The Three Ts: Crypto goes Meta, the golden fractal and ETH to $5k?

Pic: d3sign / Moment via Getty Images

Welcome to the Three Ts with CoinJar. Each fortnight we explore a big Theme, an interesting Trade and some good, old-fashioned Technical Analysis (courtesy of Tom from trading gurus FX Evolution).

Things can only get Meta

It’s safe to say that people aren’t entirely sold on Facebook’s much vaunted Meta rebrand. Is it a bold turn towards a dystopian future where all our experiences are mediated by VR goggles? Or is it a desperate attempt by one of the least trusted companies on the planet to put distance between it and the growing evidence that its product suite is bad for pretty much everyone?

Either way, it’s put the metaverse squarely on the radar of every conscientious crypto investor and it’s not difficult to see why. No company has as much power over the shape of the internet as Facebook does and if they want to push the ship towards the unmarked patch of the map marked “Metaverse” then it’s fair to assume that’s what’s going to happen.

Investors in OG metaverse plays Decentraland and Sandbox have already seen 200-300% increases in a week and there are plenty of other tokens (of varying reputability) having their moment in the sun.

Get rich investing in the metaverse so you can be one of the few able to afford living in the real world.

— The Crypto Dog 📈 (@TheCryptoDog) October 29, 2021

Crypto moves in waves. We’ve seen DeFi, NFTs, Solana and more have their hype cycle this year. Expect the metaverse – both existing projects and the soon-to-be-unleashed horde of pack followers – to lead the charge towards Christmas time.

Gaming crypto & the metaverse will be just like Ready Player 1. AKA the biggest industry in the world.

And again PSA…All of it combined…is not even worth the market cap of ONE meme coin (shib) at the moment. pic.twitter.com/qJDCjUZD69

— Alex Becker 🍊🏆🥇 (@ZssBecker) November 1, 2021

The golden fractal

How much you believe in the predictive power of fractals probably depends on how much you believe in technical analysis more broadly. Both proceed from the assumption that markets (being the sum product of humans making simple yes/no decisions) only have a certain number of possible patterns. Your edge comes from working out what pattern applies in any given situation.

One idea currently gaining traction is that Bitcoin’s price action closely resembles that of gold between 1970-79 – but playing out at around 10 times the speed. Economic historians would be able to tell you that the 1970s saw the greatest surge in US inflation in the 20th century, hence the rush for a hedge against currency devaluation.

Well, the inflation is here and so is the digital gold. So, are we on track for US$290k Bitcoin by the end of January? That’s the trillion dollar question.

Back to the macro.

Update on the mind-bending gold fractal…

For those unfamiliar, this marks the 54th straight week that #Bitcoin has followed gold from 1970-1979.

Both local topped at exactly 1.2T MC.

If it continues, top at 290K end of January.

Will we finally deviate? pic.twitter.com/Dcyeg4EHJL

— TechDev (@TechDev_52) October 22, 2021

ETH leads the way

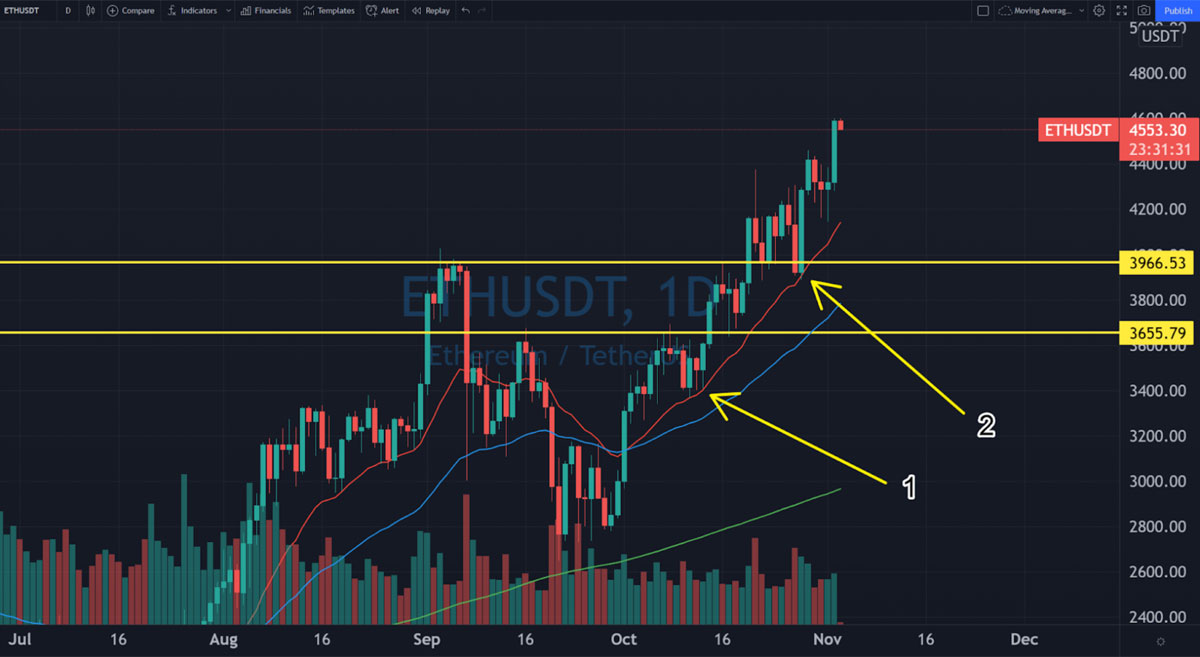

Having first broken its all-time high last Friday, Ethereum is now officially in price discovery. While the first major target/resistance should be around US$5000, according to Tom from FX Evolution we can look for any corrections to be supported by the daily 20 EMA – responsible for the tweezer formations identified below.

Even more promising signs can be seen on the ETH/BTC chart. We can see that Ethereum has clearly broken out of a two-month long downtrend against Bitcoin. The ratio bounced from a double bottom and has now soared past the descending resistance, as well as the daily 200 SMA, 20 EMA and 50 EMA – all of which are pointing up again.

If the recovery continues we could be heading back to the local high at 0.08, which would be consistent with a US$5000 target. This would also be good news for the alt market more broadly, which tends to take its cues from the ETHBTC ratio.

CoinJar is Australia’s longest-running crypto exchange. Since 2013, CoinJar has helped more than half-a-million Australians buy and sell billions of dollars in cryptocurrency.

FX Evolution is Australia’s premier forex, stock and crypto trading community.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.