‘The Google of blockchain’: The Graph (GRT) is regarded as a crucial layer of Web3 tech. Here’s why

Getty Images

Decentralised crypto protocol The Graph (GRT) has been gaining a good amount of investor attention so far this year, with a near 200% rise in value since the beginning of 2023. It’s also highly regarded within the blockchain industry.

Why? We caught up with Edge & Node Chief Business Officer and co-founder Tegan Kline (via electronic means of communication) to find out.

Hang on, what’s Edge & Node? It’s the initial team behind The Graph. And what’s The Graph do? Yep, that was our first question…

What is The Graph?

Hi Tegan. Please tell us what The Graph is, in a sentence or two.

The Graph is a decentralised protocol for indexing blockchain data and making it available for querying for use in downstream applications, like dapps (decentralised applications) frontends, plots, dashboards and data analytics. It’s used by over 40,000 developers and powers thousands of dapps.

We’ve often seen it referred to as “the Google of blockchain”. Is that still a good way to describe the protocol?

Yes, and that’s because The Graph’s primary goal is to make blockchain data accessible by indexing it. Google made the internet user-friendly by making it simple to search, and The Graph makes blockchain available to developers by making it easy to be queried. So what Google does for the web, The Graph does for blockchain technology.

‘What good is a public ledger if no one can read it?’

Can you explain what is the main purpose of indexing blockchain data? And what are the primary purposes of querying the data?

One of the most important value propositions of the blockchain is that it’s a public ledger. But what good is a public ledger if no one can read it?

By indexing blockchain data, The Graph makes reading blockchain data simple and seamless for everyone. Anyone can query data that they need.

Imagine running a DeFi dapp without displaying charts, transactions, and market data. The Graph is the best way to get this data without a centralised point of failure.

So, in other words: interacting with blockchain data is like looking for a needle in a haystack. If you’re just looking at the raw data, you’ll easily get overwhelmed. Even if you use a block explorer [such as Etherscan], it’s still not easy to identify the exact data that you need.

You can use The Graph to organise data any way you like, for various use cases.

What are the advantages of making The Graph a decentralised indexing protocol?

Some of the most important advantages of that are reliability, transparency, and cost. By trusting a centralised entity’s APIs [application programming interfaces] to serve blockchain data for you, you’re making yourself vulnerable to downtime, vendor lock-in, censorship, and outright deletion.

The Graph protocol ensures consistently reliable data, and freedom from manipulation of centralised gatekeepers, via an open-data economy that distributes data service across 450+ indexing nodes around the world.

Is The Graph an ‘AI coin’?

We’ve noticed The Graph and its GRT token being lumped into the artificial intelligence “AI coin” conversation quite a bit lately. In fact, it was recently revealed to be the top Google-searched AI crypto over the past 12 months or so.

However, we’re struggling to find any particular connection the protocol has to AI tech? Should it be categorised some other way? Web3 infrastructure? Big Data meets meets DeFi?

AI comes into play in a few ways, but mainly through existing protocol economic optimisation.

So, The Graph’s decentralised network is fuelled by an open-data economy. That means its participants must make informed decisions on things like:

- how to price queries (as Indexers), and

- how to budget for queries (as devs and data consumers).

At the same time, core developers contributing to The Graph must assess the economics of the network to create well-designed incentives and encourage helpful behaviour.

Semiotic Labs, a core developer of The Graph, has a charter that emphasises using research to bring new AI and cryptography capabilities to The Graph to address these complexities including tools for automated decision making.

So, we’re talking using AI to optimise The Graph’s revenue-earning process for participants? How is that achieved?

Semiotic Labs does this with an applied and impact-oriented mindset, taking a hands-on approach to research including running their own indexer.

This enables them to design and deploy AI tools that simplify the decision-making process for protocol participants. And to that end, Semiotic labs has contributed to two AI tools: AutoAgora & the Allocation Optimizer. Both are designed to help Indexers increase their protocol performance and revenue.

In the future, AI can continue to benefit users of The Graph and participants in the decentralised network through implementing tools like Large Language Models, which could be used to access subgraph information with human language.

‘Building with The Graph in web3 is a no brainer’

From what we already know about it, The Graph is very widely adopted within the blockchain-agnostic crypto space and crypto-developer world, with a significant uptake of users and collaborators since launch.

Although it’s obviously performing a different service, would you equate it to something like the Chainlink oracle in that regard?

The Graph is foundational infrastructure for building out web3. So while Chainlink specialises in bringing off-chain data on-chain, The Graph fulfills a different need: making it easy to consume blockchain data.

Blockchains are write-optimised, meaning they are designed to record data. Because they are not read-optimised, developers rely on The Graph to pull data off of blockchains.

Does The Graph have what might be considered a network effect in the space?

The Graph launched in 2018, and rapidly became the de-facto indexing protocol for Web3, particularly DeFi [decentralised finance].

After the launch of The Graph’s decentralised network in 2020, the protocol solidified itself as the decentralised data layer of web3.

You’ve probably already covered this, but just in case, can you please go over it again (and yep, we sound like Emmett from The Lego Movie)… why is The Graph considered significant?

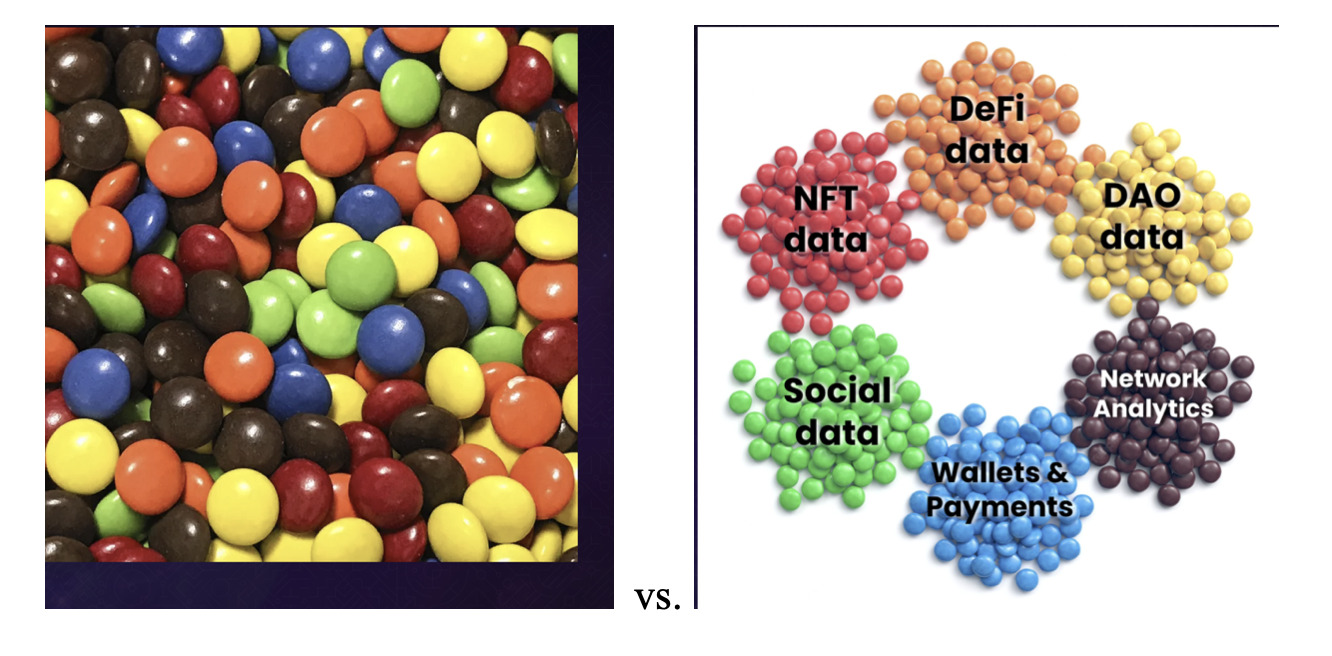

So, as the indexing and query layer of web3 The Graph supports 40 Layer 1 and Layer 2 blockchains – including Ethereum, Optimism, Arbitrium, Avalanche, Gnosis, etc. Because it is a chain-agnostic protocol, and it can be used for almost any web3 use case (DeFi, NFTs, DAOs, social media, gaming, identity, data analytics and so on), it constitutes essential infrastructure for anyone building in web3.

Also, because The Graph is a decentralised protocol, it enables developers to build unstoppable applications with APIs (subgraphs) that are not controlled by any centralised authority, thanks to a network of hundreds of indexing nodes serving data for applications.

The Graph is crucial to building in web3 and with The Graph’s decentralised network seeing Quality of Service better than anything centralised, building with The Graph is a no brainer.

‘Anyone can use and participate in The Graph’

Do you think The Graph is a “high-concept crypto” that might fly under the radar a little for the average crypto investor?

I think that when it comes to those interested in participating in crypto, anyone who is familiar with how search engines shaped web2 should already be familiar with the concept of indexing.

Indexing data is the process of organising data in order to more quickly and efficiently retrieve it later. Google did this for web pages – search results load quickly because they’ve been previously indexed.

The Graph indexes data across multiple blockchains, so when applications need to serve blockchain data rapidly into front ends, they use The Graph.

How do you best try to market The Graph, and who are you hoping to draw in as users of the protocol? Do you need to have an existing, solid understanding of blockchain to delve in and play around?

While The Graph primarily serves people who need to access blockchain data, whether for display in applications or for data consumption and organisation by other means, it’s also one of the best ways for web3 novices to get their footing in the space.

Thanks to the structure of The Graph Network and the breadth of The Graph community, anyone, regardless of technical skill level, can dive into web3 and start learning about blockchain technology and the importance of organising blockchain data. And absolutely anyone can participate in The Graph Network.

There are more than 11k Delegators around the world delegating GRT to help secure The Graph Network, which is an easy way to get started in web3 and begin adding immediate value.

There is no other protocol or product that can offer comparable quality of service, cost of service, and developer experience in addition to being a decentralised protocol.

with @graphprotocol you can index and query functionality to quickly retrieve the specific data that you need for your dApp – and more features. that's why I made this blog to teach you how to get started with The Graph

exciting protocol, take a look 👀 https://t.co/qfP3bV9xgA

— Abril Zucchi (@abruzuc) March 10, 2023

The Graph’s earning roles

Can you please briefly explain the three different revenue-earning participation roles in The Graph protocol – Delegator, Curator and Indexer? We know that delegating is a fairly straightforward staking (passive yield-earning) process. But can anyone become, for instance, a ‘Curator’ with limited techy skills and know-how?

Yes, that’s right – Delegator is the most accessible role on the network. Delegators help secure the network by delegating – aka staking – their GRT with Indexers that they believe are providing valuable, trustworthy indexing on the network. In turn, Delegators receive a portion of that Indexer’s revenue, while enabling that Indexer to service more subgraphs and serve more queries.

Curators meanwhile require a little more web3 ecosystem familiarity because their primary incentive is collecting future query fees. Curators stake GRT to signal on subgraphs they believe provide the greatest utility and have high quality and reliability. There is some degree of risk involved when selecting a subgraph to signal on. That being said, the act of curating a subgraph is as simple as staking GRT on a subgraph of your choice.

Why is it important for the protocol to have a token – GRT?

The Graph is a decentralised protocol that enables easy access to blockchain data peer to peer. It’s similar to a B2B2C model, except it’s powered by a decentralised network of participants.

Network participants work together to provide data to end users in exchange for GRT rewards. And GRT is the work utility token that aligns data providers and consumers.

GRT serves as a utility for coordinating data providers and consumers within the network and incentivises protocol participants to organise data effectively. There is no centralised company in the middle of The Graph taking fees or rent seeking – the value you put into The Graph is the value you are rewarded for – peer to peer.

Clocking up the milestones

What are some of the milestones (statistical or otherwise) that you’re most proud of when talking about The Graph?

I’ll bullet-point it for you, because there are a lot… In Q4 2022, The Graph’s decentralised network added:

- 121 new subgraphs (+24%)

- 72 new Indexers (+33%)

- 968K in query fees (+51%)

- +12.5% active developer participants

- By the end of Q4, the network was powered by almost 300 Indexers. Now it’s over 400

- The Graph Network is outperforming the hosted service

- And The Graph is multi-chain: Ethereum and Gnosis Chain are now live on the network. Additionally, The Graph Foundation announced more chain integrations onto The Graph Network including Polygon, Optimism, Arbitrum, Avalanche, and Celo.

Edge & Node more committed than ever

So Edge & Node describes itself as “the initial team” behind the development of The Graph. Does that mean it’s now taken more of a back seat as The Graph protocol has gained more of a decentralised life of its own?

Actually, Edge & Node has only increased its contributions to The Graph. However, there has been a surge of improvements to the protocol from core dev teams and network participants alike.

The open-source nature of the protocol enables anyone and everyone to make meaningful contributions. [There are ] seven teams and hundreds of independent contributors. So, essentially, Edge & Node is one of many companies contributing to The Graph.

The Graph ecosystem is also home to a thriving community forum, where a variety of network participants share ideas, collaborate, and contribute to the protocol in a decentralised way.

Finally, we saw in crypto media news somewhere or other that Edge & Node recently became an official Indexer on the protocol. Why was that a big deal?

[For this answer, Kline deferred to her colleague Brandon Ramirez – CEO of Edge & Node.]

“[Edge & Node] running an active Indexer benefits the entire ecosystem [through] the incentive we now have to dogfood the exact same tooling and economics that Indexers interact with every day,” said Ramirez.

“Because our goal is to provide good-quality service to the network while also operating at a profit, we expect to gain even more empathy for the challenges high-quality Indexers might face when trying to run a high-quality Indexer at a profit.

“This is in contrast to our philanthropic Indexer operation, where there was no need to optimise our Indexer’s allocations or other key decision problems Indexers face.”

“The significance of becoming Indexers on The Graph Network shows our commitment to The Graph’s decentralised network,” added Kline.

This interview was edited lightly for clarity. None of the information or views expressed in this article should be construed as financial advice.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.