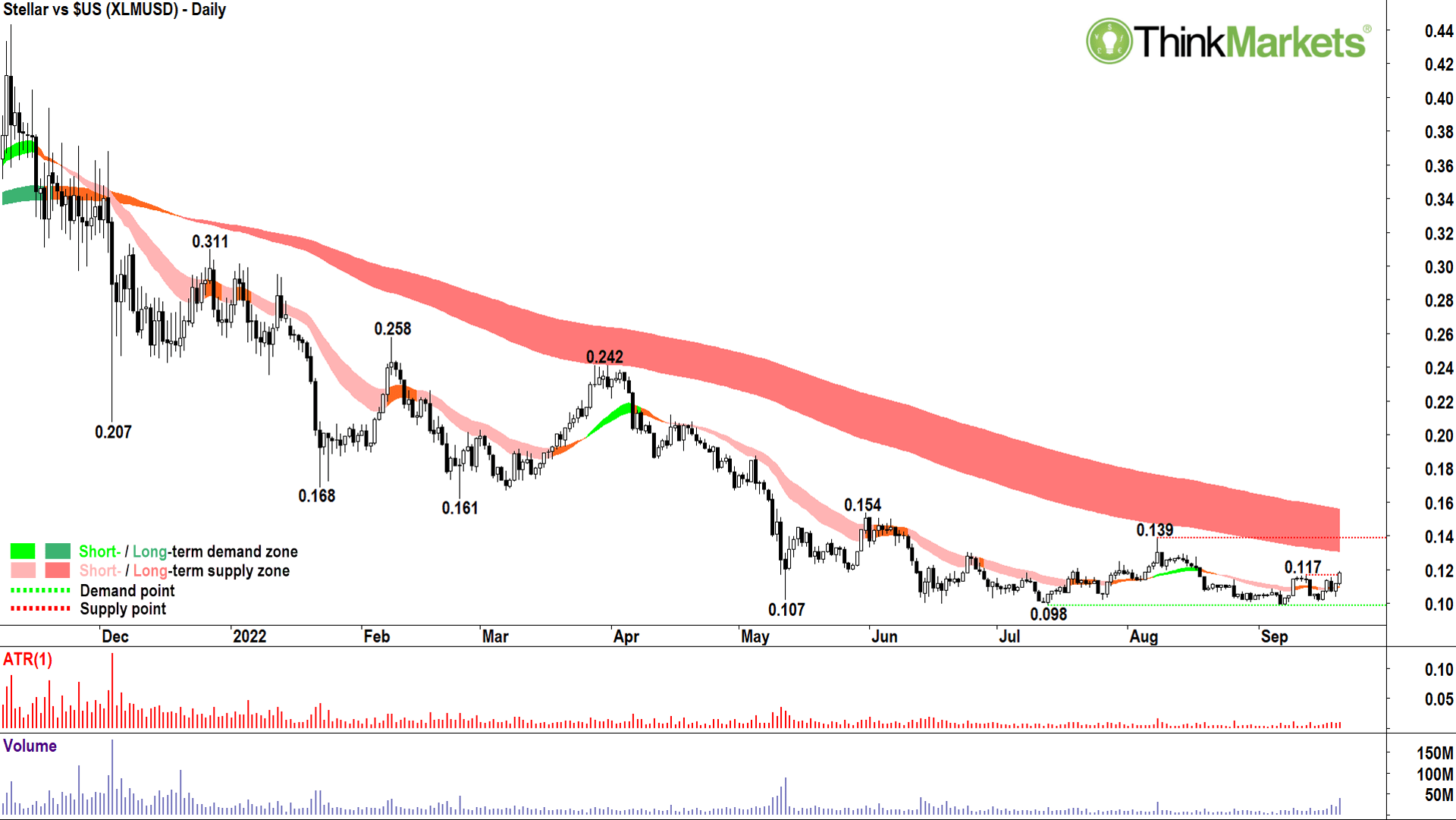

Stellar (XLM)

Similar setup to Ripple, a fledgling short-term uptrend which looks set to at least challenge the well-entrenched long-term downtrend. Similar price action and candle dynamics to Ripple, also, and also closing above a key resistance in 0.117. Another (very) spec BUY with a target at 0.139.

CoinJar is Australia’s longest-running crypto exchange. Since 2013, CoinJar has helped more than half-a-million Australians buy and sell billions of dollars in cryptocurrency.

FX Evolution is Australia’s premier forex, stock and crypto trading community.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.