Telstra Ventures delivers a crypto market health report. Prognosis? Actually pretty good

Image: Getty

Maybe it fell in ages ago, but Aussie telecommunications beast Telstra appears to be down the crypto rabbit hole. Well… at least its affiliated, US-headquartered venture capital arm is.

This month the San Francisco-based investment outfit Telstra Ventures released a 12-page blockchain-focused report titled Blockchain Open-Source Developers Signal Strength of Web3 Community. And if you can’t quite figure it out from the unwieldy title, the information contained within is quite upbeat about the crypto industry.

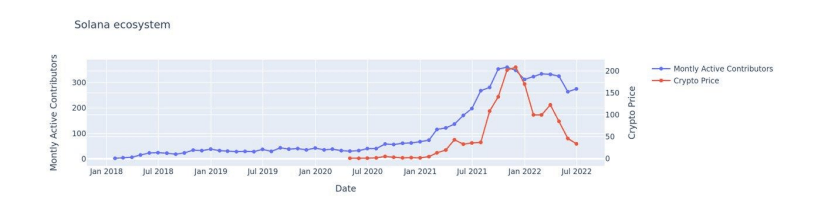

Specifically, the report focuses on three top blockchains – Bitcoin, Ethereum and Solana – with the overall takeaway being: steady growth in the number of active contributors/developers across these ecosystems indicates the strength of “Web3” (meaning crypto) as a whole.

And this is despite the crypto market this year travelling about as smoothly as Will Smith’s post-Oscars career.

Our latest data driven report is out now!

'Blockchain May Be Out but It's Not Down'

You can download the full study on our website right here: https://t.co/F9g4KUglkQ#web3 #blockchain #venturecapital pic.twitter.com/qEEn9V1i4w

— Titanium Ventures (@TitaniumVC) August 3, 2022

Referencing the “crypto contagion” sparked by the Terra LUNA collapse in May and the overall crash this year that wiped out about US$1.3 trillion in value from investors, Telstra’s data-focused VC arm went deep to get a sense of what’s still thriving in the space.

Led by Dr Donghai He (we’re imagining from a remote, tightly guarded volcano base) the firm’s team of data scientists analysed 1,000 active organisations contributing to more than 30,000 open source Web3 projects across the three blockchains.

Some of the key findings (using the report’s words) included:

• “Blockchain developers’ participation in Web3 communities remains robust, as measured by compound annual growth rates in the number of unique active contributors per project and per ecosystem each month.”

• “Venture and corporate investors are well aligned with 7 of the top 10 most active projects across key ecosystems.”

• “Only 4 to 5 of the top 10 most active projects in each ecosystem are backed by venture and corporate investors, suggesting unfunded opportunities remain.”

Also…

Ethereum reigns supreme for developers

The most robust and largest developer community, the report found, is Ethereum, which shouldn’t be a surprise to anyone who’s followed crypto for a while. The leading smart-contract platform has long had the network effect in terms of decentralised applications, which also means a shedload of active developers.

According to Telstra Ventures, Ethereum’s community has grown 24.9% over the past four years since the beginning of 2018.

And despite the decline in crypto prices since the market peaked in November, Ethereum’s number of monthly contributors has only slipped by 9% as of July this year, which indicates the crypto downturn hasn’t fazed developers too much. Maybe positivity around Ethereum’s upcoming Merge has something to do with that.

Solana and Bitcoin, meanwhile, have also been showing overall strength with these developer metrics in the same timeframe, although the former has been by far the most volatile, with its number of active users declining 21% since the November peak.

Bitcoin’s active contributor ecosystem, meanwhile, has actually, amazingly, seen more than 8% growth since BTC’s all-time-high of about US$69k last November.

Bitcoin maxis will dig that stat, but ETH heads can still point to scoreboard on overall monthly active contributors. That figure has remained up around 2,500 each month since the first half of 2021.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.