The Three Ts: Good regulation, ultrasound Ethereum and ultra-stable BTC

Picture: Getty Images

Welcome to the Three Ts with CoinJar. Each fortnight we explore a big Theme, an interesting Trade and some good, old-fashioned Technical Analysis (courtesy of Tom from trading gurus FX Evolution).

Regulators, mount up

When it comes to crypto, there are few bogeymen quite as potent as the ever looming prospect of *shudder* regulation. For as long as I can remember, the prevailing ethos has been “well, enjoy the party while it lasts, because soon Big Government’s gonna come barging in and we’ll all be flipping burgers at McDonalds again”.

But now that governments are finally starting to get around to this whole crypto thing, there are signs that regulation could actually be a net positive for the space.

“We want to encourage innovation in crypto assets, innovation creates jobs & growth.

There are many innovative use cases for crypto assets, many of which are not far away from becoming mainstream.

These include int payments, lending & borrowing, NFTs & asset tokenisation”

— Jane Hume (@SenatorHume) March 21, 2022

If they’d gotten their act together in 2018 and taken some decisive action the governments of the world could have wished crypto out of existence. But in the intervening years, crypto has simply become Too Big to Kill. Trillion dollar market caps, billion dollar trades and tens of millions of investors; at a certain point you have to acknowledge it’s here for good.

So instead we have Australia declaring that it wants to be a crypto hub. We have Joe Biden issuing an executive order that acknowledged the positive role that crypto and blockchain could play in the economy. We have the EU, well, narrowly deciding not to de facto ban Bitcoin, and instead settling on a pro-innovation framework. And South Korea just elected an unabashedly pro-crypto President.

For sure, this will (and should) be bad for the scamcoins, meme-of-memecoins, pump’n’dumps, vaporware projects and all the other stuff that tarnishes the space. But if you’re a believer in the long-term prospects of crypto, then this is a marker that Phase 2 is beginning.

Ultrasound money

Many years ago, Bitcoin backers took to describing Bitcoin as “sound” money; that is, money that couldn’t suddenly depreciate in value due to its fixed issuance.

After Ethereum instituted EIP-1559 (AKA the one that started burning all that ETH) last year, it became a meme in Ethereum circles to describe ETH as “ultrasound” money – money whose supply actually diminishes over time.

if capped-supply BTC is sound money

decreasing-supply ETH is ultrasound money pic.twitter.com/Y9N8HBmHBr

— Justin Ðrake (@drakefjustin) September 10, 2020

While the term is mostly used to mock BTC maxis, it speaks to a brewing Ethereum supply shock. Already more than 5% of the total Ethereum supply is locked in the ETH 2.0 contract. Post EIP-1559, it’s become increasingly common for Ethereum to burn more ETH than it mines in a given week. And when Ethereum transitions to Proof-of-Stake in June, the selling pressure being exerted by miners will vanish; PoS actively incentivises coin hoarding.

Add it all together and, well, something could be brewing.

Ultrasound pic.twitter.com/mJ6iNVPD6m

— //Bitcoin ack (@BTC_JackSparrow) March 21, 2022

Island of stability

While equity, forex and commodity markets have been acting like SHIB knock-offs recently, Bitcoin has, well, been doing very little. Which given the chaos on all sides is really saying something.

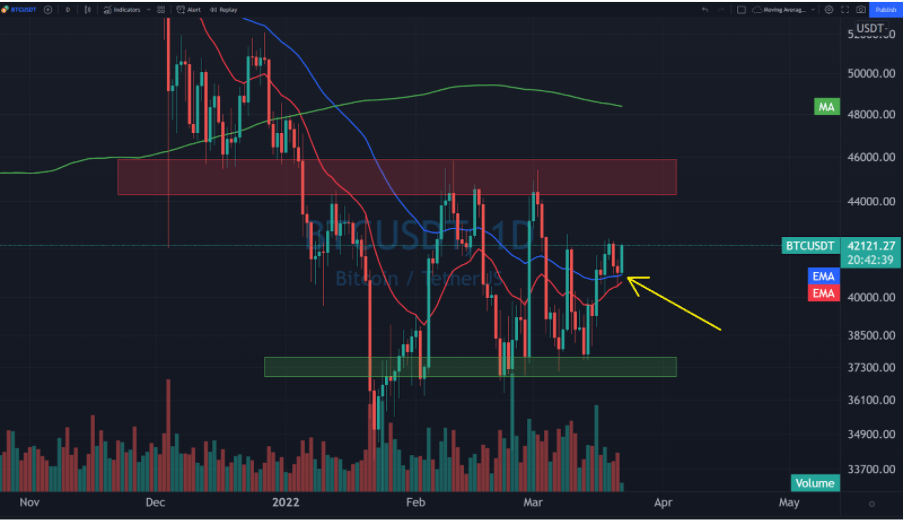

According to Tom from FX Evolution, Bitcoin appears to be in a short-term accumulation mode, buoyed by the confluence of the 20D and 50D EMAs. Speaking of, those two are about to form a golden cross, something we haven’t seen since August last year. Nonetheless, the defining range remains US$37-44k. Everything between that is just noise.

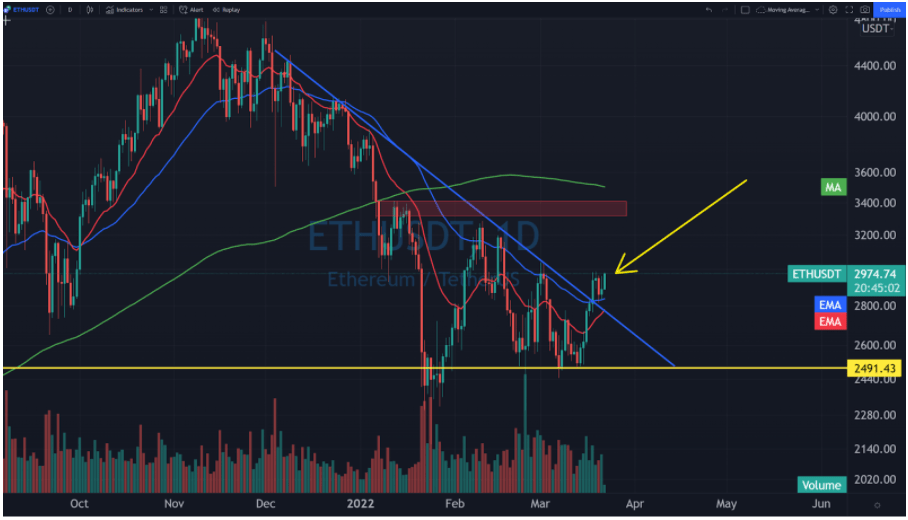

Ethereum, on the other hand, looks ready to make a decisive move. Price is trading above the 20/50D EMAs (which are also about to cross) and has also busted through a strong diagonal on the log chart. With price bouncing around the US$3000 mark, a trip to US$3400 looks increasingly likely.

CoinJar is Australia’s longest-running crypto exchange. Since 2013, CoinJar has helped more than half-a-million Australians buy and sell billions of dollars in cryptocurrency.

FX Evolution is Australia’s premier forex, stock and crypto trading community.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.