‘Taking the world by storm’: Low-cost digital broker Stake to offer crypto late this year

Stake co- founders Matt Leibowitz and Dan Silver. (Supplied)

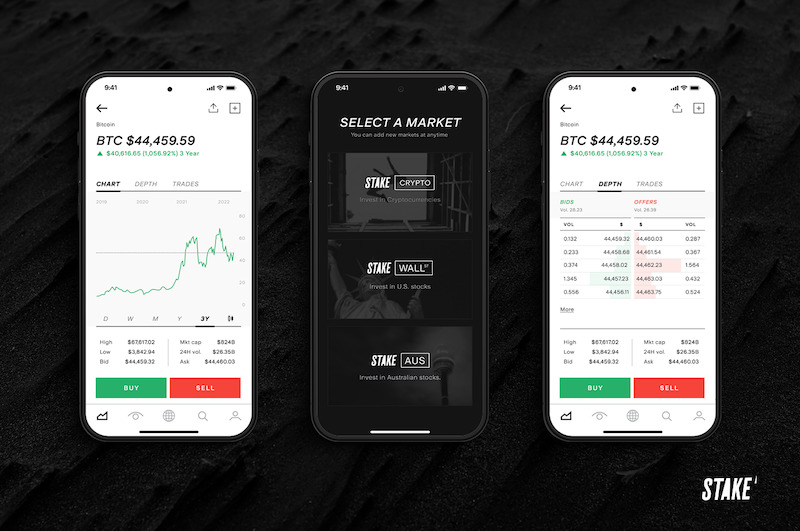

Fast-growing new Aussie digital broker Stake says it will add a cryptocurrency offering by the fourth quarter, including for its self-managed superannuation fund customers.

“Crypto is taking the world by storm and established itself as a legitimate asset class,” said Stake founder and chief executive Matt Leibowitz.

“Forward-looking SMSF trustees are asking for a simple and seamless way to invest in cryptocurrencies, and it’s time for them to have that in the same place as their equities investing.”

Sydney-based Stake has amassed more than 450,000 global customers and over US$1.5 billion in funds under administration since its launch in 2017. It added ASX trading in late 2021 and has gained over 100,0000 ASX customers in five months, lured by its CHESS-sponsored trading for a $3 flat brokerage fee.

The crypto rollout will begin in Q4 in Australia, with global markets following. Stake offers zero-fee trading of US equities and has overseas customers in the UK, New Zealand and Brazil.

Stake said it was working with a third-party liquidity provider to offer crypto to its customers.

While it couldn’t yet say what the fee structure would be or what specific cryptocurrencies would be available, Stake said “this isn’t just about adding a few coins to our platform — we’re building a complete wealth management experience for the next generation of investor.”

“We’ve demonstrated that sophistication doesn’t have to be complex with our US and ASX platform and now it’s time to break the same barriers to crypto,” Stake’s crypto product manager, Jeroen Van Amerongen, was quoted as saying in the announcement.

In response to a Stockhead query, a Stake representative said that crypto transfers to external wallets were “certainly on our radar” but the offering was in the early stages of development and they couldn’t confirm if outside transfers would be offered.

Stake won’t apply any limits or guardrails on self-managed super fund customers investing all their retirement savings in crypto, the representative indicated.

“With that said, our SMSF accountants and tax agents will always recommend that customers seek financial advice before making any financial decisions,” she said.

The SMSF option costs $990 per year, which covers an independent audit, investment reports and preparation and lodgment of an SMSF tax return.

(There are other ways to invest one’s SMSF in crypto, but they generally involve setting up an account with an SMSF service provider and then buying crypto with an established Australian exchange. Stake’s $990 annual fee for SMSFs may seem high, but it’s actually less than what many other providers charge).

Australia’s fourth-largest broker, SelfWealth (ASX:SWF), announced last month that it had partnered with BTC Markets to offer crypto to its 120,000 active Australian investors, although it hasn’t announced a launch date for the offering.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.