The Bitcoin Halving: This Time it’s Institutional – coming to a crypto portfolio near you

Coinhead

Coinhead

Special Report: The biggest catalyst known to crypto returns – the Bitcoin halving. With help from analysts at popular crypto exchange Bitget we remind ourselves what it is and look at what to expect this time around.

Four years in the making, it’s one of the biggest, most important events known to humankind. Okay, maybe that’s overselling the upcoming Paris Olympics. But here’s something even larger than that – for cryptoheads at least.

The halving (or ‘halvening’ to some) and its asset-scarcity-inducing narrative is a very big deal for Bitcoin and its investors, ‘hodlers’, traders and miners.

Event – is it, though? It’s more of a built-in, behind-the-scenes occurrence in the Bitcoin cryptographic protocol that might not seem to make much difference at first. But there are certainly cryptoheads here and there making a big event of it nonetheless.

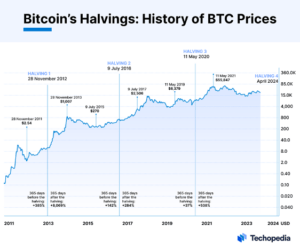

And who can blame them? Historically speaking, all three prior Bitcoin halvings have certainly resulted (usually a few months later) in an explosive price event for the number one cryptocurrency, and by proxy the altcoin market.

There’s no folk better to turn to for a definition than those who analyse the Bitcoin and crypto market day in day out. Bitget Research does exactly that, and here’s just some of their version:

“The Bitcoin halving is a fundamental event that occurs approximately every four years, reducing the reward for mining new blocks by half.

“This mechanism is designed to control the supply of Bitcoin, introducing a deflationary aspect to its economy.

“The next halving, expected on 20 April 2024, is particularly significant as it will further constrain the already limited supply of Bitcoin, with more than 19 million of the total 21 million Bitcoins already mined.”

Each halving occurs after every 210,000 BTC ‘blocks’ (data structures recording set amount of BTC transactions) are mined. And that translates to roughly four years.

This latest halving sees Bitcoin mining rewards will halve from 6.25 BTC per block mined to 3.125 BTC per block, thus increasing scarcity of new BTC supply.

This will continue until roughly the year 2140, when all BTC will finally be mined.

The recent surge above US$70k and now, where it’s pulled back to the low-mid US$60k range, is seen as prelude to the halving, notes Bitget Research.

Many a crypto investor, influencer, commentator is anticipating higher prices post halving.

“This bullish sentiment is further bolstered by sustained on-chain activity growth and positive market structure updates,” added the crypto exchange.

Bitget Research Chief Analyst Ryan Lee noted that “if demand remains constant or increases, the price is likely to rise”.

“Historical data supports this view, with significant price increases observed after previous halvings,” said Lee, adding:

“For instance, post the 2016 halving, Bitcoin’s value soared from about US$650 to peak near US$20,000 in 2017.

Similarly, the 2020 halving saw the price escalate from around US$8,600 to highs of US$69,000 by 2021.”

That said, actual price movement post-halving can vary substantially.

While halvings have been followed by substantial bull markets in the past, Bitget reminds us that “immediate post-halving periods have sometimes seen price consolidation or even short-term declines as the market adjusts to the new reward structure.”

Also, as you can see from the stats shown below, courtesy of Bitget Research, the past two Bitcoin halvings have brought returns when compared with the first one, which delivered a stupendous 10,250% gain at peak.

But even if, for example, this halving ‘only’ delivers a, say, 100% post-halving gain, then from its current price, that would still see about a US$130,000 BTC price at the top of the market.

Many crypto enthusiasts and investors are predicting a much higher mark than that, while others seem to think that could be about the peak, while some expect lower.

But according to Bitget, post-2024, Bitcoin is widely expected to break the US$100,000 mark, supported by:

• Regulatory clarity. Improved regulatory frameworks in major markets will likely boost investor confidence and foster greater adoption.

• Technological advances. Innovations such as enhanced Bitcoin protocols and Layer 2 solutions should improve its functionality and appeal.

• Macroeconomic factors. With interest rate cuts still predicted later this year and continuous institutional inflow, the economic environment appears favourable for Bitcoin’s growth into 2025.

One factor to take into consideration this time around for the pre-halving and post halving periods, notes the crypto exchange analysts, is the introduction of a far more influential institutional element than ever before.

And that’s playing out in the background with the potential to exacerbate the BTC price in either direction, but more likely than not to the upside.

“The adoption of Bitcoin ETFs [notably from massive Wall Street/global asset managers including BlackRock and Fidelity among others], has introduced a new demand source, potentially mitigating sell pressure and supporting higher prices,” noted Lee, adding…

“The approval of spot Bitcoin ETFs in the United States has been a landmark development, attracting significant capital inflows and indicating a maturing market.

Increased institutional investment can bring more stability and reduce volatility in Bitcoin prices, as institutions are likely to hold long-term positions, absorbing some of the price fluctuations and supporting a gradual price increase.

Looming, too, by the way, are impending likely Bitcoin ETF approvals in Hong Kong – one of the most influential financial markets in the world, and a potential gateway to eligible Chinese investors.

At the time of writing, these new financial products were set to hit the market as soon as April 16.

For what it’s worth, we tend to think this Bitcoin halving will prove to be another big positive catalyst for the BTC price, which will have positive flow-on effect to the altcoin market.

That said, caution should still be adhered to as short-term volatility is still likely, especially with an uncertain macroeconomic landscape (wars, inflation, rates-cut timing doubt) playing out in the background.

We’ll leave the final thoughts to Bitget, though:

“As we draw closer to the Bitcoin halving, we are reminded of the constantly evolving and dynamic nature of the cryptocurrency industry.

“Regardless of what happens, one thing is certain: the event will mark another significant moment in Bitcoin’s ongoing narrative.”

This article was developed in collaboration with Bitget, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.