Technical indicator shows Bitcoin at most ‘oversold’ level since Covid crash

Getty Images

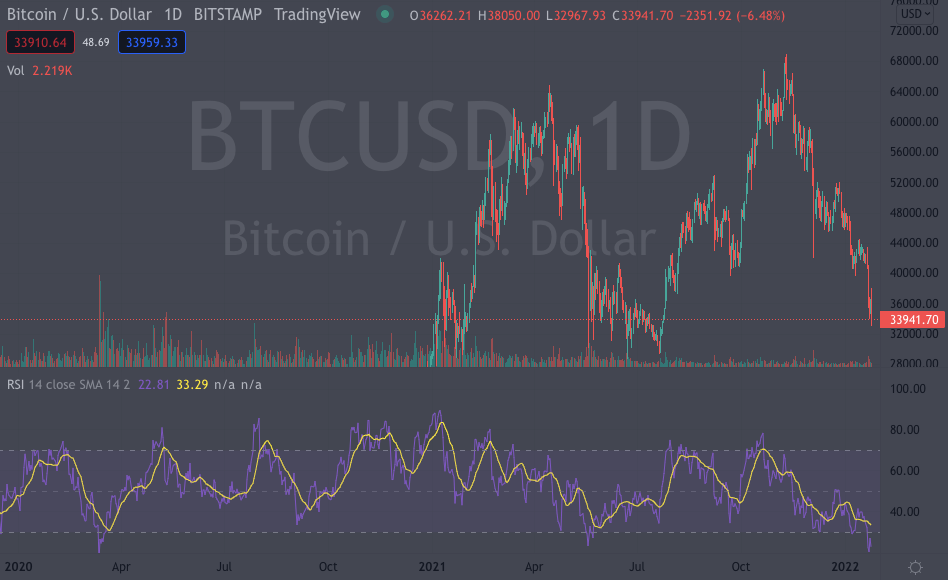

Amid the current crypto bloodbath, there’s a technical indicator a number of analysts and traders are keeping half an eye on. It’s Bitcoin’s Relative Strength Index (RSI), and it’s flashing “oversold”.

The entire cryptocurrency market has lost more than US$400 billion over the past handful of days and there have been many predictions of more short-term pain.

Ahead of the US stock markets opening on Monday, crypto prices are losing further ground, at the time of writing.

Over the past week, Bitcoin (BTC) is down 19%, with most altcoins taking a worse beating, for instance: Ethereum (ETH) -28%; Polkadot (DOT) -38%; Terra (LUNA) -27%; and Solana (SOL) -40%.

What is the Relative Strength Index?

Bitcoin’s 14-day RSI chart represents price momentum, taking into consideration the speed and magnitude of directional price movements in the asset.

Based on how quickly Bitcoin’s price changes and how much, an RSI score is attributed to a given month relative to the same metrics over the previous 12 months. The higher the RSI, the more positive the price movements are in comparison with what’s occurred over the past year.

As of last week, Bitcoin’s RSI has dipped below a score of 30, which is a level commonly regarded as being oversold for the asset, meaning BTC has fallen quickly below its typical value metrics.

It’s reached an RSI level the lowest we’ve seen since the dramatic Bitcoin crash of early March 2020, which was related to COVID and its spread taking hold as the dominant media narrative. This preceded a monumental year-long bullrun for crypto, before it all took a breather again in May of last year.

The last time the BTC RSI dipped below 30 was, in fact, on May 20, 2021, after which Bitcoin chopped and crabbed sideways (mostly) for several weeks around US$30,000 before a bust higher in late July.

As hopeful as that all sounds, however, it doesn’t necessarily mean history will repeat so favourably and that Bitcoin has bottomed out here.

As Investopedia explains, “An oversold condition can last for a long time, and therefore being oversold doesn’t mean a price rally will come soon, or at all.”

What’s overall sentiment and Crypto Twitter telling us?

This…

The last time #Bitcoin dipped this low, it went lower.

— Brian Latorre (@TechLatorre) January 24, 2022

vibes tho pic.twitter.com/MiiRX7bDYV

— Meltem Demirors (@Melt_Dem) January 24, 2022

Look, it's really simple. Once this #Bitcoin mini panic is over, the price will go back up. Tens of billions of dollars of new capital is going in to mining, software, and infrastructure over the next 12 months. Adoption continues and the plebs and tutes are stacking and hodling.

— Mike Alfred (@mikealfred) January 23, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.